What is the Cost of AI for BFSIs in 2026? 4 Examples To Budget Accordingly

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

If you’re researching the top AI consulting firms in the financial services industry (FSI), you likely want to adopt artificial intelligence to enhance your company’s operational efficiency, productivity, and revenue, but lack the in-house expertise to make this happen. You may be looking for:

However, not all AI consulting companies take the same approach, which can make choosing the right partner complicated. Some specialize in AI, bringing deeper expertise and tailored solutions that integrate it deeply into operations. Others focus on broader digital transformation, where AI is part of a wider offering like ERP, supply chain, or compliance.

Drawing on our lessons from 100+ enterprise AI projects and our financial services expertise, we’ll share the top AI consulting companies in 2026 with proven FSI experience. Because FSI needs vary, we’ll show where your firm fits best. Incumbents often value scale and compliance, while challengers prioritize speed, modernization, or deep industry expertise.

In this article, we cover:

Want to get started with an AI-exclusive consulting firm that co-creates with you to build tailored solutions? Book a call with us today.

| Consulting Firm | AI Exclusive | Industry specialization | Key Services | Notable Clients | Best for |

|---|---|---|---|---|---|

| Neurons Lab | Yes | Financial Services | Executive AI Alignment, AI Strategy & Governance, Enterprise Data Foundation, Rapid Proof of Concept, Agentic AI Systems, AI Training & Education, Cloud Cost Optimization | Visa, AXA, HSBC, SMFG, PrivatBank, Fortune 500 firms | Mid- to enterprise-sized FSIs, challenger banks, and insurers that treat AI as a strategic priority and need fast, compliant deployment |

| Accenture | No | Communications, Media & Technology; Financial Services; Health & Public Service; Consumer Products & Resources¹ | Enterprise AI strategy & roadmap, Generative AI & LLM consulting, Data readiness & foundations, Responsible AI, Workforce enablement, Scaling AI solutions² | Unilever, ESPN, HPE, United Nations³ | Large, complex FSIs needing multi-year AI programs as part of broader transformation |

| Deloitte | No | Financial Services, Life Sciences & Healthcare, Energy & Resources, Consumer & Public Services⁴ | AI strategy & use case identification, Generative AI integration, Trustworthy AI framework, Analytics modernization, ML solutions⁵ | Adobe, Marathon Oil, Yamaha⁶ | Enterprises requiring governance-heavy AI adoption with compliance frameworks |

| Infosys | No | Healthcare, Finance, Retail, Telecom, Energy, Consumer Goods, Manufacturing, Governments, Agriculture⁷ | Enterprise AI strategy, Predictive/Generative/Agentic AI, Human-centered design, Responsible AI⁸ | Pfizer, Telstra, BP⁹ | FSIs needing scalable but cost-effective AI integration with legacy systems |

| BCG | No | Retail, Telecom, Financial Services, Industrial Goods, Education, Healthcare, Energy, Technology¹⁰ | AI strategy & governance, Generative AI & agents, Responsible AI frameworks, Process redesign, (10-20-70) Transformation Approach¹¹ |

BMW, Zeiss, Allstate¹² | Enterprises aiming for org-wide change with AI as part of business model transformation |

| Cognizant | No | Manufacturing, Retail, Healthcare, Travel & Hospitality, Automotive, Communications & Media, Transportation & Logistics, Banking & Capital Markets¹³ | Data modernization, Edge AI applications, Multi-agent AI, AI business accelerators for operational solutions¹⁴ | Storebrand Bank ASA, Mead Johnson Nutrition, CareOregon, Etex¹⁵ | FSIs seeking rapid modernization and pilot-to-production execution |

| DataRobot | Yes | Energy, Government, Financial Services, Manufacturing, Healthcare¹⁶ | Agentic, Generative, and Predictive AI, Ready-to-use AI blueprints, AI integrations and governance, Industry-specific AI app suites¹⁷ | Razorpay, CVS, U.S. Army, BMW¹⁸ | FSIs that want off-the-shelf, customizable AI apps with consulting support |

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. As an AI enablement partner, we design, build, and implement agentic AI solutions tailored for mid-to-large BFSIs operating in highly regulated environments, including banks, insurers, and wealth management firms. Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization.

Unlike generalist consultancies, Neurons Lab focuses exclusively on AI, with certifications in both AWS Generative AI and Financial Services. This means we understand how to apply AI-driven solutions where FSI firms struggle most: automating compliance-heavy workflows, detecting fraud, and scaling operations without introducing regulatory risk.

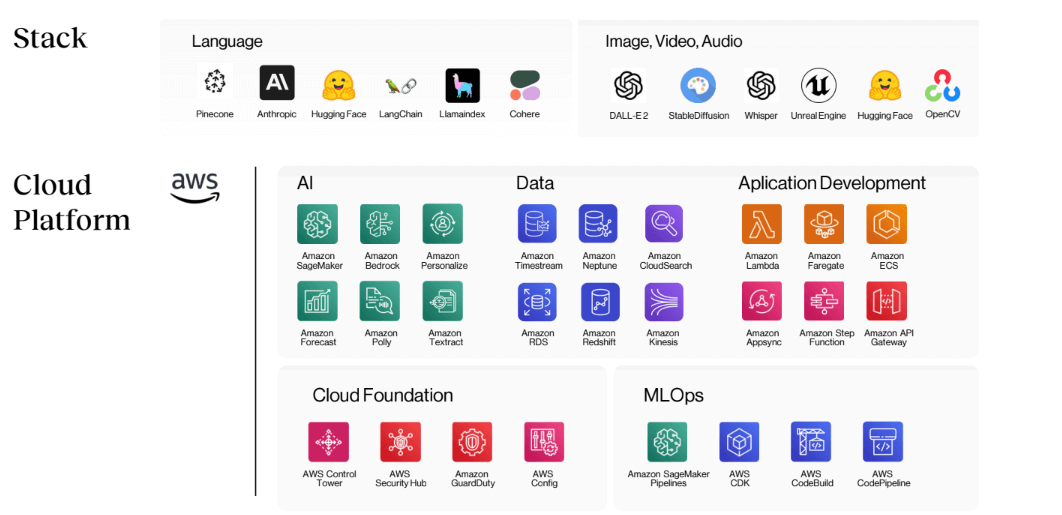

Neurons Lab’s tech stack aligns with industry regulations and offers enterprise-grade trust and safety features

With over 100 enterprise implementations, we help financial organizations move from fragmented tools to fully integrated, scalable AI systems. As one of the few consultancies combining strategic depth with hands-on delivery, Neurons Lab is trusted by industry leaders like AXA, HSBC and SMFG looking for AI that performs in production and at scale.

Here’s why top firms choose to partner with us:

You’ll receive customized AI development projects for regulated processes like KYC checks, fraud detection, and customer support. These solutions include GenAI, agentic AI systems, advanced analytics, machine learning and chatbots. Clients such as Visa and PrivatBank use our AI development company to reduce backlogs and quicken data-driven decision-making.

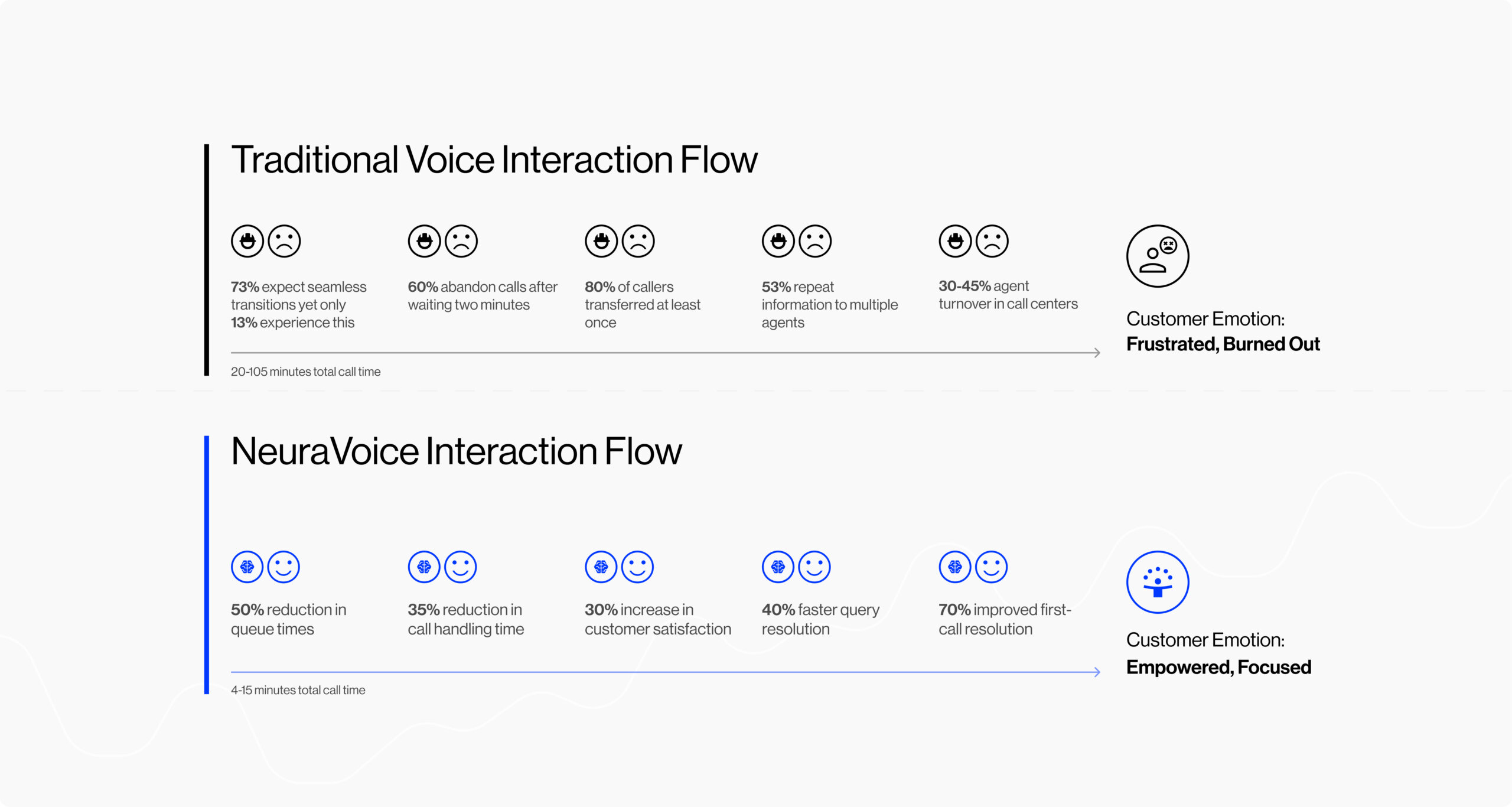

Traditional voice interaction flow vs an AI agent interaction flow with Neurons Lab’s NeuraVoice. Learn more.

For example, our NeuraVoice system combines voice AI and natural language processing to automate high-volume customer calls and compliance checks, helping institutions cut delays while improving service through real-time data analytics. Explore our FSI solutions: NeuraVoice, NeuraChat and NeuraDoc.

Many firms struggle to move beyond proof of concept because leadership lacks clarity on return on AI investment, teams fear disruption, or fragmented systems block integration.

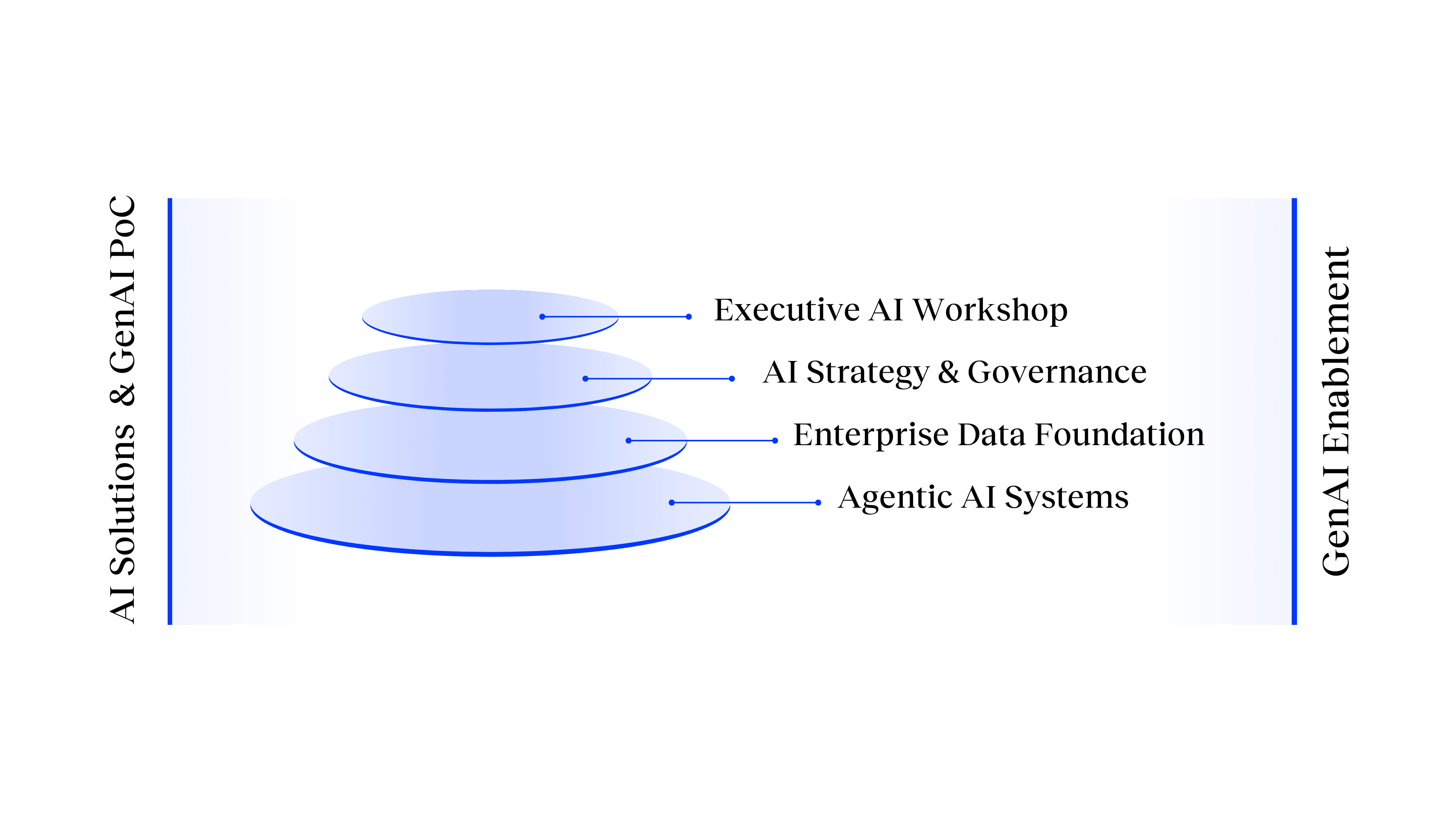

Neurons Lab end-to-end consultancy services

With our end-to-end framework, you can address these roadblocks by aligning executives around measurable outcomes, building governance to meet GDPR and ISO/IEC standards, and designing data foundations that make prototypes deployable at scale. This ensures pilots turn into scalable, AI-powered systems that improve compliance and productivity.

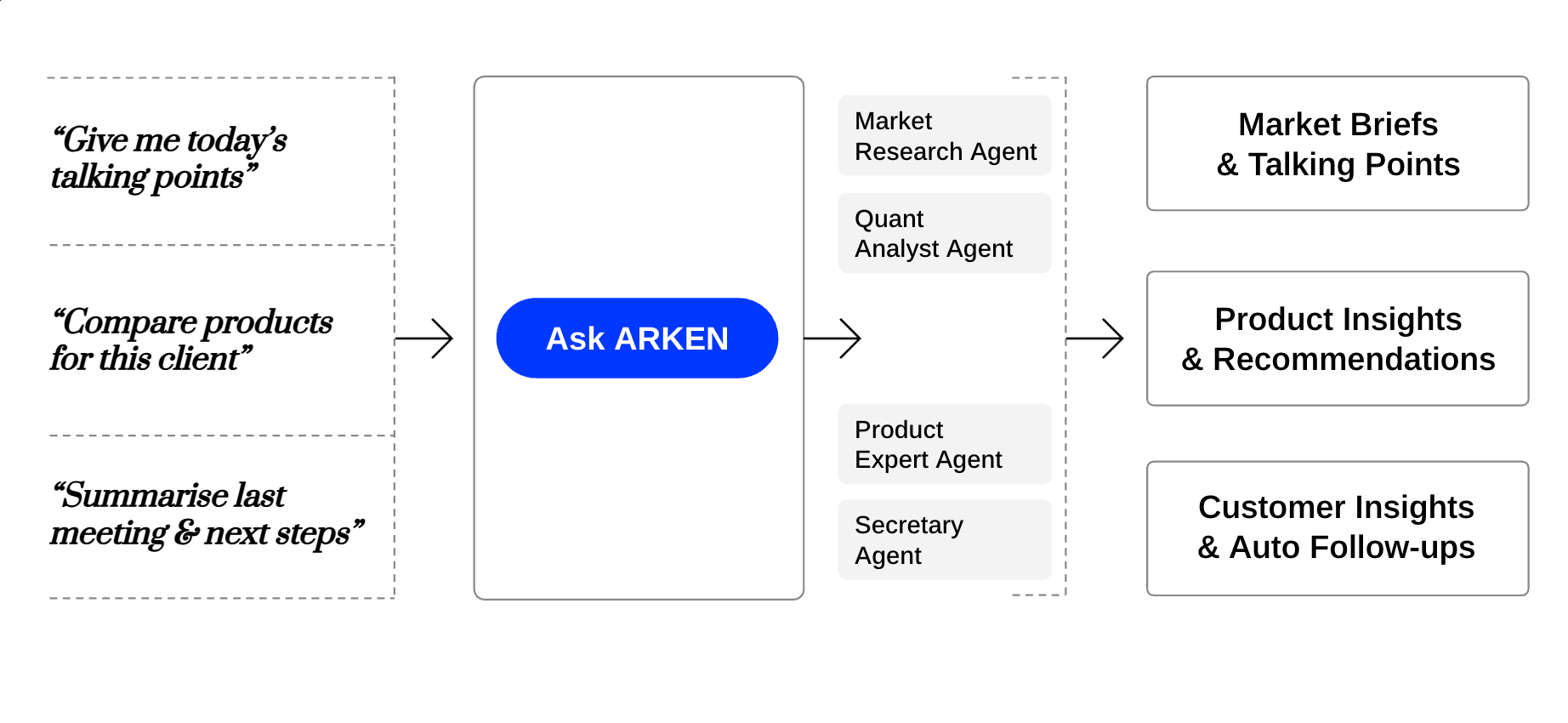

ARKEN – the AI-accelerator wealth management solution you can customize

Take ARKEN as an example. Our AI accelerator solution for wealth managers automates routine tasks so you can double engagement touchpoints and raise NPS by 15–20%. Discover more about ARKEN.

AI initiatives often feel too costly up front from a pricing perspective. We help clients de-risk adoption by securing 75–100% AWS funding support and optimizing cloud credits. With phased AI implementation, you spread costs over time and validate ROI early so projects don’t stall for financial reasons.

The biggest frustration in AI adoption is speed as proofs of concept can linger without moving into production. Our boutique agility and 500+ global engineer network mean we can integrate with your existing infrastructure and scale solutions quickly, taking you live in as little as 8–12 weeks.

As a global leader in artificial intelligence consulting, training, and development, we’re best suited for mid to enterprise-sized financial institutions that see AI as a strategic priority but struggle to move past pilots, connect AI into legacy infrastructure, or ensure regulatory compliance. You can count on long-term partnerships with us to combine speed with capability building, embedding responsible AI practices into everyday operations so adoption is sustainable.

We know we may not be the right fit for every company, so here are seven more consulting firms that help with AI.

Accenture is a global professional services firm that helps organizations transform their operations with AI technology. Its data and AI consulting practice serves clients in communications, media and technology, financial services, health and public service, and consumer products and resources.¹⁹

Main AI consulting services include²⁰:

Example clients: Unilever, ESPN, HPE, the UN²¹

Best for: Global, complex financial institutions that need AI embedded into large-scale digital transformation programs

Deloitte is a global professional services firm specializing in providing audit, consulting, tax, and advisory services.²² Its AI and data services combine advanced analytics, automation, and AI to help make operations faster and more cost-effective. Deloitte supports clients in various industries, such as financial services, life sciences and health care, energy and resources, consumer and public services.

Main AI consulting services include²³:

Example clients: Adobe, Marathon Oil, Yamaha²⁴

Best for: Enterprises where regulatory rigor, governance, and trust frameworks are critical to AI adoption

Infosys is a global digital services and consulting firm specializing in AI, cloud, and digital solutions.²⁵ Headquartered in India with offices worldwide, its Enterprise AI consulting practice supports a range of industries, including healthcare, finance, retail, telecom, energy, consumer goods, manufacturing, governments, and agriculture.²⁶ Infosys also partners with startups through its Innovation Network and Innovation Fund, helping scale emerging technologies like AI for enterprise use.²⁷

Main AI consulting services include²⁸:

Example clients: Pfizer, Telstra, BP²⁹

Best for: Startups as well as mid-sized financial organizations aiming to modernize legacy systems with cost-efficient, scalable AI solutions

Boston Consulting Group is a global management consulting firm that combines human and technical capabilities to help organizations improve productivity and innovation. BCG works with clients across industries, including retail, telecom, financial services, industrial goods, education, healthcare, energy, and technology.³⁰

Main AI consulting services include³¹:

Example AI clients: Helios, Zeiss, Allstate, BMW³³

Best for: Incumbent banks pursuing enterprise-wide reinvention, where AI is part of broader business strategy and process redesign

Headquartered in the US, Cognizant is a global consulting company that specializes in modernizing and transforming businesses through technology. They work with 20 different industries³⁴, including manufacturing, retail, healthcare, travel and hospitality, automotive, communications and media, and transportation and logistics.³⁵ In financial services, they cater to banking and capital markets.

They offer GenAI solutions along with compliant, ethical AI frameworks to build and embed AI in your systems and operations.³⁶ They can also take your projects from pilot to production.³⁷

Main AI consulting services include:

Example AI clients: Storebrand Bank ASA, Mead Johnson Nutrition, CareOregon, Etex

Best for: FSIs prioritizing speed that need to move AI projects from pilot to production without heavy overhead

A US-based firm with global reach⁴⁷, Sage IT helps financial institutions operationalize AI with integration-first design, governance-by-default, and an eight-week, low-risk validation path. Its data and AI consulting spans banking, payments, insurance, and capital markets, delivering auditable outcomes, fraud resilience, and automation aligned to regulatory realities.⁴⁸

Main AI consulting services include

Example clients: Life Is Good, Western Governors University, NexRev, Koala Software

Best for: FSIs with stalled PoCs and strict governance, needing production AI, legacy integration, and measurable business value within weeks.

With headquarters in the US, DataRobot is both a machine learning platform and AI consultancy firm.⁴² It provides developers and data scientists⁴³ with automated tools to build and deploy AI solutions fast, while enabling leaders⁴⁴ to reduce costs and increase efficiency.

DataRobot serves various industries such as energy providers, government agencies, financial services, manufacturing, and healthcare.

Main AI consulting services include:

Example AI clients: Razorpay, CVS, U.S. Army, BMW⁴⁶

Best for: Financial institutions that prefer pre-built, customizable AI apps and blueprints to accelerate deployment

AI adoption often stalls not because the technology isn’t ready, but because the consulting partner lacks the focus, industry depth, or technical foundations to take pilots into production. To avoid that, here are the qualities that matter most when choosing a partner.

Many of the best AI consultancies can deliver a promising pilot or prototype, but without a clear path to integration and compliance, these proofs of concept rarely scale. This is especially common in FSIs, where PoCs often stall or fail once they face regulatory review or need to connect with legacy core banking systems or complex infrastructures.

Look for a partner with a structured approach that includes feasibility checks, return-on-investment estimates, and deployment milestones before projects begin. This way, early projects don’t end up stalled once they face real-world systems and regulatory requirements.

To see if they have a production track record, look for case studies and ask directly about their work with other companies in your industry or with similar use cases.

By reducing uncertainty up front, you can implement secure and compliant AI solutions and scale them across your organization.

Many top firms offer generic approaches that overlook the regulatory, security, and operational realities of industries like financial services. This can lead to costly rework or delays in approval.

In FSIs, this means expertise in fraud detection, AML/KYC automation, credit risk modeling, or regulatory reporting, not just generic AI use cases.

A partner with sector-specific expertise brings ready-made frameworks, proven playbooks, and specialized talent, helping you move faster while staying compliant.

Even well-designed AI pilots fail when they aren’t designed to connect with legacy systems or withstand audit requirements. Without solid data pipelines, governance, and cloud architecture, scaling is nearly impossible, even with top AI consultancies.

This is especially relevant for FSIs, where decades-old systems and fragmented infrastructure demand robust data pipelines, audit-ready governance, and cloud migration expertise.

Seek out firms with recognized certifications and infrastructure depth to ensure your systems are production-ready from day one. With this foundation in place, you can expand from initial deployments to more advanced use cases without reworking core systems.

AI adoption loses momentum if projects take months to show value. Larger firms may bring extensive resources, but their size and processes can slow delivery.

Challenger banks and insurers, in particular, can’t afford 18-month timelines. Instead, they need partners who prove value quickly while maintaining compliance guardrails.

Specialized consultancies can deploy working systems in weeks, adapting to your workflows while still keeping long-term scalability in mind. See if a firm also offers ready-made AI solutions or agentic systems you can tailor to your business needs to deploy more rapidly.

Some top partners build in a black box, leaving you dependent on them for every change. That slows innovation and adds cost.

For FSIs, transparency is especially important. Regulators and risk officers need clear visibility into how AI systems make decisions and how governance guardrails are applied, while internal staff need support to integrate AI into everyday processes.

The best firms work with you as a strategic partner, building alongside your development teams. Look for AI-native consultancy companies with deep expertise that ranges from predictive analytics and OCR to NLP, computer vision and multimodal AI.

These types of consultancies are more able to transfer knowledge by providing training, workshops, and practical resources to get your teams up to speed and help you innovate. You also get ongoing support and governance to keep solutions effective, secure, and compliant.

The best AI consulting firms for FSI don’t just deliver a project and walk away. They work with you to achieve measurable business outcomes and make your organization AI native. The right partner combines technical expertise with a collaborative, advisory approach, guiding you before, during, and after launch.

If you’re ready to move beyond generic solutions and co-create custom AI solutions that deliver a lasting transformation and competitive advantage, get in touch with us today.

An AI consulting firm helps organizations identify where artificial intelligence adds value through expertise in data science, NLP, machine learning, and related disciplines. In FSIs, this often includes compliance automation, fraud detection, credit risk modeling, and customer experience improvements. They then develop and integrate these solutions into your systems, with some firms also providing ongoing training, governance, and support.

It can take anywhere from a couple of weeks to several months to develop and deploy an AI solution. There are various factors to consider, including the complexity of your project, your data readiness, integration needs, compliance requirements, and governance needs.

AI consulting helps organizations define and deploy AI solutions. In contrast, software development focuses on building applications that follow predefined rules and logic. Within FSIs, AI consulting often tackles nuanced areas, such as KYC or claims processing, where flexibility and learning are required—something traditional software can’t provide.

A company should consider working with an AI consulting firm when it needs to identify high-value AI use cases, accelerate deployment, or scale solutions responsibly, but lacks the resources to do so in-house. FSIs often engage consultants to scale AI securely, reduce risk, and ensure compliance.

The best AI consulting firm specializes in AI and has deep knowledge of your industry and challenges. Consultancies like Neurons Lab can help you deploy custom AI business solutions quickly, with full support from pilot to production. They are also providers of ongoing AI enablement so that your internal teams develop the AI skills to improve their workflows.

Sources:

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

See how wealth management firms can use AI to streamline workflows, boost client engagement, and scale AUM with compliant, tailored solutions

Discover how FSIs can move beyond stalled POCs with custom AI business solutions that meet compliance, scale fast, and deliver measurable outcomes.

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.