What is the Cost of AI for BFSIs in 2026? 4 Examples To Budget Accordingly

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

In June and July of 2025, Anthropic’s Claude for Financial Services and Perplexity Finance were launched, respectively. Both are hoping to transform how the financial services industry manages AI. But are they worth your time?

That’s what we’ll explore in this article.

As a leading AI consultancy that has successfully delivered tailored AI solutions to over 100 clients, including Fortune 500 companies and governmental organizations, we’ll share our knowledge on these new LLM tools designed for finance.

We’ll explain when it makes sense to use them out of the box or when deeper integrations make sense for your specific use cases and business goals.

In this article:

If you’re considering Perplexity or Claude for Finance, we can help you assess how these tools fit into your workflows and what it takes to make them reliable at scale. Let’s talk.

You’re probably already familiar with Perplexity and Anthropic’s Claude as popular Large Language Models (LLMs) and generative AI tools. And you may have even tried to use it in your financial organization for day-to-day tasks, like market research. But you probably noticed that it lacks capabilities such as industry-specific integrations and reasoning, that generate superficial responses.

For example, you may have asked Perplexity or Claude for stock price data or stock analysis, but it doesn’t go to the usual data source that your company relies on like Bloomberg Terminal.

Now, by combining their general-purpose LLM cores with real-time internet search and financial tools and data sources integrations, Perplexity and Claude for Finance act as your smart search assistants and natural-language chatbots. They can turn time-consuming manual research and insight gathering into automated summaries of market news, research reports, earnings calls, and more in an instant.

This makes Perplexity and Claude AI for finance great for growing productivity, especially for independent advisors, financial professionals, and small teams.

But, if you’re a financial services firm, you may be questioning how you can extend these tools beyond productivity gains to:

Here’s what you need to know about each of these new offerings.

Image source: Perplexity

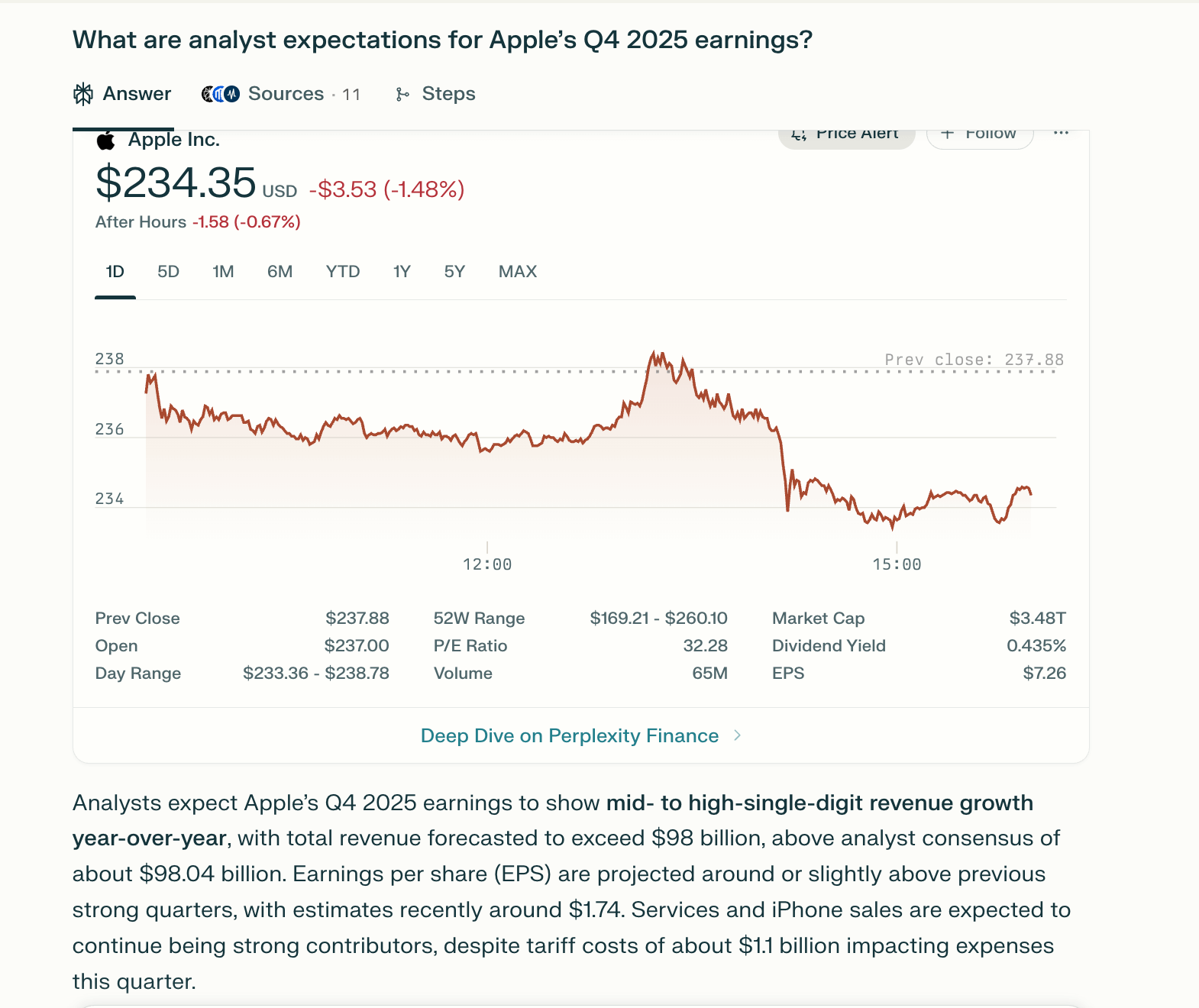

Perplexity AI for finance is built for the financial sector. It combines its LLMs with real-time internet search and integrated finance data from sources like Morningstar, SEC/EDGAR, Crunchbase and FactSet. This allows it to deliver current, source-backed answers to finance queries and follow-up questions.

For example, in general Perplexity search mode, a query about Apple’s performance may return a vague summary blending old training data and generic web content:

“Apple stock prices might go up because some analysts are optimistic, but others are cautious about market conditions.”

With Perplexity Finance, the answer draws on finance-specific tools:

“According to Bloomberg and CNBC, analysts project Apple’s revenue to grow 6% in Q4 due to strong iPhone demand.”

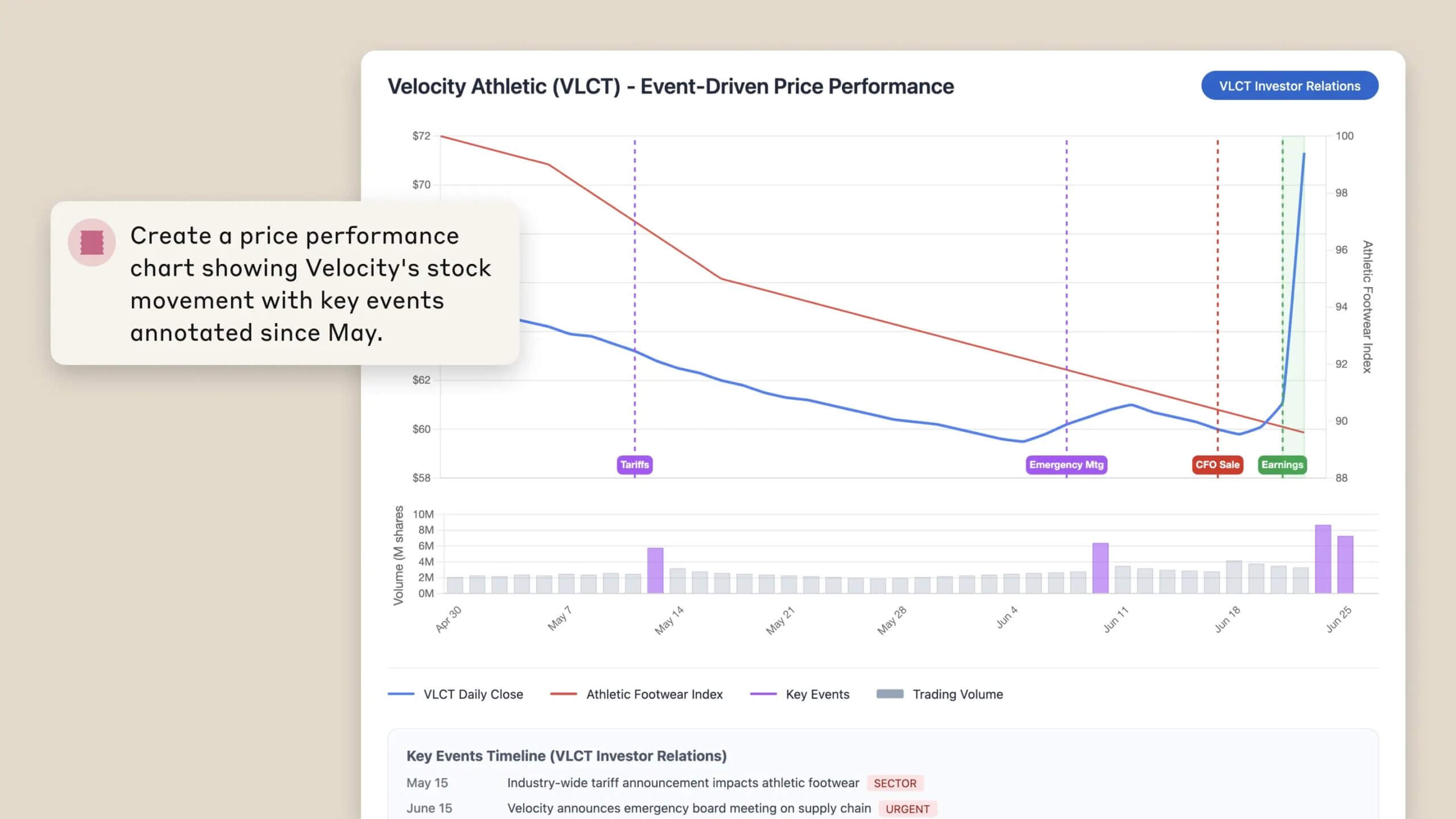

Perplexity AI finance response example

This makes Perplexity’s finance-specific answer engine a market research co-pilot. It compresses hours of research into minutes and reduces the risk of missing signals by drawing on real-time data.

It also shortens the learning curve for junior staff by simplifying complex topics with cited sources, helping to verify accuracy.

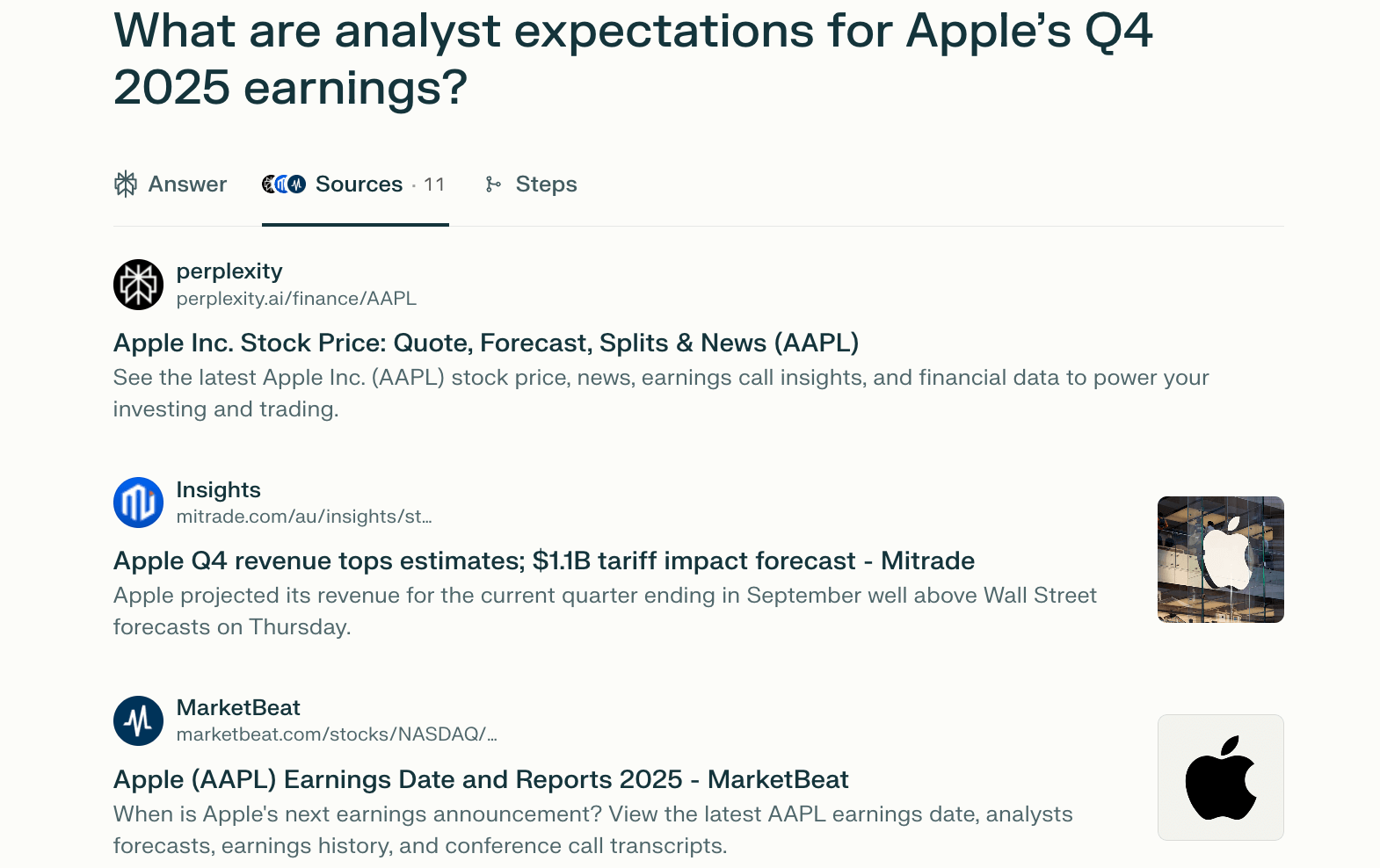

Source citing in Perplexity’s finance model

With Perplexity Finance, you can:

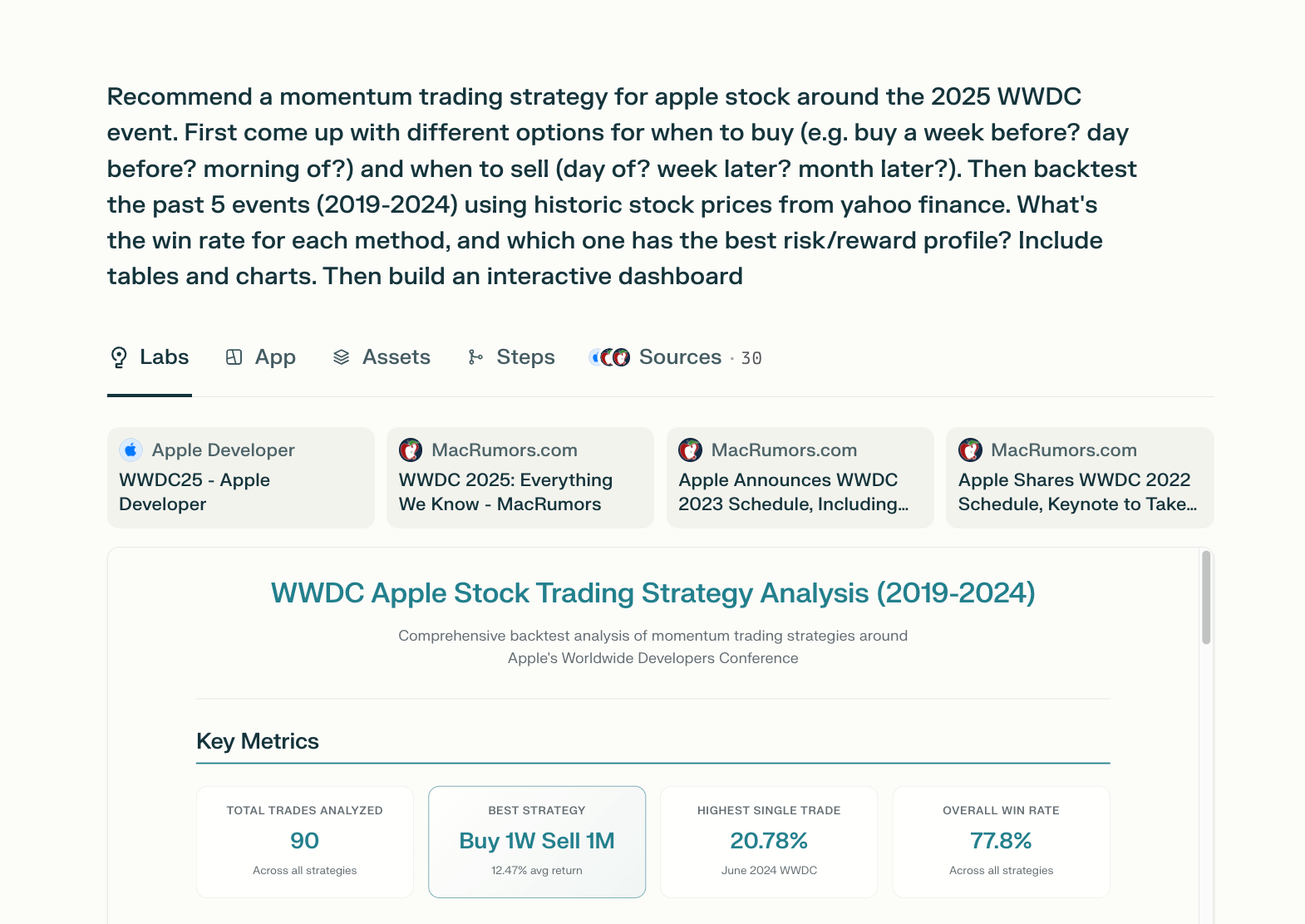

As an industry-specific LLM tool, it automates routine market analysis and stock market research, making it useful for traders and advisors. When paired with Perplexity Pro, Perplexity Labs and its open API , you can build dashboards, presentations, strategies, and custom applications that embed directly into workflows.

Developing custom applications with Perplexity Labs

Perplexity’s OpenAPI

According to early users, its current limitations include handling complex analysis and providing global coverage beyond the US and India.

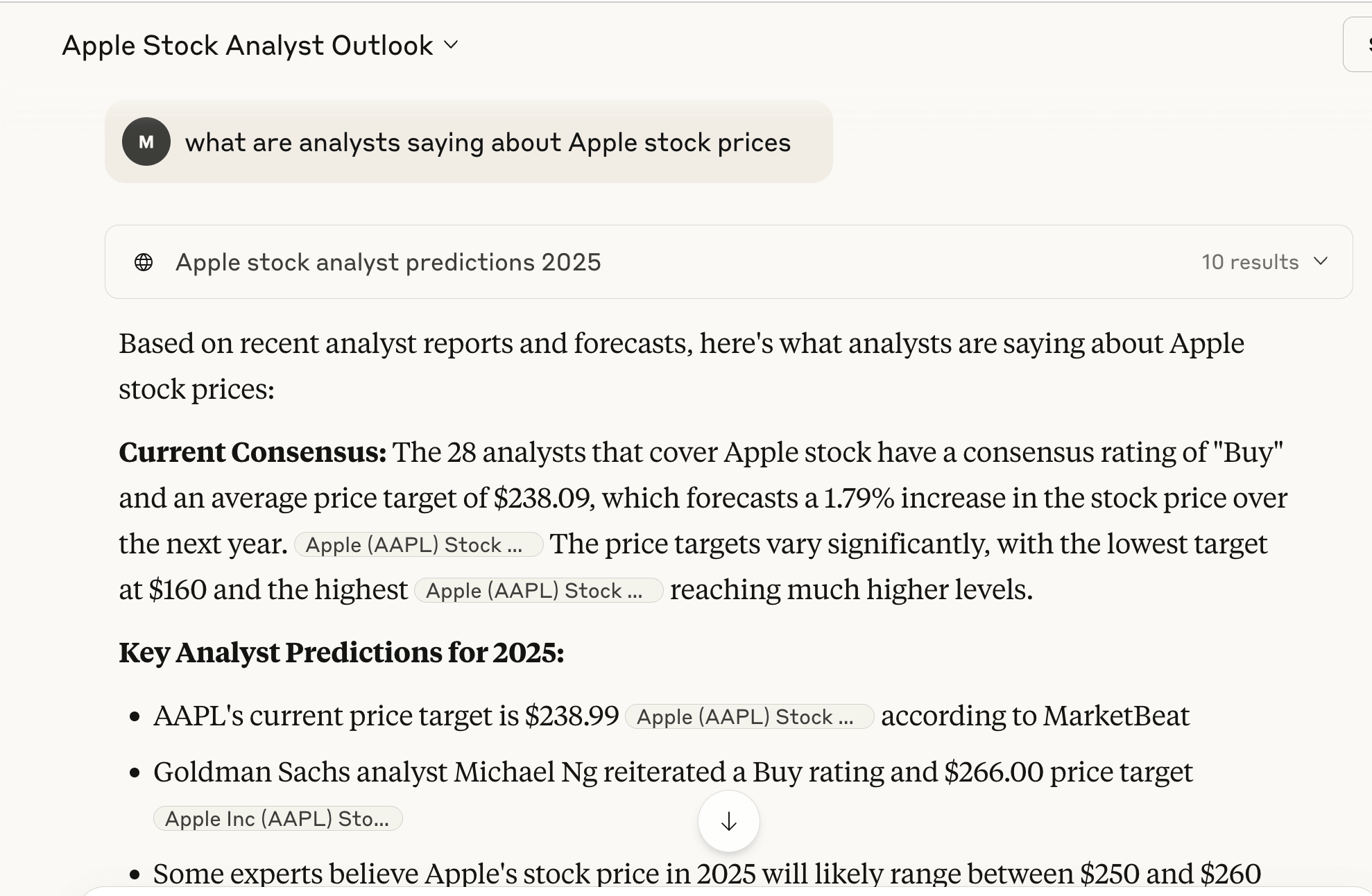

Like Perplexity, Anthropic’s Claude for Financial Services combines its core LLMs with finance-specific data sources and real-time search to provide cited answers.

Cited sources in Claude for finance

Unlike Perplexity Finance, it has stronger finance-focused reasoning, as shown in industry benchmarks.

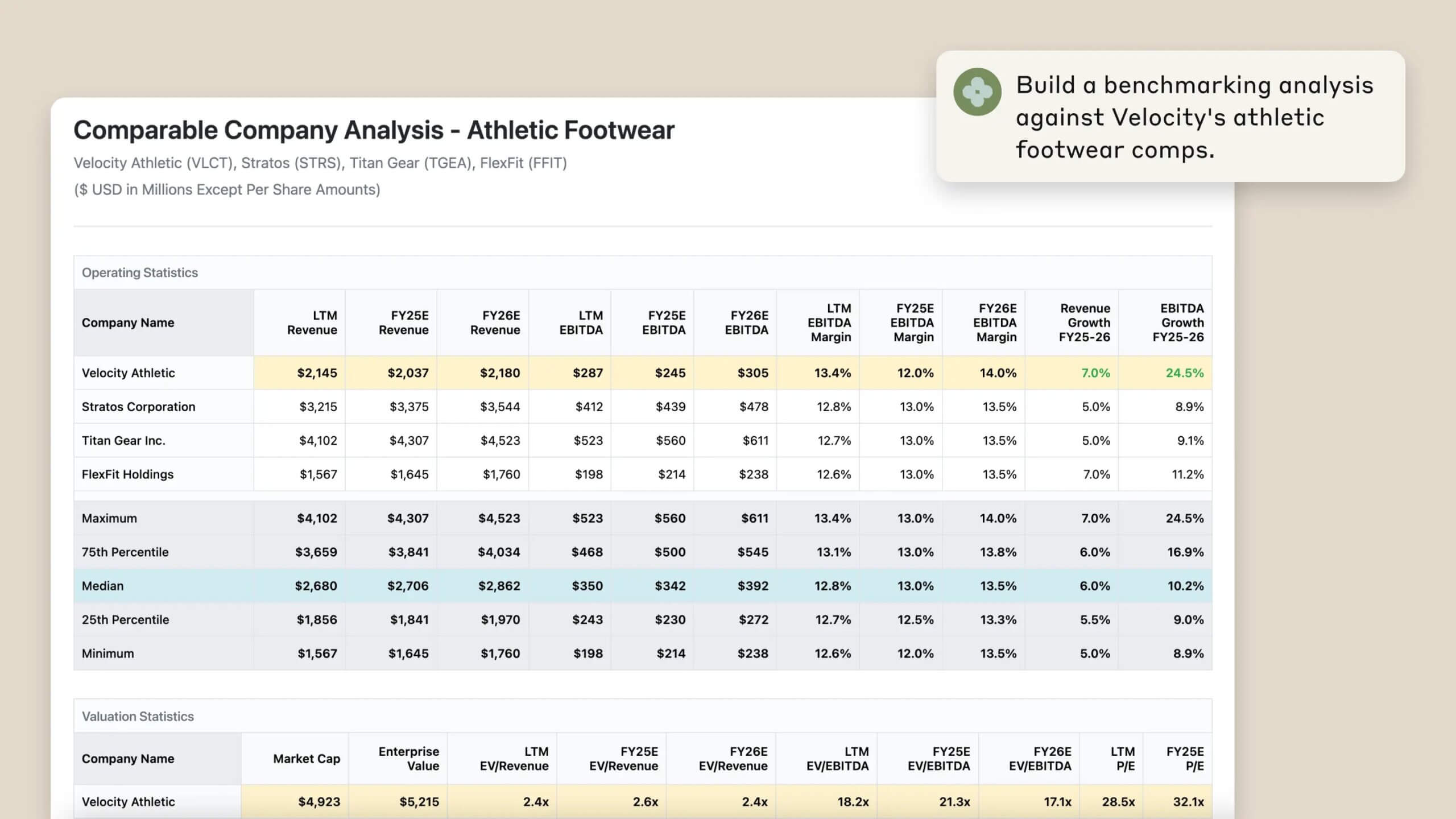

Building benchmarking analysis with Claude Finance

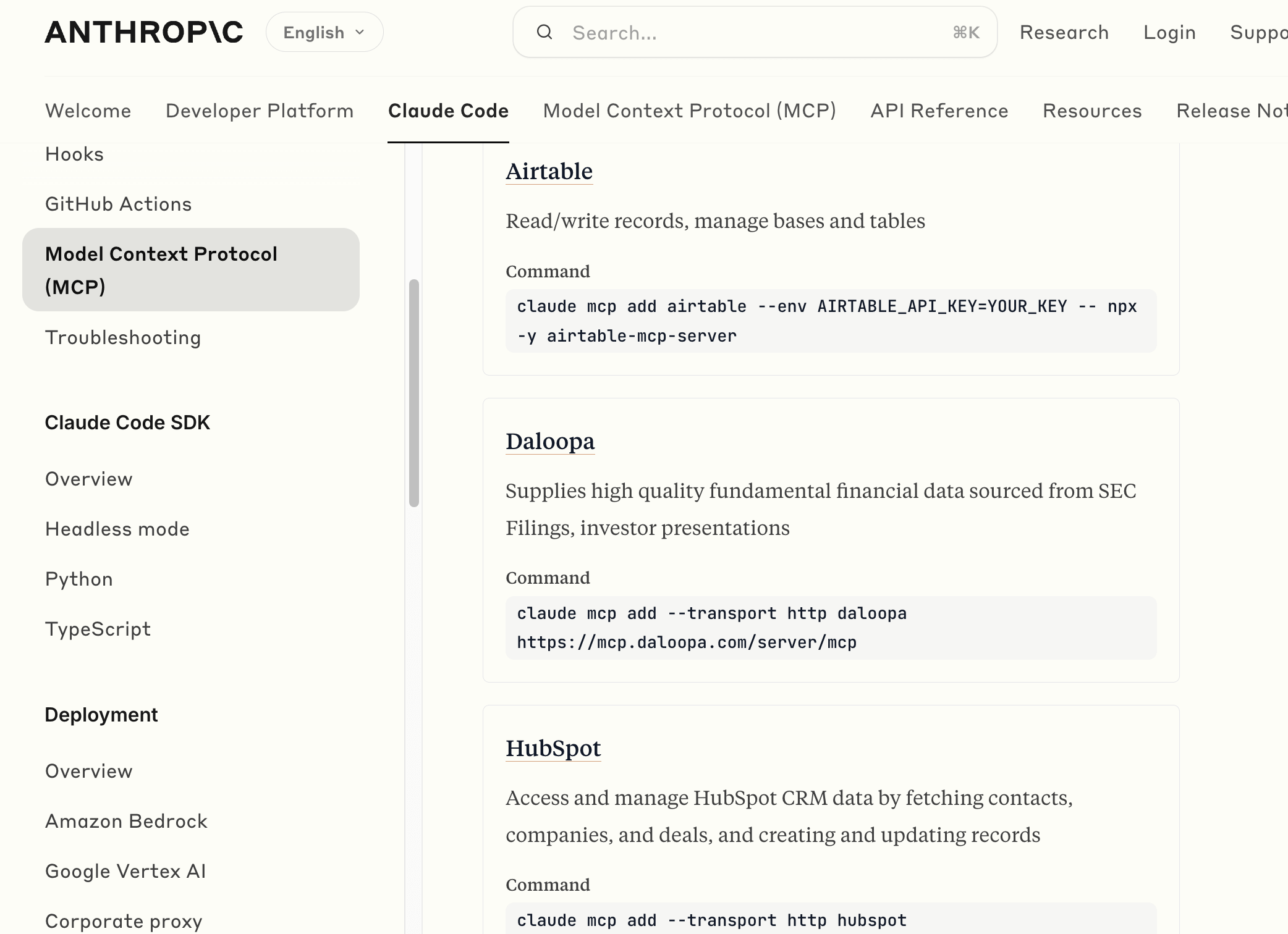

Claude’s finance-specific ecosystem also goes further on customization.

With low-code and minimal setup, firms can connect live market feeds and internal data from platforms like Databricks and Snowflake. Pre-built connectors extend to leading providers such as Box, Daloopa, Palantir, PitchBook, and S&P Global, allowing teams to begin analysis without heavy integration work.

Claude connectors within Anthropic

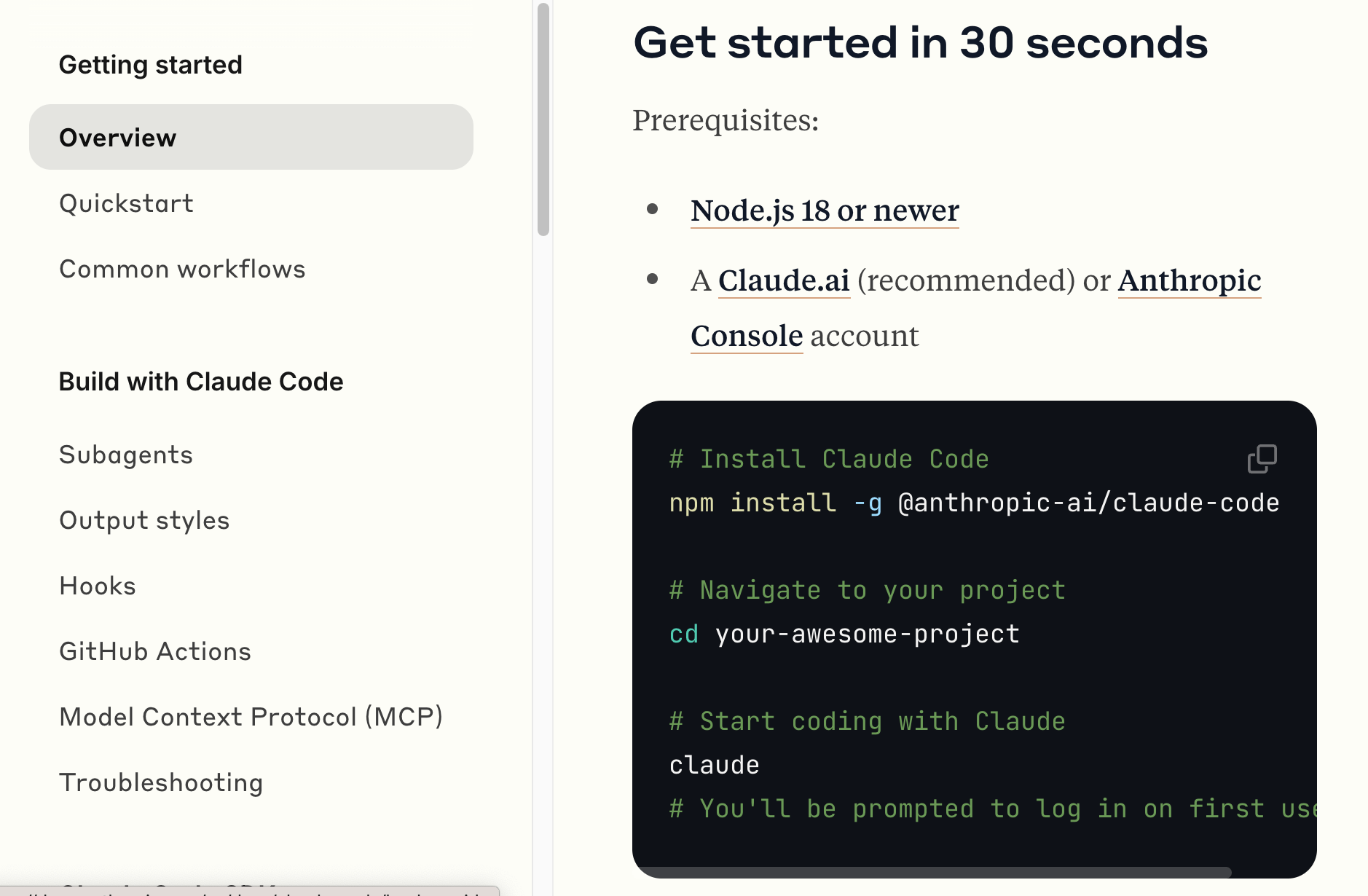

Firms with advanced technical resources can use Claude for Enterprise and Claude Code to modernize legacy systems, build proprietary financial models, and run heavy workloads without usage caps. This enables large-scale simulations, risk modeling, compliance automation, and handling peak periods such as earnings season or deal deadlines.

Claude Code

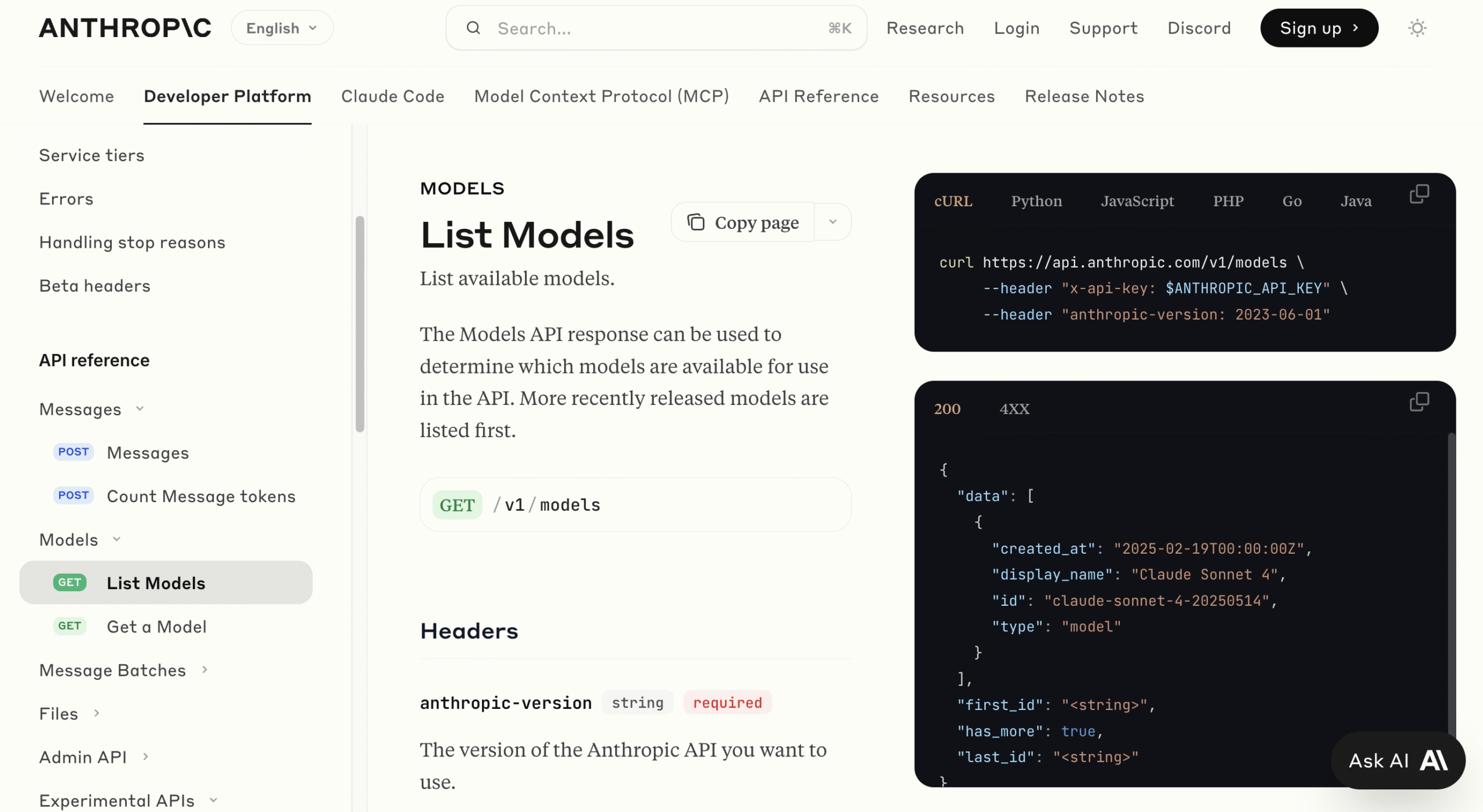

Claude’s API also allows firms to design custom workflows for underwriting, compliance, customer experience, or back-office operations.

Claude API

These capabilities mean Claude works well with financial services firms with in-house or outsourced engineering, quant, or data science capacity. Typical applications you can create and customize include:

For financial services companies without the technical expertise, Claude partners with consulting firms, such as Deloitte, PwC, and TribeAI, for AI adoption support.

Using the finance versions of Claude and Perplexity out of the box can be a great time and effort saver if you’re doing heavy market analysis, such as how HNWI are shifting their allocation to alternative investments.

But if you need more robust solutions that you can integrate with complex infrastructure and large product portfolios and client data, here’s what you need to know before attempting to build out a custom AI solution in house with these LLM tools:

Both Perplexity’s and Claude’s multi-source verification and citing provides instant cross checking to reduce hallucinations. And its ability to pull up-to-date financial information on demand prevents it from providing outdated figures or making up numbers.

Even so, their financial data analysis may not always be correct.

A best practice to ensure greater accuracy is adding another layer of checks and balances by setting up custom workflows and validation rules to ensure LLM tools stay on track. This prevents you from using data that could infringe regulations, bringing reputational damage, increased scrutiny, and fines.

Custom workflow to set up checks and balances

An organizational framework that defines how AI fits into workflows ensures you use it responsibly and effectively. This is especially important if your firm has multiple business lines, dispersed teams, and layered compliance structures, where misaligned use can create risk. A clear framework should:

Technical integration adds another layer of complexity. Legacy systems, proprietary datasets, and fragmented infrastructure often require custom engineering to connect with AI tools.

These LLM tools, for example, cannot directly access ERP systems, Microsoft Excel models, or proprietary financials without custom integrations, which may not always align with existing infrastructure. Forecasting with these tools may also be limited.

Careful planning across both organizational and technical dimensions reduces your risk of compliance breaches, misinformed decisions, and costly rework.

Safety measures ensure AI output remains predictable and reliable. Claude and Perplexity Finance do not store private data unless you input it, but you should still be cautious. Avoid pasting or uploading confidential information unless you are in a controlled environment.

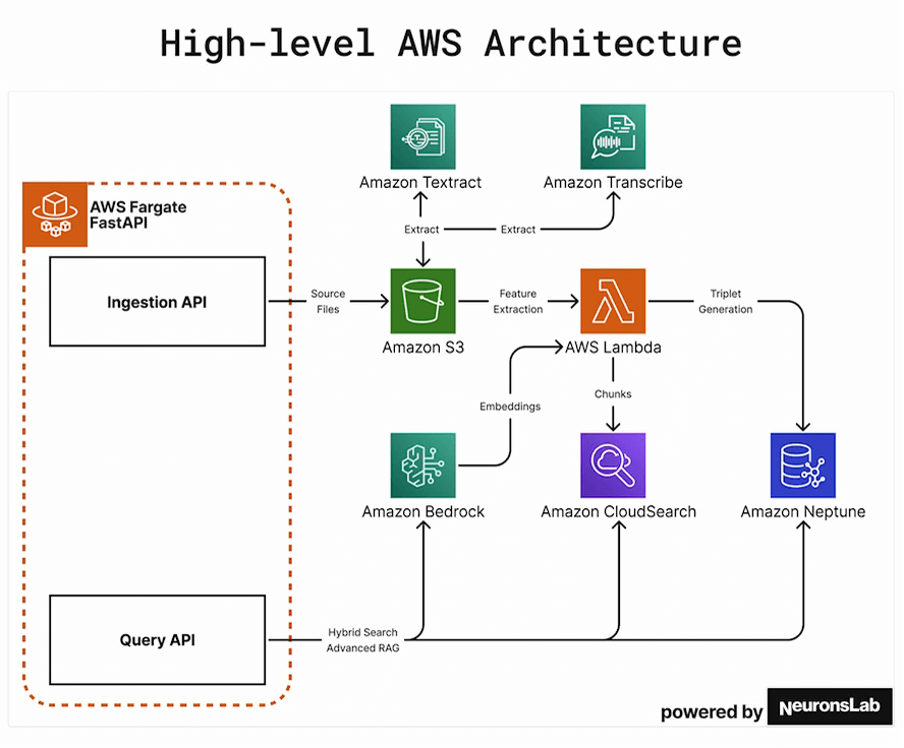

Enterprise Pro plans offer stronger safeguards, including encryption, SOC 2 compliance, and a guarantee that your data will not be used for model training. Even so, you’ll often need to create custom controls to reduce the risk of mistakes or misuse. These can include:

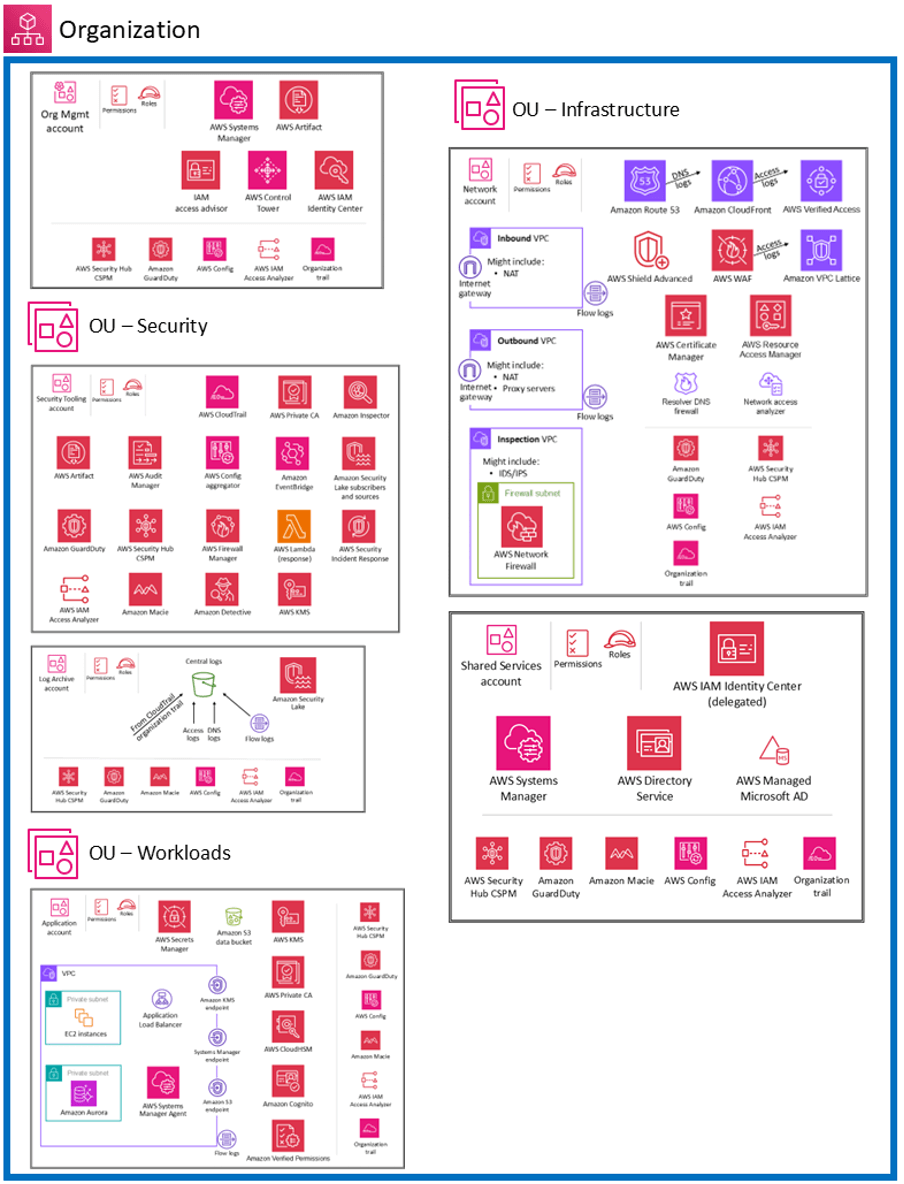

An example of an AWS secure architecture

By embedding these safeguards into workflows, you can reduce the likelihood of breaches, regulatory issues, and operational disruptions.

While Claude for Finance and Perplexity Finance offer strong out-of-the-box value for self-employed advisors and smaller firms, and integration options that work well for startups and fintechs, larger firms may find these tools do not deliver enough efficiency gains on their own.

As a mid- to enterprise-sized firm, you may face deeper organizational, technical, and regulatory complexity. You’ll need to integrate AI with legacy systems and proprietary datasets, meet strict security and compliance standards, and adapt tools to reflect deal histories, client portfolios, and internal risk frameworks. LLM tools on their own cannot meet these requirements.

AI consultancies fill this gap. They bring the technical, strategic, and regulatory expertise to:

Consultancies also help you establish governance structures. They define what AI can automate (e.g., client decks, research summaries) and what requires human oversight (e.g., final investment recommendations).

They assign accountability so your portfolio managers, underwriters, CIO offices, and compliance teams remain responsible for outputs, avoiding a situation where “the AI said it” becomes a justification.

Beyond compliance, consultancies design reasoning frameworks such as knowledge graphs or triage logic. These help your portfolio managers prioritize clients, frame conversations, and identify relevant products. They also build strategic roadmaps to align AI adoption with enterprise goals, such as growing client assets, increasing share of wallet, or improving revenue.

For larger firms, consultancies make AI not just faster but safer, more reliable, and aligned with business priorities.

The right approach depends on firm size, technical capacity, and regulatory environment, as the table below shows:

| Firm Type | Best Approach | Example Uses | Why This Fit Works |

|---|---|---|---|

| Independent advisors / small to mid-sized firms | Use Claude or Perplexity out of the box | Pull earnings call transcripts into memos, run peer comparisons in Excel | Low cost, easy setup, no heavy integration required |

| Startups and fintechs with dev teams | Build custom integrations with Claude / Perplexity APIs | Embed AI in underwriting workflows, connect risk dashboards to Snowflake, automate compliance checks | Technical resources allow deeper customization and automation |

| Mid-to-large enterprises ($500M+ revenue) | Work with AI consultancies | Integrate AI with legacy systems, align outputs with proprietary data, scale across compliance-heavy workflows | Enterprises need expertise to manage complexity, regulatory risk, and large-scale deployment |

Earlier, we outlined why larger financial institutions need more than out-of-the-box AI tools. Firms require governance, secure integration with proprietary data, and adoption frameworks that match regulated workflows.

This is where Neurons Lab operates.

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. As an AI enablement partner, we design, build, and implement agentic AI solutions tailored for mid-to-large BFSIs operating in highly regulated environments, including banks, insurers, and wealth management firms. Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization.

With Neurons Lab, you gain an AI system integrator partner that takes you from strategy through deployment. We help you:

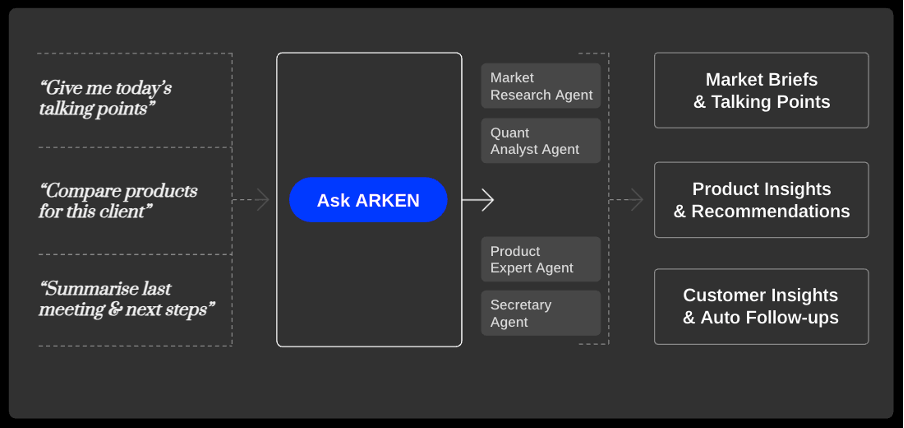

We recently developed ARKEN, a solution accelerator designed specifically for wealth management firms that need more than what generic LLM tools can offer.

Claude and Perplexity Finance are powerful, but they assume a one-size-fits-all model. Wealth relationship managers don’t work that way. They rely on flows, routines, and compliance frameworks unique to their firm. Out-of-the-box AI tools often feel too foreign because they don’t account for legacy platforms, client-specific data, or CIO-approved policies.

That’s where ARKEN comes in. It’s not another standalone LLM tool. Instead, it’s the integration and reasoning layer that adapts these models to your environment.

With ARKEN, you can:

The result is a co-pilot built for your team’s daily reality, not a generic AI tool.

Recent deployments show measurable outcomes, such as

Neurons Lab’s Arken: a solution accelerator for wealth management you can customize to fit your specific use case and business KPIs

Our work with clients shows that Neurons Lab helps enterprises move from experimentation to AI systems that are secure, auditable, and tied to financial performance.

Here is why it makes sense for enterprises to partner with Neurons Lab when a single LLM tool isn’t enough.

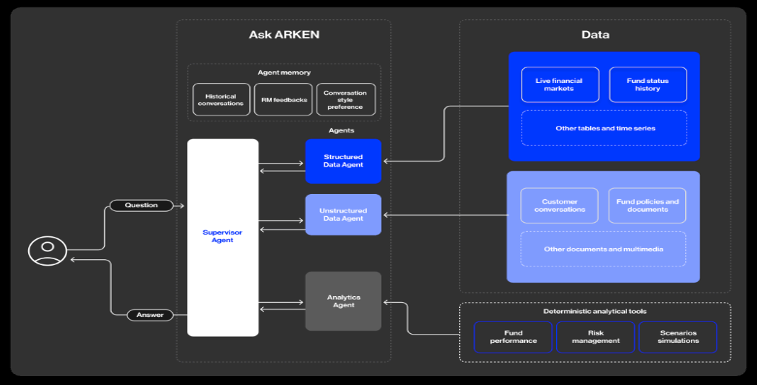

LLM tools like Claude or Perplexity Finance can query Bloomberg, Yahoo Finance, Google Finance and similar sources, but they do not see your client data, product constraints, or CIO policies. Teams like portfolio managers still need to reconcile systems of record, CRM histories, and market data by hand, which invites errors and missed opportunities.

With Neurons Lab, you can build custom AI copilots that connect internal and external data into a single interface. For example, your portfolio manager can ask for client-specific talking points, and receive responses such as: “Your client’s bond exposure dropped 5% due to X event last week, so here’s how to frame it today.”

By partnering with an AI consultancy that acts as your personal AI-tool integrator, you can connect AI models like Perplexity or Claude Finance with:

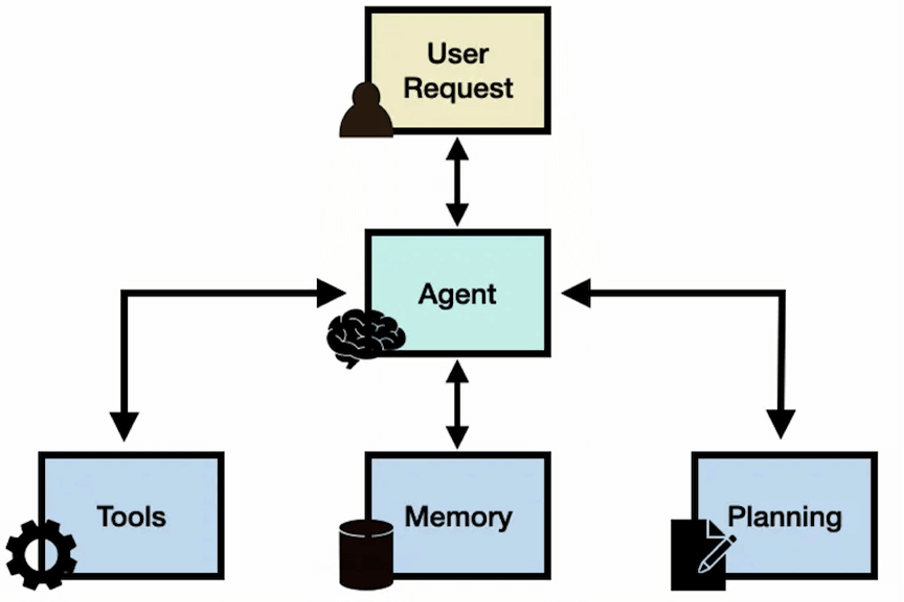

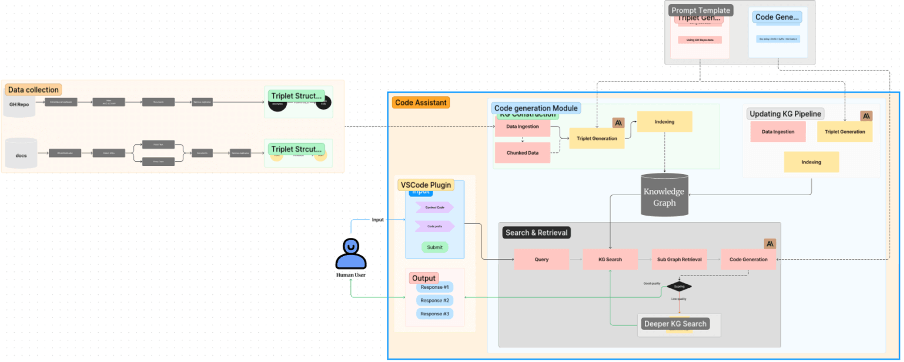

We then add a reasoning layer with knowledge graphs and workflow agents that combine these inputs.

This allows the co-pilot to link market events with a client’s portfolio and the bank’s approved products, then frame the information into actionable guidance. The result is a conversational interface that thinks and works like a junior analyst, producing client-ready insights while reducing manual cross-checking.

This reduces manual cross-checking and frees your managers to focus on client advice.

Generic LLM tools and GPTs can cite sources, but they are not grounded in your firm’s investment outlook or CIO-approved products. This creates compliance risks and generic recommendations.

With Neurons Lab, you can build an AI co-pilot that ties every output to fact sheets, CIO reports, and your pre-approved product catalog. Each recommendation is fully traceable, creating an audit trail that satisfies both internal governance and regulatory requirements.

To strengthen accuracy, we deploy specialized agents for different tasks such as market analysis, portfolio preparation, compliance checks, and proposal generation. This prevents generic answers, reduces hallucinations, and ensures recommendations align with CIO guidance.

You can also embed automated compliance checks and human reviews before final decision-making. The result is an AI assistant that your managers can trust, one that supports client conversations with clear, auditable reasoning.

For one Luxembourg investment firm, we helped reduce reporting time from 20 to 5 days, cut error rates by 90%, and boost investor satisfaction by 40% while ensuring traceability.

Unlike LLM tools such as Claude or Perplexity for Finance, a Neurons Lab solution builds on the knowledge graph and custom workflows created during integration. This foundation allows the assistant to translate complex data into client-ready insights, tailored talking points, and investment proposals that are accurate, compliant, and relevant.

Building knowledge graphs on AWS

Client meeting preparation accelerates from hours to minutes. Relationship managers walk in with real-time insights and briefing materials specific to each client. Conversations become more targeted, proposals more accurate, and client trust stronger.

At scale, this reduces knowledge bottlenecks, speeds onboarding of new managers, and enables experienced staff to handle more accounts. Firms can serve more clients, expand assets under management (AUM), and grow revenue without compromising compliance or service quality.

Learn how we helped Visa integrate LLM tools into its systems, creating a message constructor with compliance checks and multilingual support for faster, more efficient communications.

Large language models like Claude and Perplexity Finance show how AI can speed up research and routine analysis. For independent advisors and smaller firms, these out-of-the-box tools are often enough to boost efficiency. For enterprises, the challenges are different. Legacy systems, proprietary data, compliance demands, and scale require more than what generic LLM tools can offer on their own.

That is where specialist consultancies add value. They provide the technical, strategic, and regulatory expertise to turn promising tools into reliable systems that support portfolio managers, analysts, and advisors in their day-to-day work.

At Neurons Lab, our focus is building AI-powered solutions tailored to financial services. By combining integration, compliance, and scalability, we help firms move from experimentation to systems that deliver measurable outcomes, such as increased client capacity, faster onboarding, and growth in assets under management.

If you’d like to see how this approach could apply to your firm, we’d be glad to share what we’ve learned. Book a call with us today.

It depends on firm size and technical capacity. Perplexity Finance is lightweight, fast, and ideal for independent advisors or smaller firms that need quicker research and market monitoring. Claude Finance is stronger at reasoning with financial data and offers more robust integration options, making it better suited to firms with in-house or outsourced development teams that can build custom workflows.

As is, Perplexity Finance can summarize earnings reports, compare company financials, or track macroeconomic indicators. With light coding, you can embed it into workflows, such as generating investment memos or automating Excel peer comparisons. For deeper integration with proprietary data and compliance requirements, firms often work with AI consultancies like Neurons Lab to connect Perplexity securely to internal systems.

Claude Finance offers APIs and low-code tools that make it easier to embed into applications. Its flexibility allows integration with data platforms, such as Databricks or Palantir. For larger or regulated deployments, AI consultancies like Neurons Lab can extend Claude with custom workflows and governance structures.

Other LLM tools, including ChatGPT and Llama, can be adapted for financial services, but they are not finance-specific out of the box. To use them effectively, firms typically need to add financial data integrations, governance rules, and compliance workflows. Neurons Lab helps firms evaluate when to adapt a general LLM tool versus when to deploy a finance-specific solution.

Yes. Both tools are valuable for speeding up research, but they cannot fully integrate with proprietary client data or legacy systems without custom development. At enterprise scale, firms often turn to consultancies such as Neurons Lab to integrate these tools with internal systems, add compliance guardrails, and make them fit for daily use in regulated workflows.

Sources

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

See how wealth management firms can use AI to streamline workflows, boost client engagement, and scale AUM with compliant, tailored solutions

Discover how FSIs can move beyond stalled POCs with custom AI business solutions that meet compliance, scale fast, and deliver measurable outcomes.

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.