AI Agent Evaluation Framework: Why It Matters for Financial Services

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

If you’re exploring AI tools for investment banking and research, you may recognize some of these challenges.

Whichever side you’re on, it might also be that:

So you know what your options are and what to look for in a solution, we’ll cover the top five AI tools for investment banking for 2025.

In this article:

Want custom AI tools for investment banking that help you meet all your KPIs? Book a call with us today.

| Key AI Capabilities | How It Helps Buy Side | How It Helps Sell Side | Best For | |

|---|---|---|---|---|

| Neurons Lab | • AI search and document analysis • Search and review • Multi-step analysis • Research synthesis • Real-time data integration • Deterministic reasoning |

Streamlines research with AI-driven search, multi-step analysis, conversational comparisons, chart creation, and faster insight generation | Automates document analysis, memo creation, compliance tasks, buyer matching, and faster decision-making materials | Compliant custom AI tools that automate investment research, insight generation and complex multi-step workflows from a single conversational interface |

| Bloomberg | • Insights generation • AI document search and analysis • AI summaries • Command line NLP • Instant BloombergGPT1 |

Screens companies, pulls statements, compares metrics, tracks earnings, monitors markets, and exports data for deeper analysis | Accesses profiles, tracks news and filings, reviews transactions, and builds valuation views | Real-time data, market analytics, and detailed industry reports |

| Claude for Finance | • AI search • Multi-step financial analysis modeling • Research synthesis • Insights generation • Real-time data integration |

Accelerates diligence, benchmarking, portfolio deep dives, model validation, memo creation, and performance monitoring | Automates reviews of data rooms, filings, and transaction materials and creates comps, profiles, memos, and deal summaries2 | Investment research, multi-step analysis, and structured insights from filings, transcripts, and market data |

| Hebbia | • Insight generation • AI search • AI document analysis • Summarization • AI report generation3 |

Scans lists and reports, benchmarks deals, tracks comps, synthesizes research, surfaces diligence answers, and drafts memos | Pulls transaction data, profiles companies, reviews trends, creates CIM outlines, runs fee analyses, and supports quick onboarding | Automating multi-step workflows and extracting insights from large unstructured datasets |

| Delta Capita | • ML remediation • Data quality check • AI onboarding • Intelligent document processing4 • ML automation |

Supports regulatory reporting, portfolio automation, and outsourced operations | Provides post-trade processing5 technology and market infrastructure consulting to improve efficiency and reduce risk | Post-trade operations, regulatory workflows, and data-heavy processes using machine learning and managed services |

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. As an AI enablement company with AWS-certified expertise in Generative AI and Financial Services, we design, build, and implement agentic AI solutions tailored for mid-to-large BFSIs operating in highly regulated environments, including banks, insurers, and wealth management firms. Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization.

With Neurons Lab, you can build AI solutions that provide key artificial intelligence capabilities for investment research and banking, from research synthesis and insights generation to real-time data integration, all from a single interface. Specifically, for firms on the buy side that need to analyse and compare data from multiple sources, we provide solutions that streamline the entire research process while mitigating hallucinations and ensuring accuracy. This includes:

For sell-side teams in investment banks that need to process high volumes of deal materials and make faster, data-supported decisions, we provide:

Leading financial services firms like Visa, AXA, and SMFG already trust our solutions to support secure, compliant AI at scale. By partnering with us to develop AI-powered investment banking tools, you can expect to:

Your current tools and existing systems may rely on basic databases with filters that keep your teams stuck in manual analysis. They may also lack conversational interfaces and can’t perform multi-step reasoning or automate workflows.

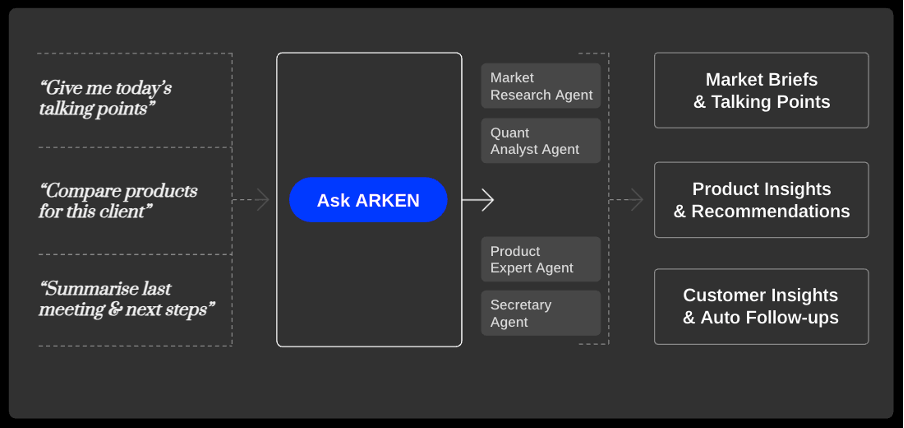

With Neurons Lab, you can build custom tools that automate multi-step analysis and complex workflows from a single interface on either the sell side or buy side. This creates a one unified point of access for your analysts or bankers.

The system pulls and integrates data from your internal platforms, real time market feeds, and compliance approved documents. Specialized AI agents then analyze these combined inputs and produce clear insights that would otherwise take hours of manual work across multiple tools. Your teams can then query a single system, receiving instant, source-backed answers.

And with enterprise-grade security, governance, and cloud best practices built in from the start, your solution will align with your goals, fit your workflows, and meet compliance requirements.

For example, an investment firm was struggling with a reporting process that was slow and prone to errors. Teams spent about 20 days each month gathering and checking data from different sources. This long cycle delayed important insights and directly affected investor decision-making.

The firm’s older systems also struggled to keep up with evolving data and regulatory changes, which limited their strategic responsiveness.

We built an AI-powered reporting solution that:

As a result, the firm achieved these outcomes:

With Neurons Lab, you’ll have the hands-on support to select use cases that can scale and deliver measurable results. You’ll also have the necessary guidance to determine whether it makes sense to invest in an off-the-shelf or custom AI tool.

In either situation, our financial services expertise allows us to tailor and integrate compliant AI solutions that address use cases your current systems cannot. This means you can implement solutions that support everything from KYC/KYB/AML workflows and back-office regulatory checks to document-heavy due diligence, audit-ready summaries, investment memos, and compliance reports.

Our AI focus also ensures you gain audit ready outputs through AI operations (AIOps) that track data sources, decision steps, and AI model behaviour for full traceability, making reviews and regulatory checks faster.

With tested code, reusable components, and proven frameworks, our pre-built AI accelerators only need to be tailored to your workflows. This speeds up production timelines and allows you to deploy in as little as two to four months.

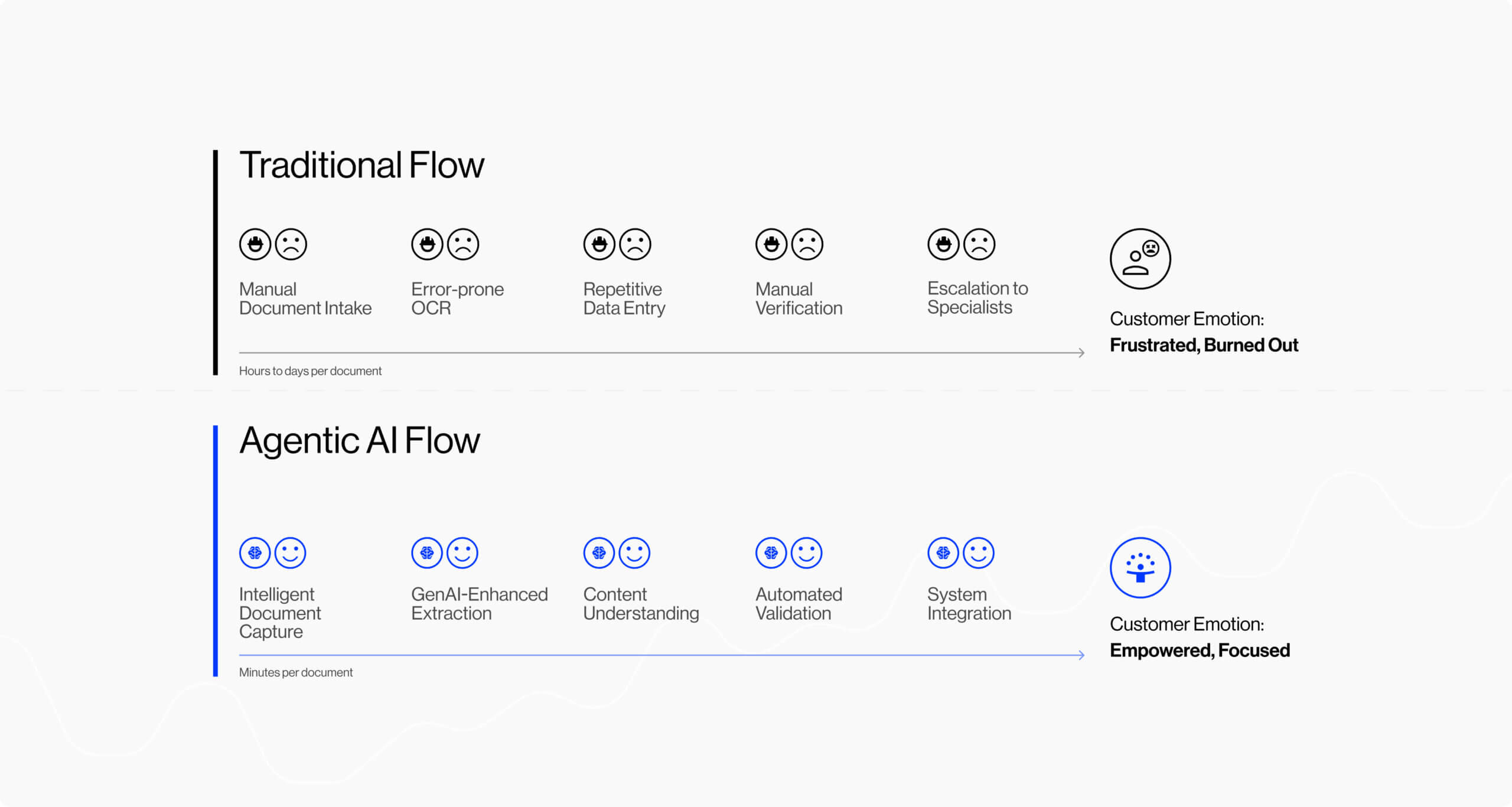

For example, our NeuraDoc accelerator helps you move beyond slow, error-prone document processing to handling everything from routine document extraction to complex multi-step workflows.

Through combining agentic AI with advanced OCR and generative AI, you could also see:

We work best for mid-to-large-sized financial institutions that view AI as a strategic advantage but don’t have the in-house expertise to build custom AI solutions, have previously tried to implement AI and failed, or got stuck at the proof of concept (PoC) stage.

Our boutique size makes us agile in helping you identify the right AI solutions and deploy them effectively, while our deep sector expertise and 500+ AI engineer network ensures you make decisions and develop solutions that maximize ROI.

However, we know that we might not be the right fit for every company, so here are four more AI tools for investment analysts and bankers to consider:

Bloomberg is a global financial news, data, and analytics platform that delivers real-time market data, financial data analysis, and trading tools via its Bloomberg Terminal6.

While not a complete solution, investment bankers use it for financial analysis, and it powers finance-focused AI tools like Claude for Finance and Perplexity Finance. It can also serve as a data source within custom AI solutions that unify multiple workflows into a single system.

Key AI capabilities: Insights generation, AI document search and analysis, AI-powered news summaries, command line natural language processing (NLP), instant Bloomberg/BloombergGPT

How it helps buy side firms: Investment analysts can screen companies, pull financial statements, compare metrics, track earnings, monitor markets, and export data into Excel models for deeper analysis.

How it helps sell side firms: Investment bankers can access company profiles, track news and filings, review transactions, and build high-level valuation views to support pitches and deal preparation.

Best for: Real-time financial data and market analytics, and in-depth industry reports

Claude Finance is a financial AI platform that supports both immediate workflows and custom development7. Teams can use its Financial Analysis Solution, API, or Claude Code to automate research, modeling, and operational tasks. It also relies on tools like Bloomberg for market analysis.

Key AI capabilities: AI search, Multi-step financial analysis and modeling, research synthesis and insights generation, real-time data integration

How it helps buy side firms: Investment analysts can accelerate diligence and market research, run competitive benchmarking and portfolio deep dives, build and validate financial models with full audit trails, and generate institutional-quality investment memos and pitch decks.

They can also monitor portfolio performance, compare metrics across investments, and surface new opportunities faster than traditional research methods.

How it helps sell side firms: Investment bankers can automate document-heavy workflows such as reviewing data rooms, filings, and transaction materials. They can generate comps, profiles, and pitch content through AI-driven analysis, and produce investment memos and deal summaries using structured, citation-linked outputs sourced from integrated financial data providers.

Best for: Investment research, multi-step financial analysis, and generating structured insights from large volumes of filings, transcripts, and market data

Hebbia is a multi-agent AI platform for finance that handles complex multistep workflows, reasons over large data sources, and provides insights.

Key AI capabilities: Insight generation, AI search, AI document analysis, AI summarization, and AI report generation

How it helps buy side firms: Investment analysts can scan company lists and reports, benchmark new deals against past IC memos, track comps from filings and earnings calls, synthesize research from consultants and brokers, surface diligence answers across data room documents, and generate first drafts of investment memos and quarterly reports.

How it helps sell side firms: Investment bankers can pull precedent transaction data, compile company profiles, review activist trends, create CIM outlines, run fee analyses, and ramp quickly on new opportunities using public and private sources.

Best for: Automating multi-step workflows, deep analysis, and extracting insights from large unstructured datasets

Delta Capita is a global capital markets consultancy and managed-services provider with financial expertise and technology capabilities8.

Key AI capabilities: Machine learning (ML) data remediation and quality checks, AI client onboarding and lifecycle management, intelligent document processing for KYC, KYB, and compliance, ML-based workflow automation

How it helps buy side firms: Investment analysts can benefit from regulatory reporting support, portfolio and data-automation services, and outsourced operations.

How it helps sell side firms: Investment bankers can get post-trade processing technology and market-infrastructure consulting to improve efficiency and reduce operational risk.

Best for: Streamlining post-trade operations, regulatory workflows, and data-heavy processes using machine learning and managed services for both buy side and sell side firms, often in workflows where pricing accuracy is critical.

For an investment research AI tool that simplifies complex multi-step workflows, here’s a short checklist of what to look for:

Whether you’re on the buy side or sell side, custom AI tools can be designed to do exactly what you need. This means your teams won’t have to force-fit or stitch together multiple ChatGPT-style off-the-shelf tools to handle complex multi-step flows. Instead, they’ll increase productivity and efficiency while focusing on higher-value tasks.

To achieve this, you’ll want to partner with a provider with deep financial services expertise, advanced AI capability, and a proven track record of deploying similar solutions successfully.

That way, you can be confident that every requirement around accuracy, compliance, data integration, multi-step analysis, and speed is handled properly. It also ensures that you have a system that can scale securely as your needs evolve.

If you’d like to explore how AI can apply to your investment workflows, our team can share insights from working with leading financial institutions. Book a call with us today.

You can ensure compliance by working with a partner that has extensive FSI industry expertise. This ensures they understand the industry’s regulatory landscape and its complex workflows.

It also ensures compliance can be built into your solutions from the start. For example, with Neurons Lab, you’ll have custom AI solutions designed to meet the standards set by regulators, such as GDPR, OCC, MAS, and ISO/IEC 27001, while ensuring your data never leaves secure environments.

Not necessarily. It depends on the solution and your implementation partner. As an AWS partner, Neurons Lab can extend cloud credits and grants to reduce upfront costs. Our phased rollout approach also helps you validate ROI early and spread investment over time.

AI tools ensure accuracy by connecting to deterministic tools such as calculators, financial models, or structured formulas rather than relying solely on probabilistic LLM reasoning. This ensures accurate and reliable outputs.

Yes. The right AI tools can automate spreadsheet-heavy work, generate structured insights instantly, and help analysts move from manual inputs to faster decision-making.

Not at first. You can start by working with an AI enablement partner like Neurons Lab, which provides dedicated AI engineering teams. If you later want to build internal capability, we can help train your existing technical staff or guide you on the roles you’ll need to hire.

Sources:

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

See how wealth management firms can use AI to streamline workflows, boost client engagement, and scale AUM with compliant, tailored solutions

Discover how FSIs can move beyond stalled POCs with custom AI business solutions that meet compliance, scale fast, and deliver measurable outcomes.

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.

LLMs for finance explained: compare top models, benchmarks, costs, and governance to deploy compliant, scalable AI across financial workflows.