AI Agent Evaluation Framework: Why It Matters for Financial Services

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

Automation alone isn’t enough to improve your customer service.

90% of customers say an immediate response to their questions is very important, and 80% have stopped doing business with a company after they’re unable to resolve their issues online.

Even your customer service representatives (CS reps) know the shortcomings of current AI solutions with tools that fragment information and legacy chatbots that escalate too much. This causes high turnover, where your institutional knowledge is lost.

Leaders in customer service also struggle. They can’t measure satisfaction or query response rates reliably and in real time with current automated tools. So, delivering first-call resolution (FCR) at the level of your best reps, persistently, at scale, and with full audit traceability is nearly impossible.

Agentic, context-aware artificial intelligence can change this. As a BFSI-focused AI-enablement partner with over 100+ projects built for Fortune 500 companies, we’ve seen how agentic AI and machine learning can empower CS teams in financial services organizations. It enhances their workflows, improves risk management and provides measurable outcomes for leadership.

We’ll break down the key customer service challenges and how you can address them with AI and tailored solutions aligned to KPIs like FCR and customer satisfaction (CSAT).

In this article:

Looking to get started with tailored AI customer service solutions for banks? Neurons Lab can help. Book a call with us today.

Your CS reps are under growing pressure to respond instantly, provide accurate information, and deliver personalized experiences that drive satisfaction, loyalty, and lifetime value. And your CS leaders expect more from AI applications that can streamline routine tasks.

However, certain operational and structural limitations make this a daily struggle. Based on our observations, we’ve identified five key challenges that hold your customer service teams back from providing consistent, high-quality support and fast response times.

Customers want their issues resolved instantly and accurately whether they reach out via chat, email or call. Your reps are required to meet these customer expectations while keeping satisfaction scores high. However, they lack the real-time context and insights needed to do this.

To assist a single customer, a rep must jump between your CRM platform, product systems, FAQ databases, and multiple tools, including legacy systems and fragmented infrastructure created by mergers and acquisitions.

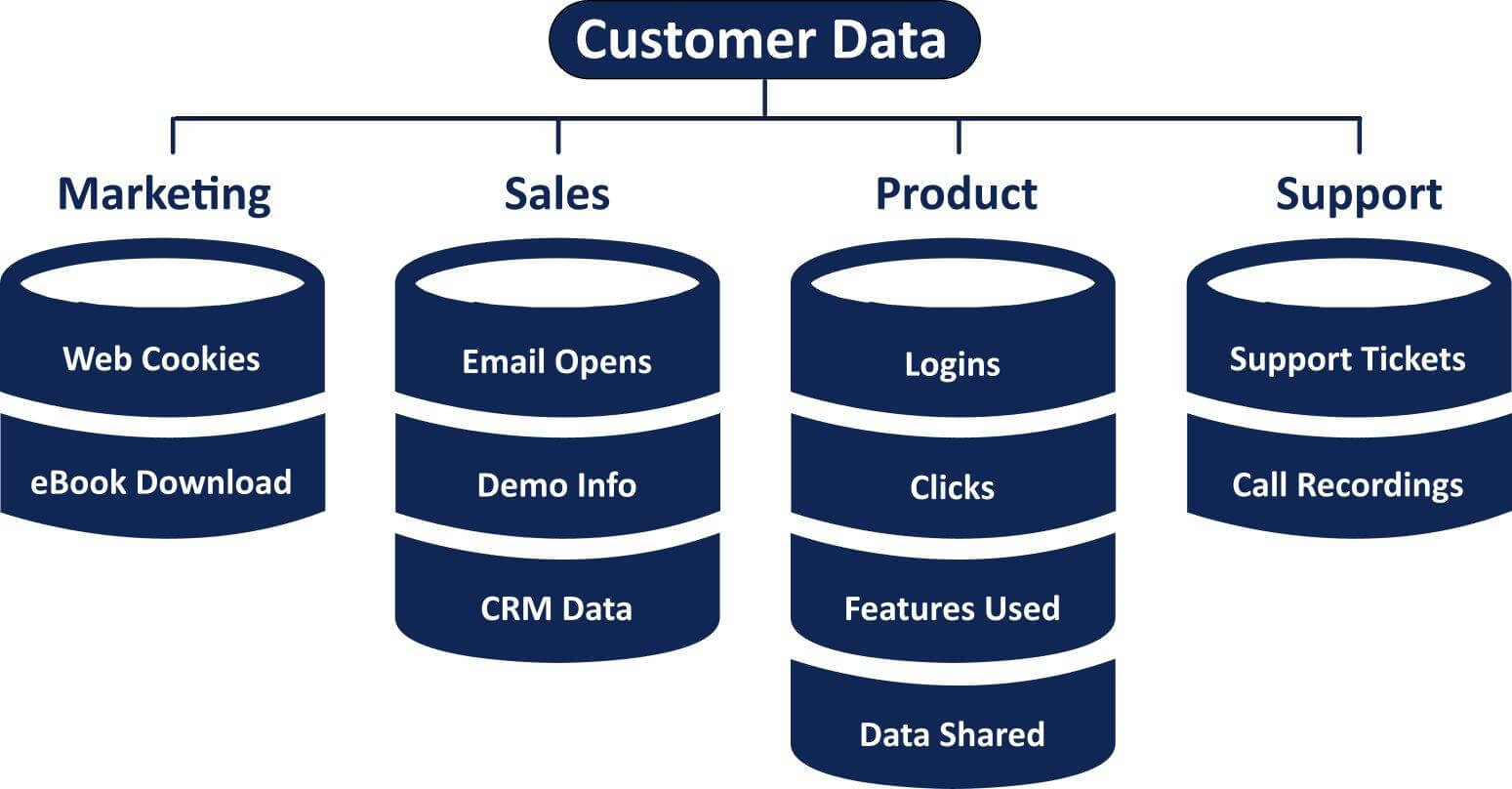

Caption: A vast amount of customer data remains trapped in departmental silos, preventing service teams from accessing the full customer picture in real time – Image source: Acceldata

Even with unified windows designed to centralize data, information remains static and incomplete. Reps struggle to interpret fragmented details, forcing them to rely on personal judgment to piece together the customer’s history and intent. This affects service delivery across all support channels:

Ultimately, without real-time insights, even the most capable reps are forced to work reactively instead of anticipating needs and creating personalized customer experiences.

How Customers are Affected When Reps Can’t See the Full Picture: The HSBC Example

A FCA investigation into HSBC UK shows how missing real-time context directly harms customer outcomes.

Between 2017 and 2018, HSBC’s customer-service and collections teams operated across fragmented systems with inconsistent data, including vulnerability markers that were isolated and not visible across brands.

As the FCA noted, agents often failed to identify customers in financial difficulty because their circumstances were “not sufficiently probed or established,” and key information was not recorded or accessible in a unified way.

These gaps meant staff relied on personal judgment instead of complete customer histories, leading to inappropriate actions, such as unaffordable repayment plans, missed forbearance opportunities, and even disproportionate defaults. HSBC ultimately paid £6.28 million in fines and more than £185 million in redress after at least 1.5 million customers were affected.

Customer service leaders need to track key metrics like CSAT and FCR across thousands of daily interactions. These KPIs are critical for spotting performance gaps, improving training, and enhancing the overall service experience.

Current KPI measurement still relies on outdated methods like post-call surveys or in-call rating prompts. These approaches interrupt the customer experience, frustrate users, and result in low response rates.

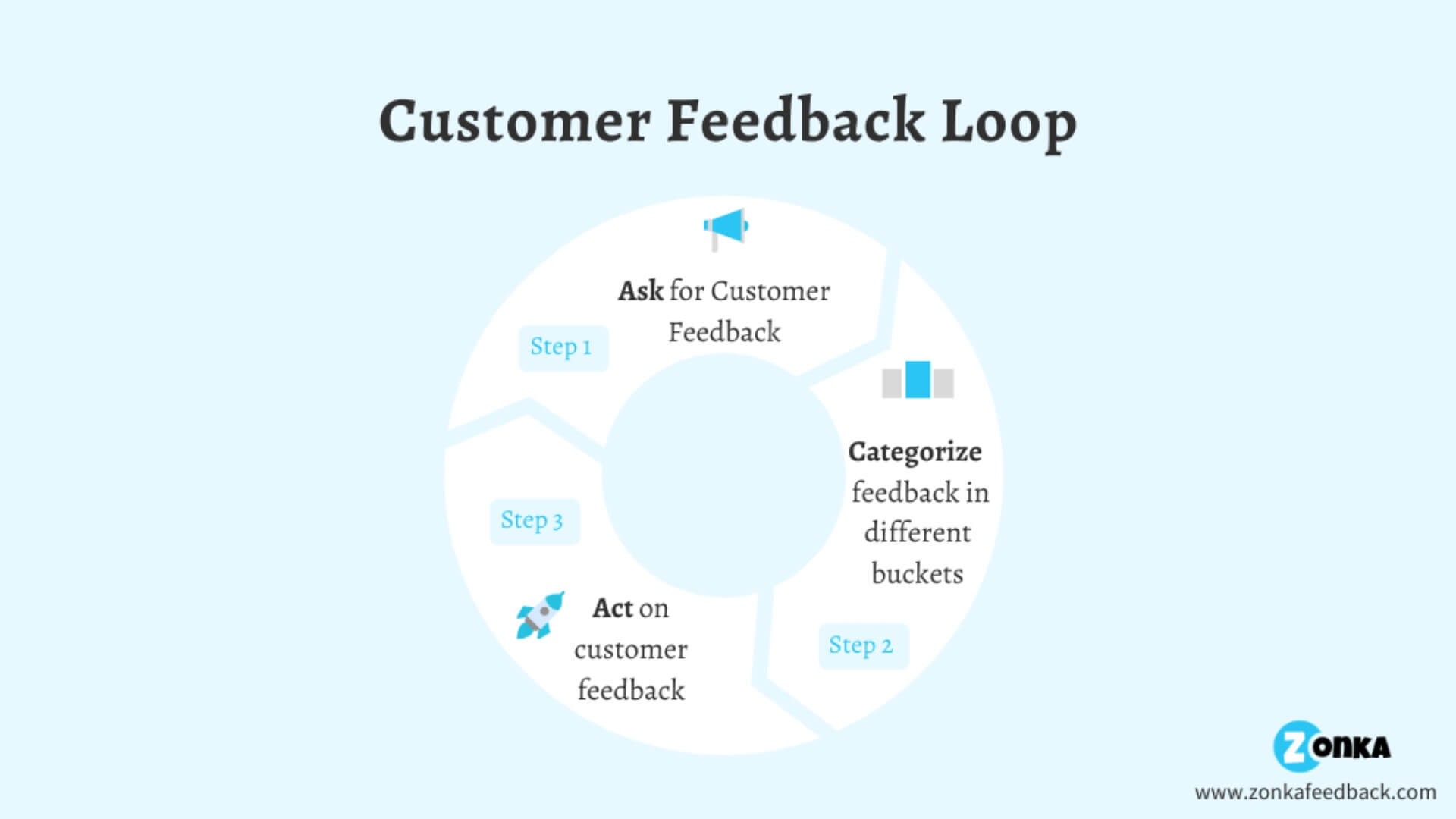

Current feedback loops rely on manual surveys and categorization, but these methods are slow, inconsistent, and capture only a fraction of real customer sentiment. – Image source: ZonkaFeedback

And even after collecting all this data, analyzing it presents yet another hurdle. Because teams handle thousands of customer journeys a day, supervisors can only review small, manually chosen samples.

But sampling captures only a fraction of interactions, leaving leaders without a true view of what drives satisfaction, resolution, or churn. These blind spots prevent improvements and make it impossible to connect service quality to business outcomes like customer lifetime value (CLV).

When High-Level CSAT Scores Don’t Tell the Truth: The Whitney Bank Case

A real-world example of this visibility problem comes from Whitney Bank. For years, the bank relied on traditional survey-based satisfaction metrics, but these high-level scores failed to reveal a critical issue: one in three new households were leaving within the first year.

Leaders only discovered the true drivers of churn when they moved beyond limited sampling and implemented a behavioral, real-interaction measurement program. Once they implemented continuous insights, attrition dropped from 33.17% to 10.19%, generating more than $19 million in revenue gains. The case shows how relying solely on sampled surveys can hide operational issues that directly impact satisfaction, retention, and customer lifetime value (CLV).

Every action from blocking a credit card to updating customer details must be logged and traceable to ensure your bank’s CS teams are following your regulatory requirements. This enables the banking sector’s regulators, auditors and even legal teams to access complete historical customer records when needed.

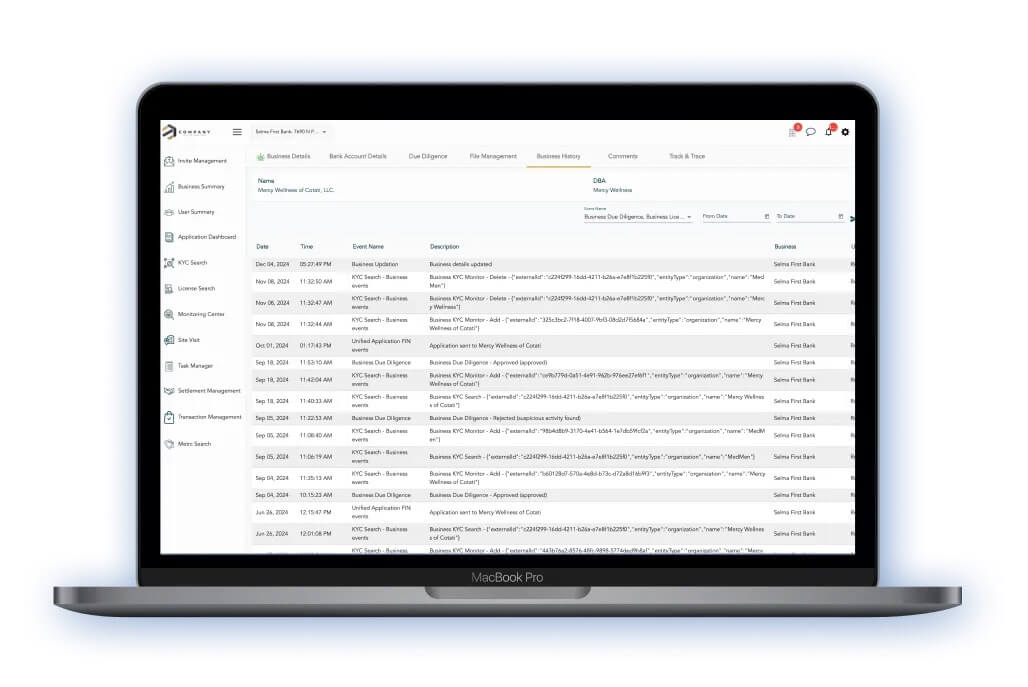

CS reps are expected to log all actions for compliance reasons – Image source: StandardC

However, maintaining years of audit trails across multiple systems adds significant operational complexity, especially when data must align with local banking regulations. These processes remain largely manual, requiring reps to follow rigid scripts, record each action step by step, and perform compliance checks.

This adds several minutes to every customer interaction, while manual logging introduces human error. Plus, missing timestamps, incomplete notes, or inconsistent phrasing can all lead to increasing regulatory risk and potential compliance breaches down the road.

When Manual Processes Create Compliance Risk: The Discover Bank Case

A recent U.S. case illustrates how fragmented, manual processes can create serious compliance risk.

In 2023, the FDIC issued a consent order against Discover Bank after finding that it had failed to maintain an effective consumer compliance management system. Regulators cited gaps across core process areas, which included written policies and procedures and complaint-response programs, along with insufficient internal controls and information systems to support them.

This meant staff were relying on patchwork procedures and manual checks instead of a unified, auditable process. The result was violations of key consumer-protection laws and consumer harm. This shows how manual, inconsistent logging and control workflows don’t just slow down customer interactions, they increase regulatory and legal risk.

Reps rely on static knowledge bases and manual scripts, which are updated too slowly to keep up with real customer issues. To be effective and consistent, customer service teams need to adopt and scale the knowledge of their top-performing reps so everyone can deliver consistent, high-quality support. However, much of this expertise resides in the minds of top performers and not in systems.

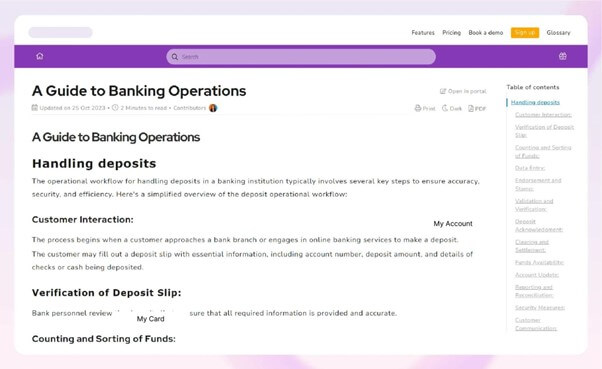

Static knowledge bases make it difficult for customer service teams to keep information accurate and up to date. – Image Source: Document360

As a result, best practices from experienced agents aren’t captured or shared effectively. This leads to wide variability in how reps deliver support, creating inconsistent customer experiences. Junior reps also take longer to learn, resulting in frequent handoffs to senior agents who become overloaded with repetitive inquiries.

Over time, burnout grows and attrition rates increase. But when experienced reps leave, their expertise goes with them, further deepening the performance and knowledge gap. When knowledge isn’t consistent, both service quality and key metrics like CSAT and FCR inevitably suffer.

What Happens When Best Practices Aren’t Shared: The ME Bank Example

For example, Australia’s ME Bank recognised that its support team was relying on a poorly organised wiki by agents which prevented consistent, quality responses. The knowledge-base content was hard to search, updated slowly, and much of the best practice lived only in the heads of senior staff.

After switching to a purpose-built system, handle times fell by 40% and staff engagement surged. This is a clear signal that capturing and scaling the tacit knowledge of top performers is essential to providing high-quality customer support.

To address customer service challenges, your in-house IT teams may have already tried to stitch together chatbots, robotic process automation (RPA) tools, and your CRM platforms. They may have also tried do-it-yourself AI builds or attempted to retrofit generic off-the-shelf systems with limited functionalities.

However, these projects often take months to deploy and are hard to modify, costing more in infrastructure than you initially budgeted for. They also increase latency without delivering enough operational benefit, leaving your CS reps and customers no better off than before.

When Generic Automation Fails to Deliver: The CBA & Virgin Money Insights

Many banks turn to off-the-shelf chatbots expecting rapid gains, but the real outcomes often tell a different story.

For instance, Commonwealth Bank of Australia (CBA) attempted to replace 45 customer‐service roles with a chatbot deployment, only to reverse the decision after call volumes increased, forcing the bank to re-hire staff. In the UK, Virgin Money’s AI chatbot made headlines when it mis-handled a simple query, embarrassing the bank publicly and demonstrating how even well-branded institutions can suffer from mis-tuned automation.

These real-world instances show that without strong integration, context-aware design and ongoing refinement, automation can drive up wait‐times and complaints rather than reduce them.

Most customer service AI tools stop at simple tasks. They answer questions, but do not reliably run multi-step, policy-constrained workflows (e.g., compliant actions across CRM, RPA, and core systems).

Even “unified views” of data don’t infer cause or determine the safe, next best action across legacy systems.

What current solutions miss is context inference. Even with recent advancements in machine learning, financial institutions continue to see this as a purely human skill: was a declined card triggered by a risk rule, a credit limit, or suspected fraud? And what’s the permitted resolution path under your current policy?

This is where agentic AI comes in.

By developing agentic AI systems, you capture and scale the know-how of top human reps, turning what your best people do (e.g., their phrasing, sequencing, judgment) into compliant, context-aware AI behavior. This preserves institutional knowledge and reduces response variability (along with frustration) across your team.

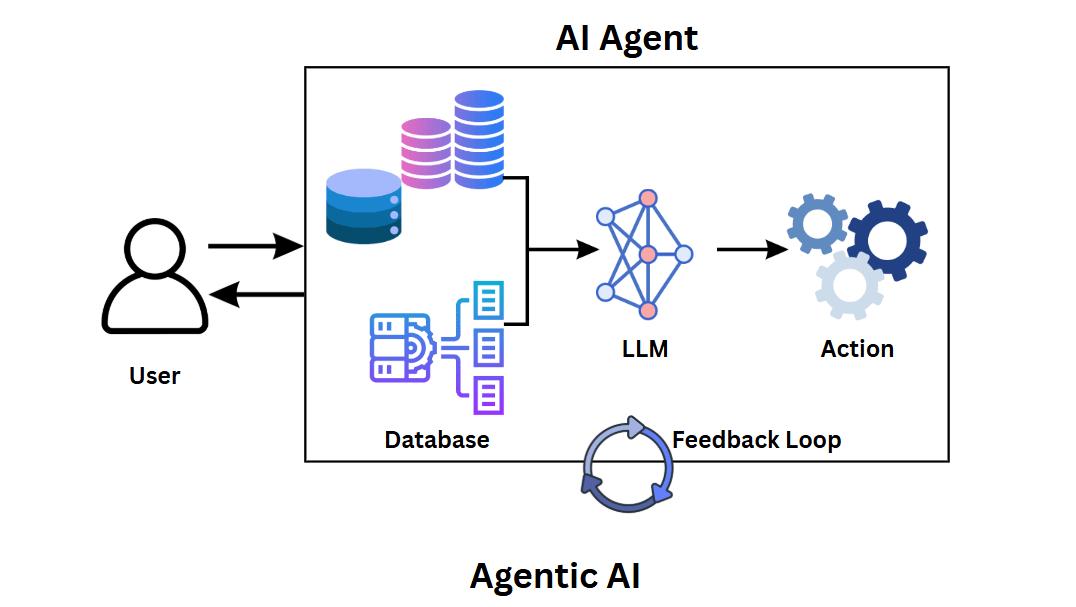

Agentic AI brings together data, LLM tools, and feedback loops to automate complex workflows while learning and continuously improving. – Image source: Codecademy

Agentic AI—systems that can reason, decide, and act autonomously within defined business rules—enables you to mine real customer conversations to detect what led to successful resolutions. It then codifies those patterns into real-time guidance and knowledge that AI agents apply consistently across channels.

This means instead of merely retrieving information and performing simple tasks, agentic AI:

While LLM tools stop at conversation, agentic systems close the loop and live in symbiosis with your customer service representatives (not replace them). They understand, decide, act, and evaluate, making every representative perform closer to your best one.

With agentic AI for financial services, your bank’s customer service team delivers faster, more consistent support while keeping their unique knowledge and service style, differentiating you from the competition.

Now that it’s clear why automation alone falls short, here’s how agentic AI works in practice to improve how your CS reps perform.

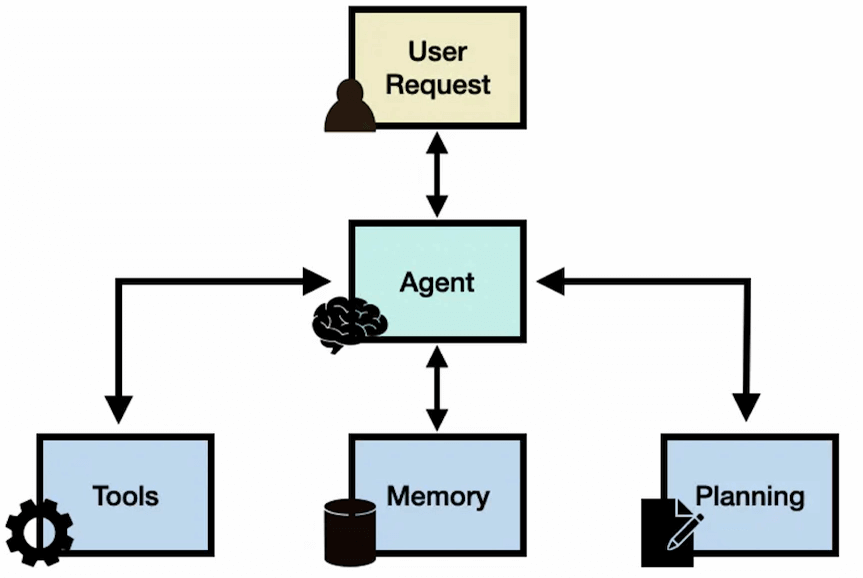

Customizing agentic AI systems creates a unified knowledge layer that reasons across context and time, filling the gap left by fragmented tools and centralized data dashboards.

These systems combine short- and long-term conversation memory with case history, product catalogs, and customer data. Using retrieval-augmented generation (RAG) powered by vector databases and knowledge graphs, they retrieve precise, policy-compliant answers and suggest contextual next-best actions (NBAs) or tailored offers during live interactions.

Customers receive relevant, personalized recommendations, increasing satisfaction, conversion rates, and first-contact resolution while reducing handling times and escalations. However, the human touch remains vital. AI reduces workload and inconsistency, enabling reps to focus on complex or empathy-driven cases.

For example, in a common banking use case, when a customer calls about a declined payment or loan application, AI can instantly pull data from the CRM, risk dashboard, and policy guide to identify that the decline was due to a daily limit. It then suggests the correct response and next-best action. The rep sees this reasoning in real time, offers to raise the limit, and resolves the query in a single interaction.

Agentic AI unifies data from knowledge bases, CRMs, and product catalogs into one dynamic interface accessible in real time

For long wait times in voice channels, AI enables faster call resolution and reduces human workload. You can combine speech-to-speech AI technology with LLM orchestration and call routing integration to create an AI agent that knows how to handle even complex requests autonomously and when to escalate to a human.

The AI captures live signals, such as tone, sentiment, and behavioral cues, then analyzes them alongside contextual data gathered across multiple conversations—not just static CRM records. This gives reps a more complete understanding of each customer’s needs in real time, leading to shorter queues, faster routing, fewer transfers, and higher FCR and CSAT.

For example, a customer calls about moving their savings into a fixed-term product. The AI agent verifies identity, pulls balances and risk data, and briefs the rep, who joins with context and focuses on providing financial advice.

Architecture of an agentic AI system that unifies data, reasoning, and retrieval to automate complex customer service workflows.

You can use an agentic AI system to keep your knowledge base automatically updated to ensure consistent handling of new and compliance-sensitive issues. It auto-generates and updates knowledge-base articles and scripts based on approved standard operating procedures (SOPs) and compliance wording.

AI also analyzes outcomes across conversations (e.g., identifying that 14 of 100 successful cases used approach X), and captures top-performer language and best practices to scale what works.

Integrated with product catalogs, CRM data, and regulatory feeds, this continuously optimized knowledge layer results in higher FCR and improved operational efficiency. It also reduces compliance risk and ensures more consistent answers and less variance across reps.

For example, AI analyzes the calls of customers asking about a new feature in their banking app. It identifies the highest-converting explanation with the best satisfaction scores and updates scripts automatically for more consistent and performing responses.

AI enables continuous, accurate, real-time tracking of CSAT and NPS through sentiment analysis across voice and text interactions. Instead of manual sampling conversations, the AI reviews every customer journey, inferring satisfaction from conversational dynamics (like tone or frustration signals) and confirming successful resolution. This is further validated by lagging indicators, such as continued product use or higher transaction volumes.

When a customer calls about a delayed payment, for instance, the AI detects frustration early, guides the rep with empathetic phrasing, and tracks how the customer’s tone shifts once the issue is resolved. This feedback automatically updates satisfaction metrics and coaching insights.

The entire process gives leaders a complete, data-driven view of service quality without relying on intrusive in-call or post-surveys. They can finally measure what truly drives satisfaction and resolution, linking customer experience directly to business outcomes like retention and lifetime value.

AI enables fully logged, compliant actions through API orchestration, detailed audit trails, an explainability layer, and integration with compliance feeds. It also helps customer service teams detect gaps against new or updated regulations, alerting them before issues escalate.

Let’s say a customer calls to update their personal details. AI verifies the request against KYC and data protection rules, confirms the required authentication steps, and records each action automatically. Your CS rep can complete the update with full confidence that every step is compliant, while supervisors can review the process instantly through the audit trail.

As a result, this lowers compliance risk since all actions can be traced, reviewed, and checked against policies.

In addition to satisfaction and resolution metrics, Agentic AI can track and measure key KPIs like escalation rates and waiting times automatically. This means your CS leaders can continuously improve their teams based on real data rather than assumptions. They identify and fix root causes faster, double down on approaches that increase satisfaction, and prove the financial value of every operational decision.

The table below breaks down key KPIs, what they measure, the benefits they enable, and how AI measures them.

| KPI | What It Measures | Benefit Enabled | How AI Measures It |

|---|---|---|---|

| Average Handling Time (AHT) | Duration of customer interactions | Shorter calls and faster resolutions | Tracks timestamps across call logs and chat sessions |

| FCR | Percentage of issues resolved on first interaction | Higher satisfaction, fewer repeat queries | Detects resolution confirmation in conversations and CRM outcomes |

| Queue Wait Time | Time customers spend in call or chat queues | Reduced waiting, improved experience | Measures from initial contact to connection timestamp |

| Escalation Rate | Number of cases handed to higher-tier support | Reduced workload and more autonomous handling | Logs escalation triggers and routing patterns |

| Offer Acceptance Rate | Customer acceptance of suggested financial products or solutions | Improved conversion and personalization | Correlates recommendations with transaction outcomes |

| Sentiment Trend Analysis | Emotional tone throughout interaction | Real-time satisfaction tracking | Uses NLP and tone analysis on voice/text data |

| Frustration Word Detection | Frequency of negative language or emotion signals | Early intervention to de-escalate calls | Detects frustration keywords and rising sentiment scores |

| Positive/Neutral/Negative Classification | Overall interaction tone | Continuous, survey-free CSAT scoring | Classifies conversation sentiment using trained AI models |

| Resolution Success after Updates | Effectiveness of new knowledge or product scripts | Continuous improvement and consistency | Compares resolved vs. reopened tickets post-update |

| Coverage of New Issues | Range of issues handled using updated content | Reduced response gaps for new products | Tracks queries matched to new articles or SOPs |

| Coverage of New Issues | Range of issues handled using updated content | Reduced response gaps for new products | Tracks queries matched to new articles or SOPs |

| Usage Rate of Updated Knowledge Content | Frequency of agents using the latest materials | Ensures consistency and compliance | Monitors retrievals and prompt usage in real time |

| AI-Resolved Call Percentage | Calls completed without human escalation | Efficiency and scalability | Logs autonomous resolutions vs. total calls |

| Full Trace of Actions and AI Reasoning | End-to-end visibility on all automated or human actions | Audit readiness and lower compliance risk | Records API calls, reasoning steps, and outcomes |

| Gap Alerts against Regulatory Updates | Detection of non-compliance or outdated rules | Prevents risk exposure and fines | Monitors compliance feed changes and flags discrepancies |

| Offer or Script Optimization Score | Effectiveness of updated phrasing on satisfaction | Data-driven continuous improvement | Correlates new phrasing with NPS and conversion shifts |

Building and maintaining the kind of agentic AI systems we’ve just described in-house is slow, complex, and costly. Most AI development teams underestimate the specialized expertise and breadth of experience required to design, orchestrate, and govern these systems effectively, and only realize it once projects stall or fail to scale.

Off-the-shelf solutions aren’t a viable option either. They can’t handle the complexity of multi-step financial workflows or meet strict banking compliance standards.

Neurons Lab is uniquely positioned to design effective and cost-efficient custom AI solutions that deliver measurable business impact. As experienced AI system integrators, we bring a ready architecture and codified patterns, then tailor them to your processes.

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. As an AI enablement partner, we design, build, and implement agentic AI solutions tailored for mid-to-large BFSIs operating in highly regulated environments, including banks, insurers, and wealth management firms. Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization.

Our principles are policy-grounded retrieval (hybrid RAG + knowledge graphs), tool execution with guardrails, explicit autonomy boundaries, full audit trails, continuous evaluations, and token-aware design.

With Neurons Lab, you build a context-plus-orchestration layer over your existing stack (using best-of-breed LLM/STT/TTS—we don’t build base models.) You also implement fast with AI accelerators that we customize to your systems and SOPs. That way you get measurable lifts (FCR/NPS, AHT, transfer rate) without needing to build everything from scratch.

Below, we show exactly how our agentic AI accelerators can help you address common customer service challenges.

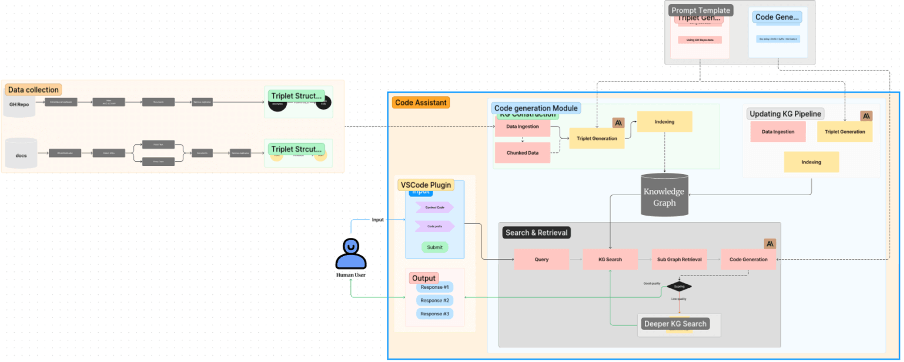

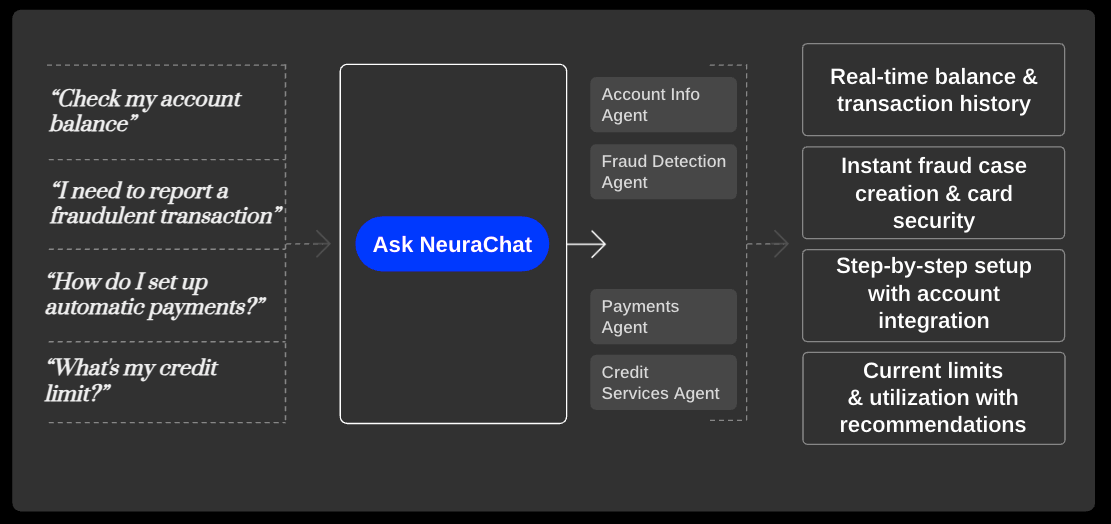

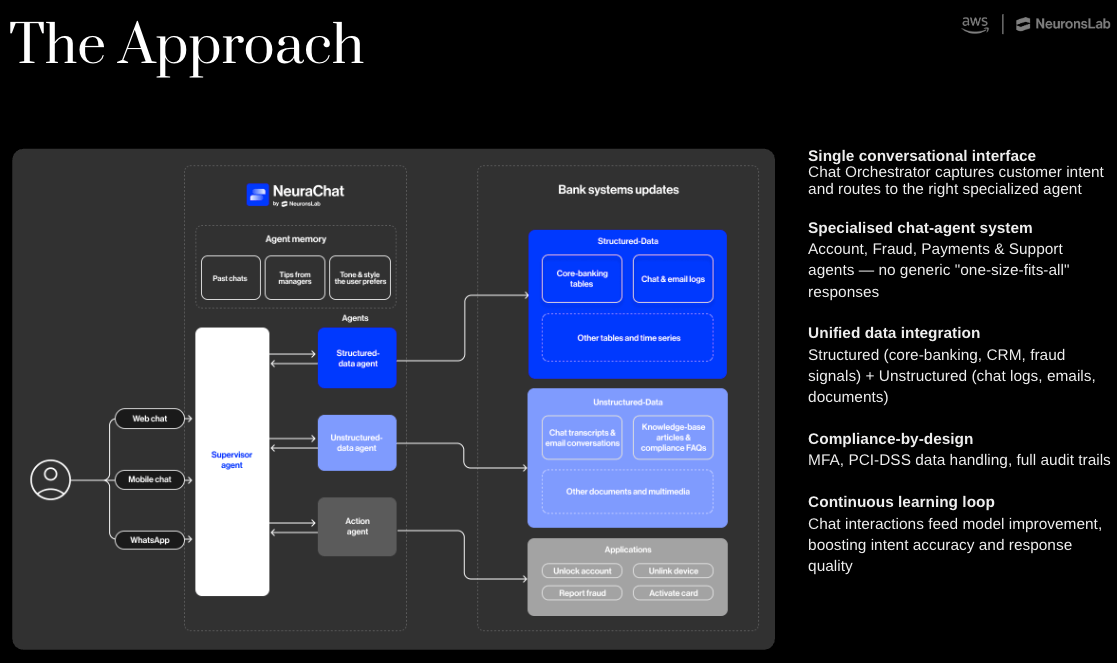

NeuraChat is an AI-powered chatbot that you can customize to help CS reps deliver fast, personalized customer support while automating the repetitive tasks that slow them down.

It provides a single conversational interface that connects directly to your existing systems (i.e., CRMs, knowledge base, core banking).

NeuraChat is designed for customer service divisions and can be customized to your systems and requirements

When a customer sends a message through web chat, mobile, or WhatsApp, a supervisor AI agent captures their intent and routes the query to the right specialized agent trained for a specific task (e.g., cards, payments, fraud detection).

Using hybrid RAG (vectors and knowledge graph rules) and policy prompts, NeuraChat draws on both structured data like core banking records, CRM, or interaction logs, and unstructured data like chat logs, emails, or documents. It identifies approved answers and orchestrates actions via APIs/RPA with consent and audit logging. This means it can answer complex, multi-step questions that span multiple systems, all in just a few seconds/minutes.

Neurons Lab’s NeuraChat uses a multi-agent system to route customer intent, unify data across banking systems, and deliver accurate, compliant responses in real time

NeuraChat also ensures every response is accurate and context-aware, rather than generic. Outcomes feed a learning loop that updates guidance and identifies reusable interaction patterns from successful calls: the wording, sequence of steps, and escalation triggers that correlate with higher FCR and better sentiment. It converts these into real-time agent prompts and updated knowledge articles, then re-tests them so only what works sticks, automatically improving intent detection and response quality over time.

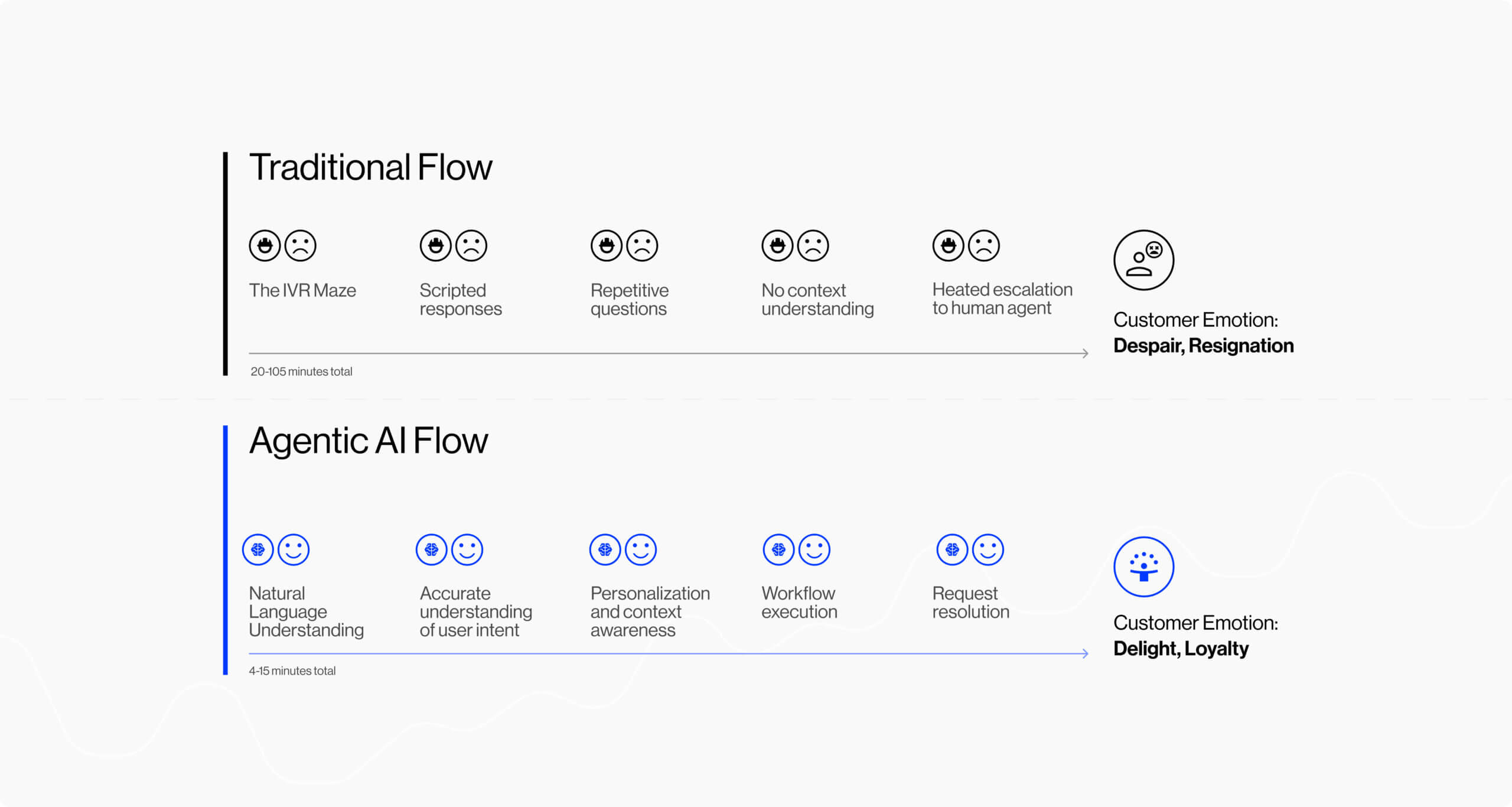

NeuraChat replaces scripted, slow chat support flows with intelligent, context-aware interactions that cut handling times, reduce rep overload, and increase customer satisfaction

As a result, up to 80% of customer inquiries are resolved with minimal human intervention, freeing your agents to tackle high-value tasks. You can also handle twice as many tickets without doubling your operational load. Other measurable outcomes include:

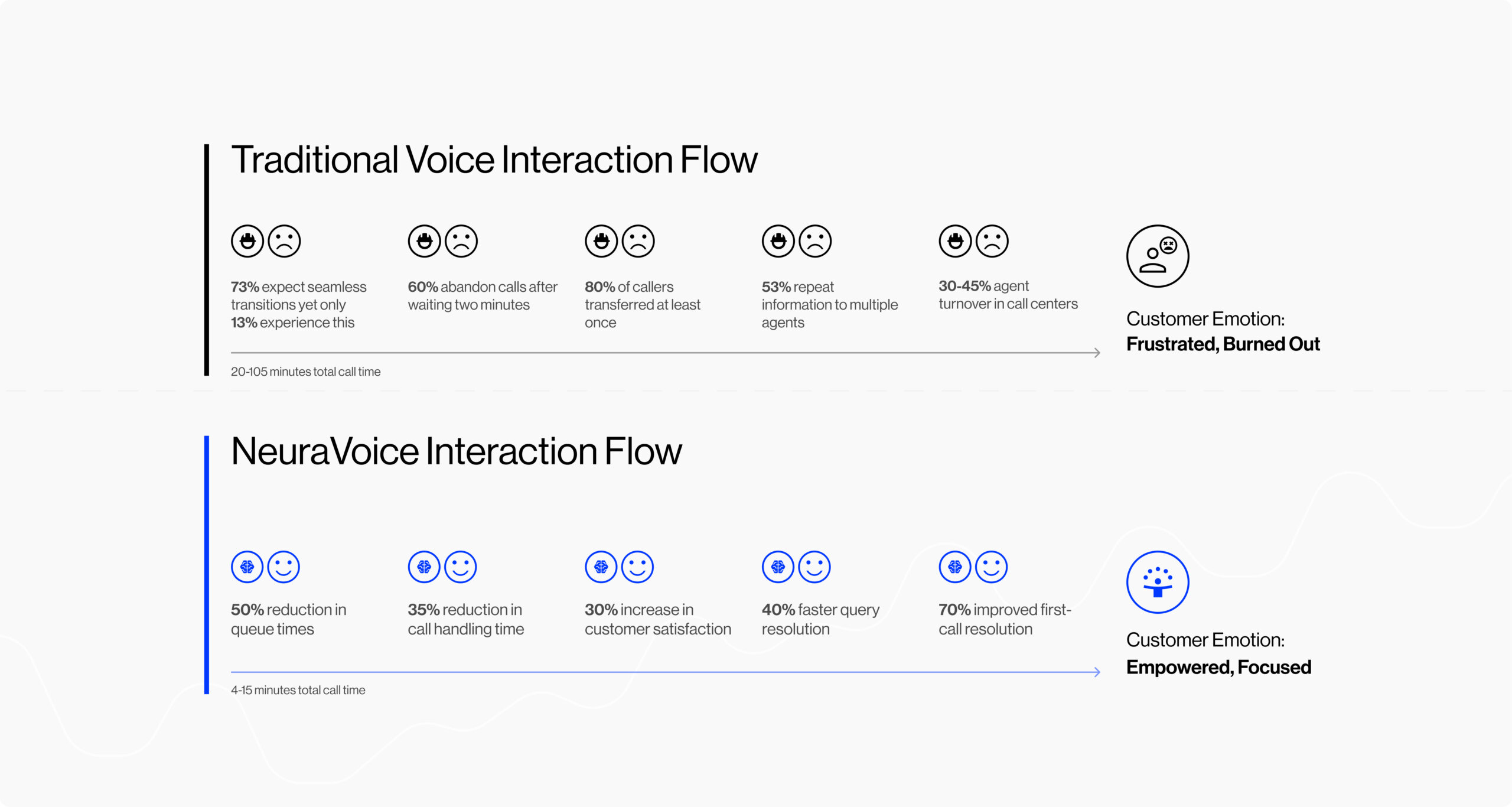

NeuraVoice is an AI-driven accelerator solution for live calls. You can tailor it to your workflows, helping your CS reps manage voice interactions faster with real-time guidance, natural understanding, context-awareness and automated compliance.

NeuraVoice enhances CS reps’ voice interactions, overcoming key challenges like a lack of understanding to speed up call times, up FCR, and increase customer satisfaction

NeuraVoice handles voice interactions with streaming STT/TTS, real-time intent/sentiment, and agent assist. It executes allowed actions (e.g., card block) with disclosures, hands off when confidence or policy dictates, and transfers full context to the human agent. Every call produces an explainable trace (consent, ID&V, policy matched, tools called), and contributes to implicit CSAT/FCR measurement and knowledge base updates.

For example, during a voice interaction with a customer:

1.A voice-understanding agent processes natural language in real-time, recognizing the context and the customer’s intent, and ensures the CS rep understands what the customer needs.

2. A knowledge agent retrieves that customer’s information from your systems, accesses the customer’s history, and provides your CS rep with the best course of action based on their full customer history.

3. The agent-assist AI provides your CS rep with real-time guidance and suggested responses while running compliance checks during the interaction.

4. Meanwhile, a conversation manager agent ensures your CS rep maintains natural dialogue flow and confirms resolution, while capturing key KPIs for reporting and improvement.

As a result, up to 80% of inquiries are resolved with minimal human intervention, freeing your reps to handle twice as many tickets. And while traditional calls typically take between 20 and 105 minutes, and often involve multiple transfers and repeated explanations, NeuraVoice shortens these interactions to between just 4 and 15 minutes. It also provides measurable outcomes such as:

As you can see, our accelerators can help your customer service division overcome key challenges, such as slow response times, inconsistent service quality, and rep overload.

Tailored to your institution’s infrastructure and workflows, they reflect how your reps actually operate while delivering the benefits of automation, unified insights, and compliance from day one.

In the next section, we’ll show how we leveraged NeuraChat to help a company operating in the highly regulated telecom industry achieve measurable results.

A major telecommunications operator in Southeast Asia faced slow, fragmented access to business intelligence, severely impacting decision-making. Leadership needed an internal support solution to give employees access to instant answers. They approached us with three goals:

Before partnering with Neurons Lab, the company’s teams spent over 40 hours a month compiling routine performance metrics from multiple dashboards and often relied on constant analyst support for basic queries.

Insights were scattered across Databricks and unstructured content like financial reports, strategic documents, and market research, made analysis slow and incomplete. Non-technical users couldn’t access data easily, creating bottlenecks and delaying strategic decisions.

We worked with the company to co-create an AI-native virtual assistant that simplifies complex enterprise data into an intuitive chat experience. Built on NeuraChat, it combines multi-agent orchestration and document intelligence to deliver instant, accurate insights.

Deployed on AWS with secure, auto-scaling infrastructure, the solution integrates into existing tools like Google Chat, driving immediate adoption with zero training required. The AI virtual insights assistant delivered the following measurable results:

As an AWS Advanced Tier Partner with Generative AI and Financial Services Competencies, we’ve helped financial services firms like Visa, AXA, PrivatBank, and Oschadbank embed AI into their operations. Because of our AI exclusivity and financial services focus, we can orchestrate and customize agentic AI with faster time to value and compliant outcomes.

As a system integrator, we provide the infrastructure and architecture to help you extract your differentiating processes and knowledge—like how your top performers handle clients, make decisions, and resolve issues— and embed it into agentic AI systems. That way, AI becomes the distinctive factor that delivers faster, more consistent, and brand-aligned customer banking experiences that competitors can’t easily replicate.

Neurons Lab’s services cover the entire AI project lifecycle

Backed by a global network of 500 engineers, we deliver at scale while operating with the agility and efficiency of a boutique agency. With our AI accelerators, you can deploy RAG, voice, or document capabilities in as little as two months.

Continuous and structured evaluation processes are built into our delivery model, helping you avoid subjective “vibe checks” that lead to blind spots, costly errors, and regulatory compliance risks. As a result, your agentic AI systems stay stable and effective across specific and multi-step processes. They also adapt dynamically to regulatory updates, market shifts, and product changes.

This ongoing feedback loop preserves expertise, enforces compliance, and keeps operational costs predictable—so every interaction keeps performing like your best rep at scale and over time.

For AI in banking customer services, the real opportunity lies in using agentic AI to capture and scale the expertise of your top-performing reps. By embedding their implicit knowledge into compliant, context-aware systems, you can deliver faster, more consistent, and more accurate service across every channel.

At Neurons Lab, we help you not only automate but amplify your processes through compliant, custom CS solutions. This approach builds a symbiotic partnership between humans and AI. It also preserves institutional know-how that’s often lost through turnover while continuously learning from each interaction to enhance service quality over time.

Ultimately, every customer interaction reflects your best rep’s reasoning, helping you improve satisfaction while creating an advantage competitors can’t copy.

Ready to see how this can work for your customer service division? We are happy to share insights from our partnerships with leading financial institutions. Book a call with us today.

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

See how wealth management firms can use AI to streamline workflows, boost client engagement, and scale AUM with compliant, tailored solutions

Discover how FSIs can move beyond stalled POCs with custom AI business solutions that meet compliance, scale fast, and deliver measurable outcomes.

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.

LLMs for finance explained: compare top models, benchmarks, costs, and governance to deploy compliant, scalable AI across financial workflows.