Experience human-like understanding and real-time insights.

Our orchestrated AI Agents handle everything from market research to client follow-ups—reducing RM administrative burden by 70%, doubling client coverage, and increasing satisfaction scores by 20%.

Move Beyond Traditional Wealth Management Constraints with ARKEN

Traditional wealth management struggles with capacity constraints, uneven client coverage, and administrative overhead that limits relationship managers’ ability to deliver consistent, high-quality service across their entire client base.

RM Capacity Overload

of RM time lost to admin and compliance tasks. Limited client-facing time constrains growth potential.

Unbalanced Client Coverage

of clients receive minimal touchpoints while top 10-20% consume most RM attention, missing revenue opportunities.

Service Quality

varies widely, frequently missing KPIs. Uneven experiences erode trust and limit wallet share.

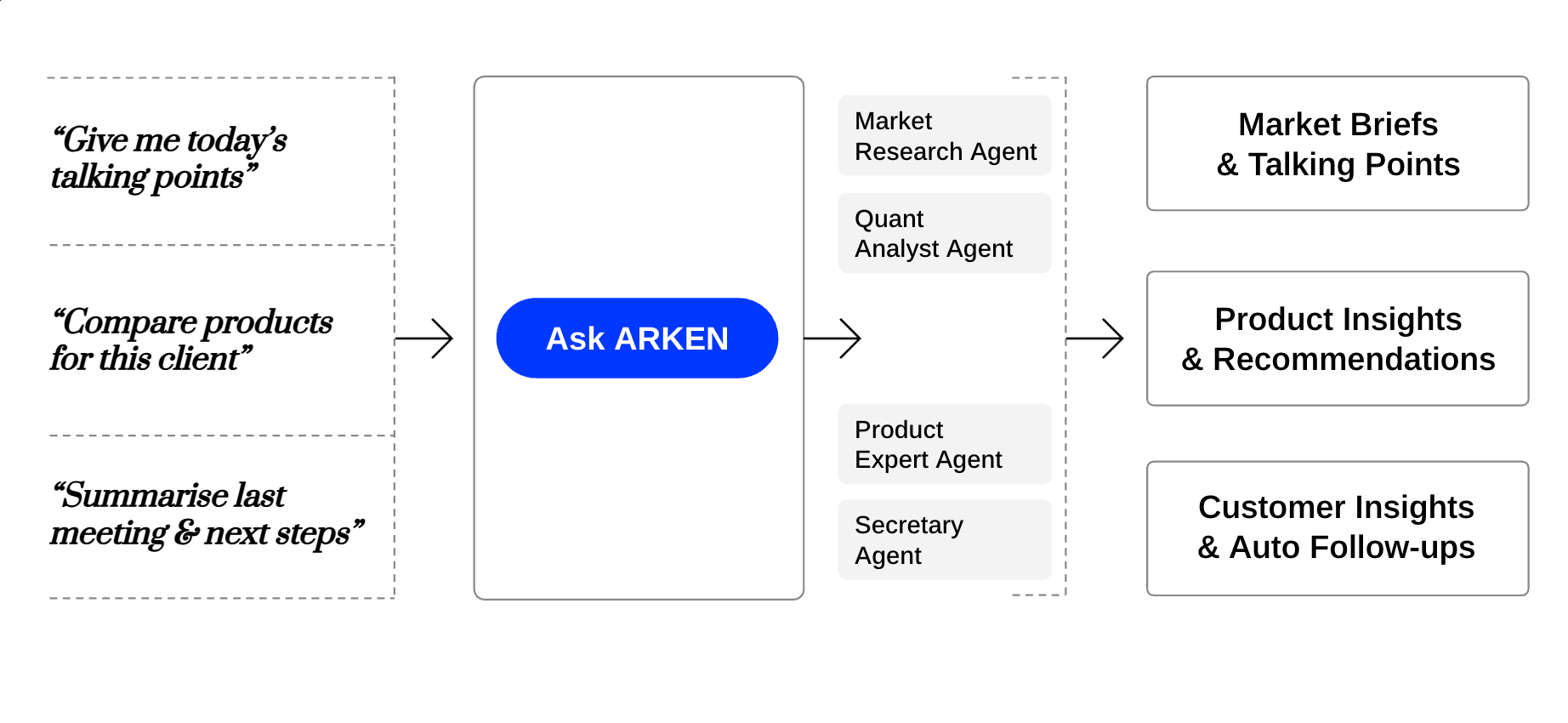

How ARKEN Orchestrates Wealth Management Excellence

ARKEN is built on agentic AI architecture, smart, contextual, and domain-aware. Our specialized AI agents collaborate to deliver comprehensive wealth management support—so your RMs can focus on building relationships and growing assets under management.

How Agentic AI Orchestrates Wealth Management

AI Orchestrator Agent

Understands natural language queries, routes requests intelligently, and delegates tasks to specialized wealth management agents.

Market Research Agent

Analyzes live market data, economic indicators, and investment trends to provide real-time talking points and market insights.

Product Expert Agent

Compares investment products, analyzes fund performance, and generates personalized recommendations based on client profiles and goals.

Secretary Agent

Manages client interactions, summarizes meetings, creates follow-up actions, and ensures no client opportunity is missed.

The Result

Up to 80% of RM administrative tasks automated, enabling 2X more client touchpoints while maintaining personalized service quality.

Achieve Measurable Business Outcomes

Scalable RM Capacity

More capacity without hiring through intelligent automation of administrative and compliance tasks.

Balanced Client Engagement

More clients touched monthly, ensuring consistent service across your entire client portfolio.

Higher Satisfaction Scores

Improvement in client NPS through personalized, timely, and comprehensive wealth management advice.

These Financial Institutions are Ushering in the New Era of Wealth Management

Get Started with a Rapid Proof of Concept

Validate feasibility, ROI, and technology fit in just four weeks. Supported by AWS, our PoC framework sets clear goals, builds specialized AI agent roles for your wealth management use cases, integrates with your existing systems, and delivers real-world insights on efficiency gains and client experience improvements.

Use-case selection, stakeholder alignment, and success metrics definition

Target KPIs validation with real wealth management data and workflows

Live system integration and comprehensive user training for your RM teams

Full rollout with continuous optimization and performance monitoring

Get Enterprise-Ready with AWS

Built on AWS services, our solutions ensure secure deployments, easy scalability, and smooth integration into wealth management systems, CRMs, and knowledge bases. Achieve robust, high-performance AI workflows without the usual complexity.

Begin your AI-Native Wealth Management Journey

Ready to increase RM capacity and deliver exceptional client experiences? Book your demo or contact us to explore a tailored ARKEN solution for your wealth management business.

Your Path to AI-Native Wealth Management Starts Here