What is the Cost of AI for BFSIs in 2026? 4 Examples To Budget Accordingly

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

According to a recent MIT study, only 5% of companies investing in artificial intelligence actually make a profit.1 If you’ve been thinking about implementing AI, this may leave you with reservations about whether it’s truly worth the investment. However, this figure isn’t a universal truth. In fact, some studies report much higher return from AI initiatives.

As AI system integrators, we know AI can produce ROI, but only if your firm has the foundations in place to use it effectively and make it profitable. The priority is confirming that readiness before launching any AI initiative.

At Neurons Lab, we’ve delivered more than 100 projects, a large share of which is already producing AI ROI. Based on experience, we’ll share how you can strengthen your ROI strategy and why profitability depends on more than the quality of your AI tools.

In the article, we cover:

Looking to achieve measurable return on your AI investments? Neurons Lab can help. Book a call with us today.

The 5% narrative often reflects industry hype more than reality. In fact, multiple studies prove the opposite is true and that many banks and financial services firms (BFSIs) are seeing a return on investment with AI:

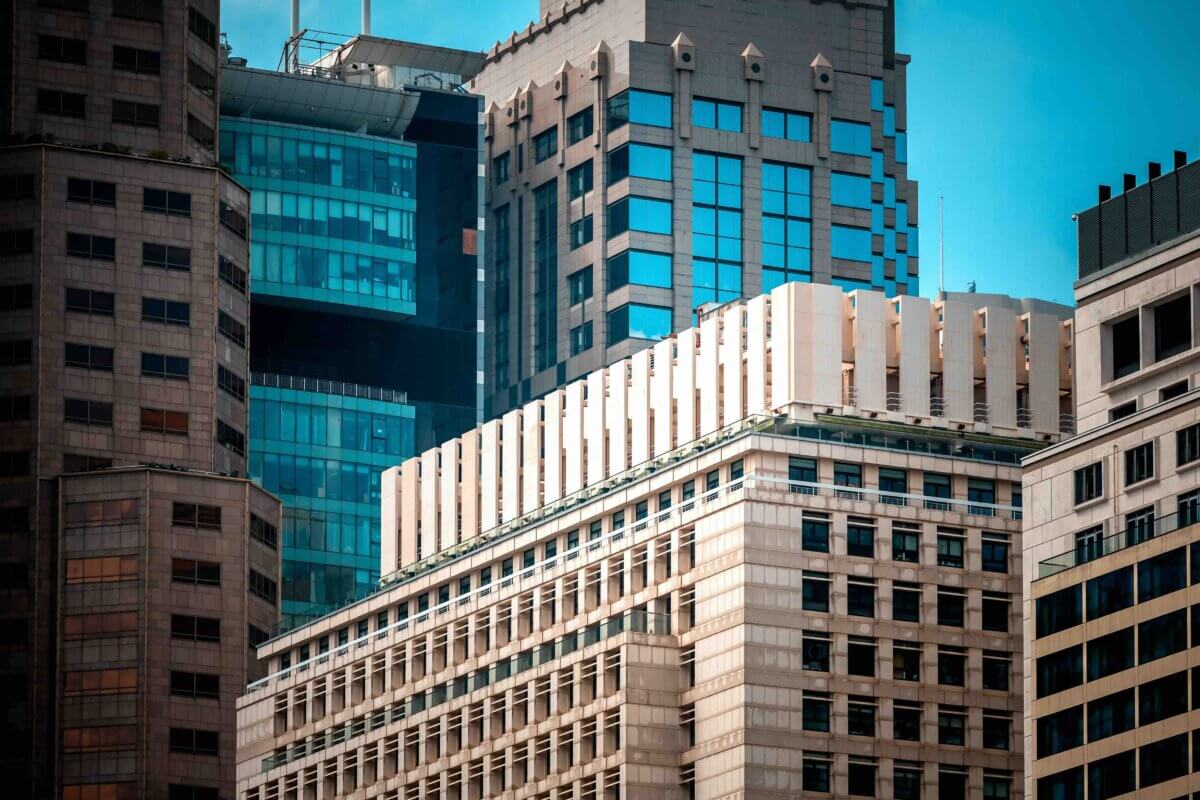

Image source: Bain Generative Artificial Intelligence Survey 2024

The difference between them comes down to the audiences studied.

MIT’s research looks at a broad, cross-industry audience, including many still new in their AI journey.

But the respondents to the other surveys and studies are all digitally native with stronger data foundations and more established AI expertise.

Google’s, IBM’s and IDC’s focus is on organizations that are already investing in AI and often have existing relationships with the sponsoring technology providers. Other studies concentrate on IT and AI leaders. And the Bain’s report shows how financial services firms are investing more in artificial intelligence and building AI solutions in house as off-the-shelf tools can’t meet their more sophisticated requirements.

So what are these more AI-savvy firms doing to make their ROI much higher and realized much faster?

They have invested first in business readiness—preparing their firms for AI implementation and AI adoption that improves operational decision-making. This includes:

Firms that see lower returns often fail to do this. Their AI efforts may even remain in the experimental phase. While this is useful for learning, tests are not structured to produce measurable business value.

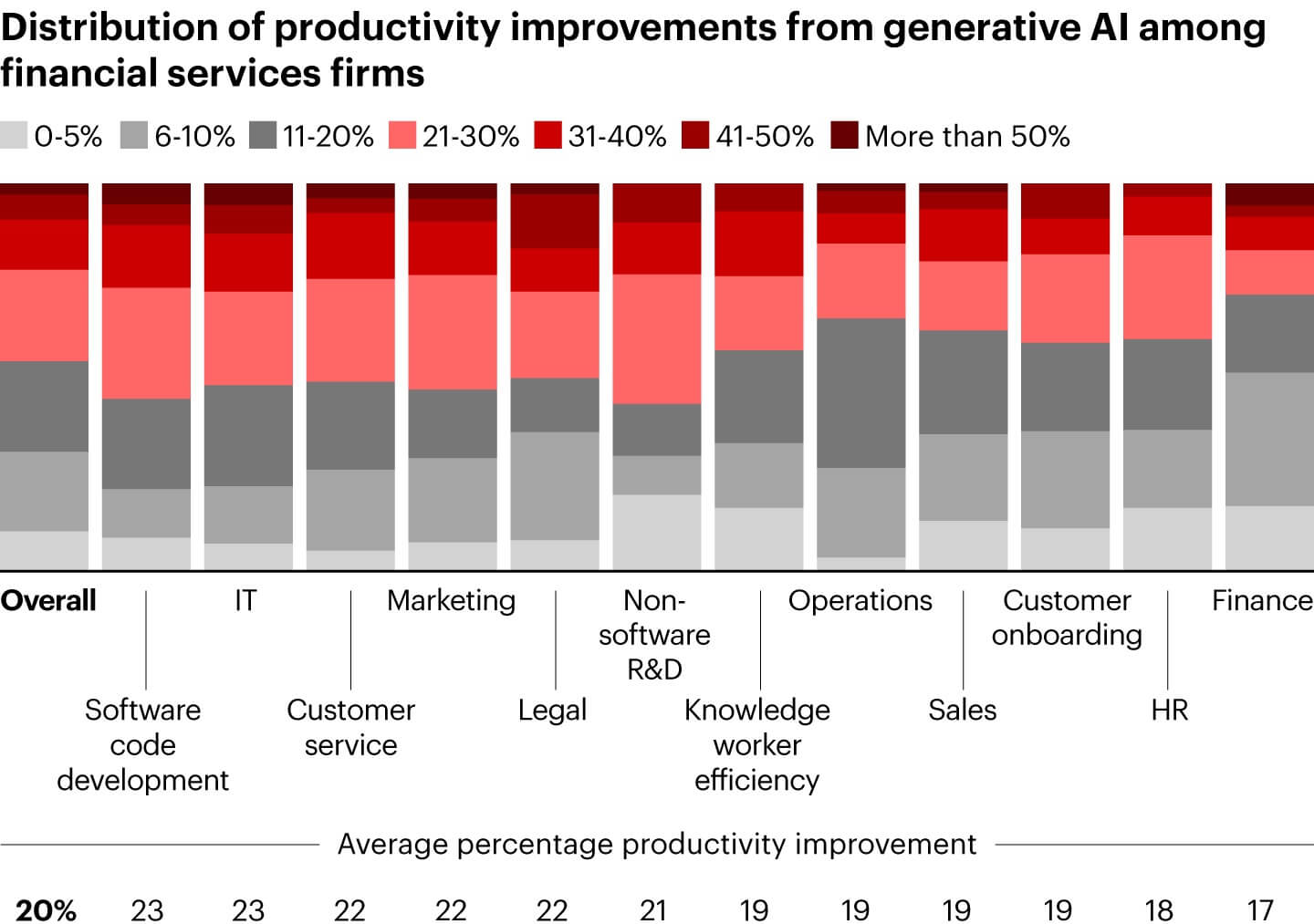

Due to a lack of readiness, only a small number of firms convert pilots into real, scalable ROI – Image source: MLQ

To become like those firms that make a profit from AI, there are specific capabilities you can put in place that ensure company readiness while also preventing you from falling into common traps along the way.

To get your ROI right and make a profit from your projects as a BFSI, here’s what to have in place:

A common mistake we often see is that financial services firms don’t have data on their current performance in the areas they want to improve with AI.

For example, a wealth management firm may want to increase its assets under management (AUM), net promoter score (NPS), client capacity, and workflow automation. While they may have the data on AUM and the number of clients served per relationship manager, they may not be tracking the tasks and services that affect their NPS or operational performance. Without the right numbers, it’s impossible to measure any relevant gains in productivity, efficiency, or revenue.

Even when firms do track this data, they often measure performance in human hours rather than units of work. The problem with this is that human hours aren’t consistent: a task might take 5 minutes or 5 hours, depending on complexity. As a result, you may struggle to track progress or pinpoint where efficiency gains come from. Instead, it’s better to base performance on what actually gets done.

By defining clear, repeatable units of output like ‘one processed support request’ or ‘one analyzed legal document’, you create a more consistent basis for comparison. This helps you measure what your teams actually produce. You can apply this same approach across back-office workflows, internal operations, and automated processes. For example:

Each example ties the unit of work to a measurable output. This lets you calculate efficiency, cost per unit, and throughput in a way that links directly to ROI. You can then compare these baselines across quarters and demonstrate where AI contributes to productivity, lower costs, or higher capacity.

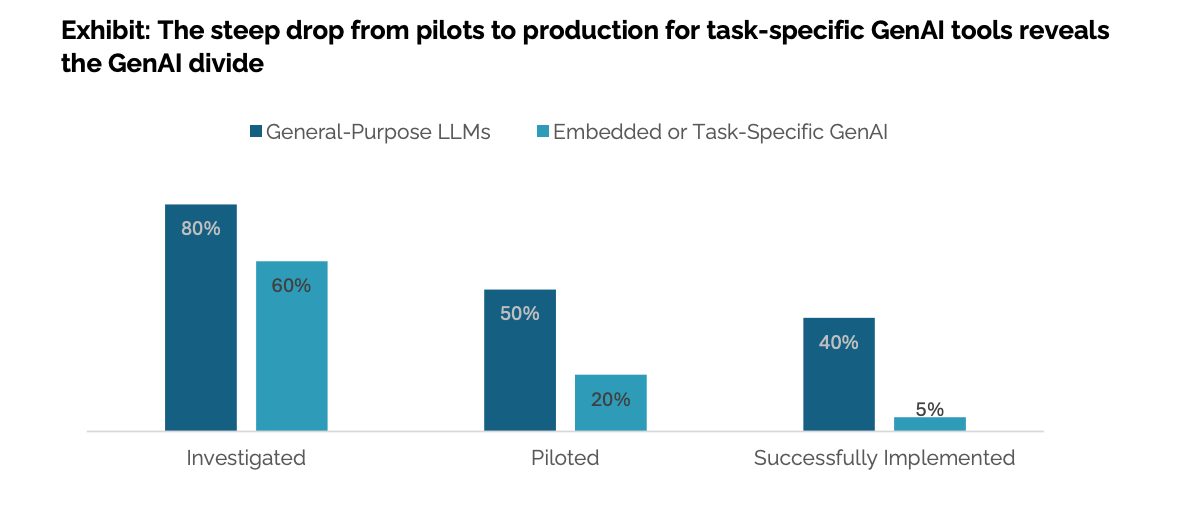

You may wind up investing in AI without knowing if an off-the-shelf tool or a custom solution is the answer, which can lead to poor ROI decisions.

Off-the-shelf tools work best for simple tasks like document search or data extraction. The benefit of ready-made solutions is that you don’t have to invest much in them. The drawback, however, is lower returns since they can’t handle complex workflows, high volumes, or compliance requirements with higher unit economics.

Custom solutions, on the other hand, work best for more complex, high-volume workflows, such as automating multi-step bank customer service queries or supporting whole departments like wealth or asset management.

The upside with bespoke systems is that you design them to integrate with your data and apply your internal rules, brand guidelines, and regulatory requirements, ensuring greater accuracy (and end-user satisfaction) while lowering risk. The downside is that this requires a much higher upfront investment.

Without this clarity, you may expect a generic tool will deliver strong returns or approve custom development for problems that don’t actually need it. Clear criteria help you choose the right approach for the right case so you can scale faster and achieve higher ROI.

The differences between off-the-shelf and custom AI technologies – Image source: CodeIT

Some firms may try to play it safe by testing AI on a very small scale, like launching an AI assistant to support only a single executive.

But this approach rarely delivers meaningful returns. The fixed costs of implementing, integrating, securing, and maintaining an AI solution don’t change whether it serves one person or an entire team. Even if that executive earns $1,000 per hour, saving a couple of hours of their time will never offset the cost of a dedicated AI deployment.

Small pilots fail for another reason. The underlying workflows are too limited to generate measurable value. For example, supporting one portfolio manager with a handful of monthly review packets, drafting memos for one analyst, or automating an infrequent compliance task spreads the cost of AI across too few outputs. These tasks do not repeat at a level that creates financial leverage.

Testing AI on rare edge cases, such as complex escalations, bespoke wealth-planning work, or unusual KYC files, produces the same problem. The work is important but does not occur often enough to produce any meaningful ROI.

A more effective strategy for business leaders is to focus on high-volume use cases and repeatable workflows, where the same task is performed hundreds or thousands of times each week. For example, firms see strong returns when they deploy AI to:

By deploying AI across a full department instead of a single individual, the fixed costs of implementation are spread across far more output. This leads to measurable time and cost savings and a faster path to positive ROI.

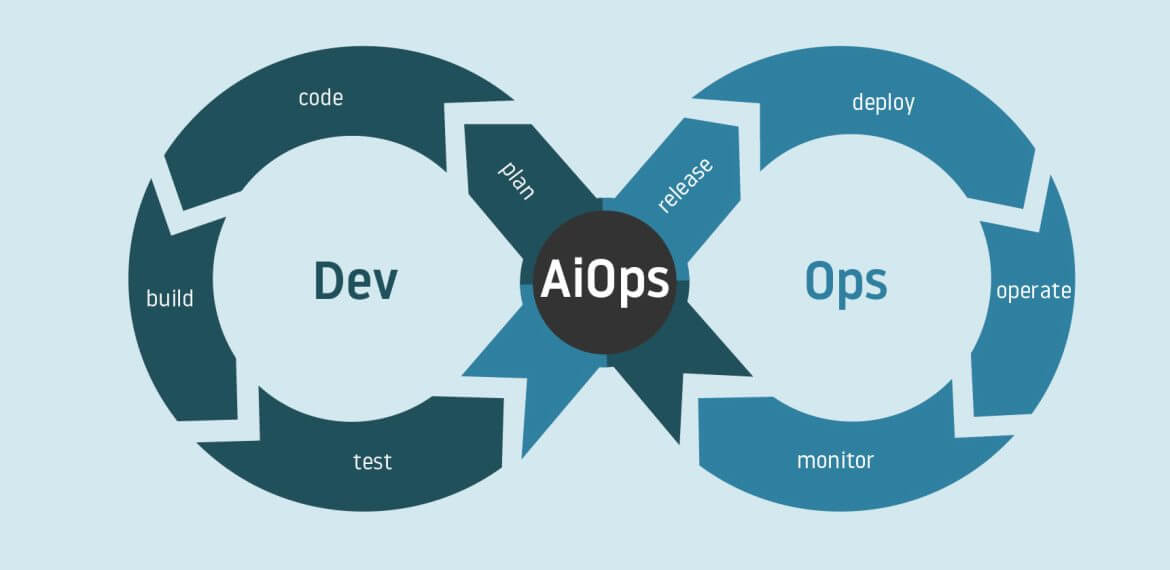

Once you add AI, you may lack strong artificial-intelligence, machine-learning or large-language-model operations (AIOps, MLOps, and LLMOps, respectively) to monitor AI performance, track costs, manage models, and keep your smart solutions running reliably. Without them, you can’t see how your AI is working or what it’s costing you. And as a result, you can’t compare performance before and after AI implementation to determine your ROI.

Misattribution also becomes an issue, and you may end up crediting AI for business outcomes caused by other factors. For example, you may assume a revenue spike came from a new banking chatbot when it was driven by a marketing campaign.

However, with strong AIOps in place, you’ll have access to more detailed performance data and your AI’s actual contribution. Let’s say you’ve set up a customer-facing chatbot. AIOps will help you understand performance at the level of each interaction and the impact on your AI spending.

For example, with AIOps, you’ll be able to track the ROI of closing one customer support request:

This gives you a starting point for calculating true ROI once you factor in other operational costs.

AIOps is central to every stage of your development and operations process – Image Source: Buxton Consulting

We understand that you may not have all the data tracking and engineering capabilities laid out in the previous section, or the ability to decide if a generic vs an AI custom solution is better.

Achieving this readiness requires the right tools and AI team, which can be difficult to set up without internal expertise. However, working with the right partner can help you set up a measurable, achievable ROI and get the right training (and even team members in place) to launch and scale your project on your own.

As an AWS Advanced Tier partner with proven expertise in Generative AI and Financial Services, Neurons Lab can provide AI-exclusive expertise, as both an AI consultancy and systems integrator, to help you gain the capabilities of creating AI systems that provide measurable returns on your investment.

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. As your AI enablement partner, we design, build, and implement agentic AI solutions tailored for mid-to-large BFSIs operating in highly regulated environments, including banks, insurers, and wealth management firms. Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization.

Neurons Lab’s end-to-end AI development and consultancy services

For most companies and use cases, we can help you quantitatively estimate ROI at the PoC or projection level. This means you base ROI on measurable metrics, such as margin increase, productivity gains, and efficiency improvements.

In early-stage or partially deployed solutions, however, return is often assessed qualitatively, through indicators like improved customer experience or faster workflows, until full production deployment allows for financial modeling.

Here are examples of how we’ve applied these ROI assessments across industries and use cases:

With ROI defined and demonstrated, the following two capabilities show how we support you in executing your AI strategy.

Some use cases perform well with off-the-shelf AI tools. Others require custom development to support high-volume or specialized workflows. The key is to match the solution to the outcome you need and confirm that the gains can be measured. A mix of both approaches often produces the strongest ROI.

With Neurons Lab, you’ll get clear guidance on which AI option makes the most sense. This ensures you’re not overspending on a custom solution when a simpler product could solve the problem faster, or choosing a ready-made tool that can’t meet your goals.

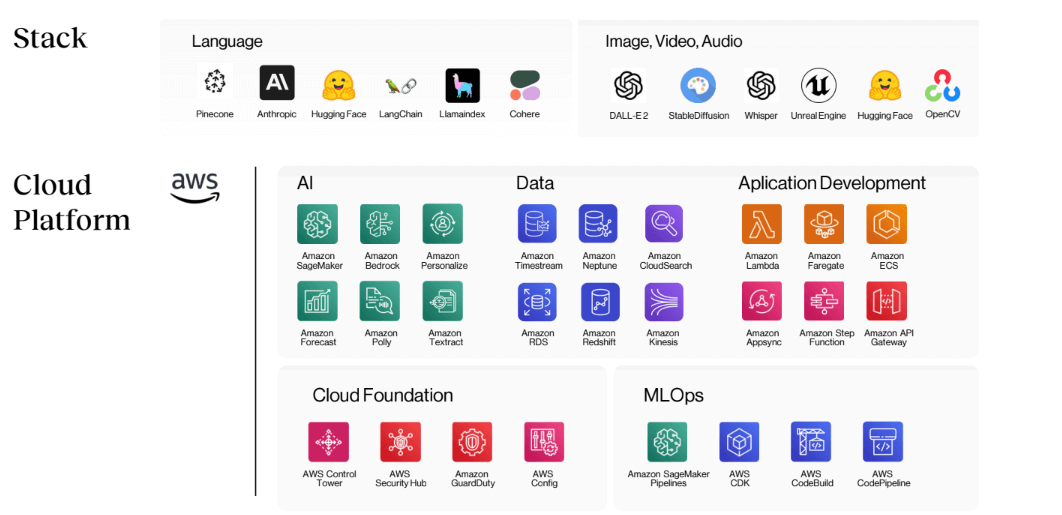

If an off-the-shelf product is the best fit, we’ll help you select the right tool or identify the most effective AI applications. If you need a custom solution, we’ll handle the implementation, including integrating LLMs or GenAI models, choosing the right frameworks like LangChain, and ensuring secure data access. We also ensure alignment with your workflows and compliance with GDPR, ISO, or IEC 27001, and ethical AI standards.

You’ll also get our expertise in defining and selecting high-volume, high-value use cases that are capable of generating measurable ROI. That way, you avoid wasting money on pilots on small groups or low-impact experiments.

We then help you set up unit economics tied to outputs rather than human hours, ensuring accurate baseline data to base your ROI calculations on. You’ll have the guidance you need to measure baseline performance and estimate potential savings or revenue gains.

Before rollout, you’ll get structured evaluations and controls for accuracy, hallucinations, and reliability until the right performance thresholds are met. Your teams will also receive training so they can run these AI-powered solutions independently and scale on their own.

Neurons Lab’s four-phase implementation plan

With our 500+ AI engineer network, you’ll have the technical support to set up a strong measurement infrastructure. This includes AIOps that can track how your AI models are performing and how much they’re costing you at a granular level. That way, you know the cost per request, task, or conversation and can accurately calculate your return on investment.

From there, we’ll help you set up controlled rollouts, select the right cohort of employees or customers, and structure the rollout so the results are statistically significant. Our technical support to ensure ROI measurement also includes:

For example, if you roll out an employee chatbot, we’ll compare its document processing speeds against your baseline numbers to see if AI has led to a measurable improvement.

To ensure accurate tracking continues after deployment, you’ll have real-time dashboards we set up that show spending, model behaviour, and performance. Your teams can receive training to use these tools so measuring ROI becomes an internal capability, rather than something you rely on an external partner to do.

Neurons Lab’s tech stack aligns with industry regulations and provides enterprise-grade trust and safety features

Discover how to forecast and calculate the ROI in AI

As we’ve shown, calculating the ROI of AI projects requires structure and intent. It depends on having reliable baseline data, clear use cases, the right AI solutions, and strong performance tracking through AIOps.

For BFSI firms wanting to turn AI investment into measurable value, there are two paths: build the capability in-house or partner with experts who already have it.

With Neurons Lab, you don’t have to choose. We act as your AI partner, supporting you across the full AI lifecycle. From identifying high-value use cases to scaling production-ready solutions that deliver measurable ROI, we guide every step.

We also work with your teams, transferring our expertise through training, workshops, and hands-on resources. That way, you develop lasting in-house capability, rather than vendor dependency.

If you’re ready to explore how AI could work for your firm or are ready to turn early experiments into real ROI, Neurons Lab can provide the strategy, systems, and support to get you there. Get in touch with us today.

Sources

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

See how wealth management firms can use AI to streamline workflows, boost client engagement, and scale AUM with compliant, tailored solutions

Discover how FSIs can move beyond stalled POCs with custom AI business solutions that meet compliance, scale fast, and deliver measurable outcomes.

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.