What is the Cost of AI for BFSIs in 2026? 4 Examples To Budget Accordingly

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

If you’re exploring AI solutions and emerging technologies in wealth management, you may already know it can reduce manual work, increase client satisfaction, and grow AUM. The challenge is figuring out which AI application makes the most sense for your business, and then navigating the complexity that follows.

Legacy systems, strict compliance requirements, and the limitations of off-the-shelf tools all make it difficult to go from idea to production. And without the right expertise, even promising proofs of concept stall before they deliver value. Left unaddressed, these issues can hold your firm back while competitors use AI to deliver faster insights, deeper personalization, more efficient service, and stronger revenue growth.

In our work with financial institutions, we’ve watched great ideas stop at the proof-of-concept stage for exactly these reasons. At Neurons Lab, we specialize in helping you build custom AI solutions for wealth management, ensuring a clear path from identifying high-ROI use cases to deploying secure, production-ready solutions.

In this article, we cover:

Want to get started with adopting AI across wealth management processes? Contact us today to explore your highest-ROI use cases.

Core wealth management workflows still rely on static rules, duplicated data, and high-touch manual review. As we outline below, AI technology offers a way to increase productivity, speed up access to insights, and deliver more personalized client experiences across wealth and asset management (and even investment management).

Wealth managers spend too much time manually gathering insights from disparate sources, like CIO reports, client portfolios, and product catalogues. AI solutions change this by delivering those insights instantly.

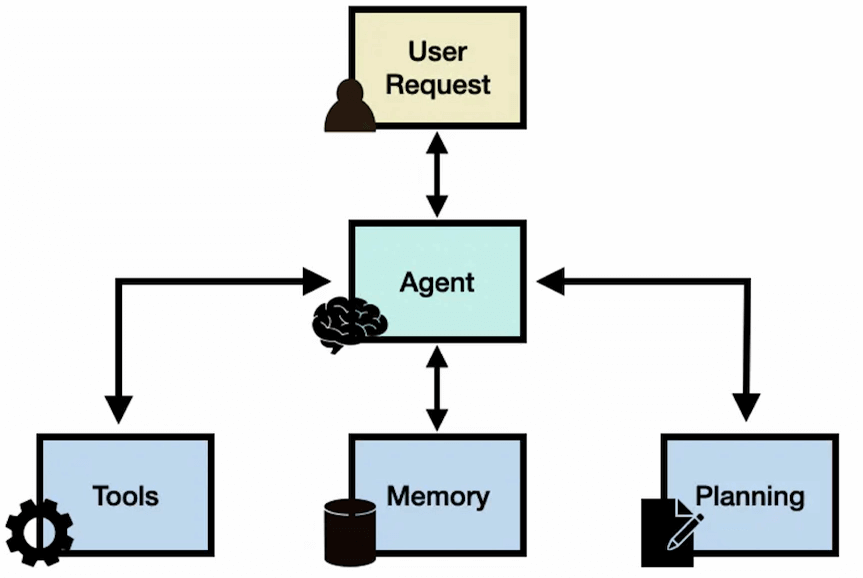

For example, agentic AI systems designed for wealth managers combine inputs from internal systems, client datasets, market feeds, market trends and compliance-approved sources into clear, actionable outputs. With faster access to relevant insights, managers can quickly deliver more accurate, data-driven investment decisions. This builds stronger client trust and risk management confidence and ensures a consistently higher standard of service.

An AI copilot unifies data from CIO reports, CRMs, and product catalogs into one interface to surface actionable insights for wealth managers in seconds

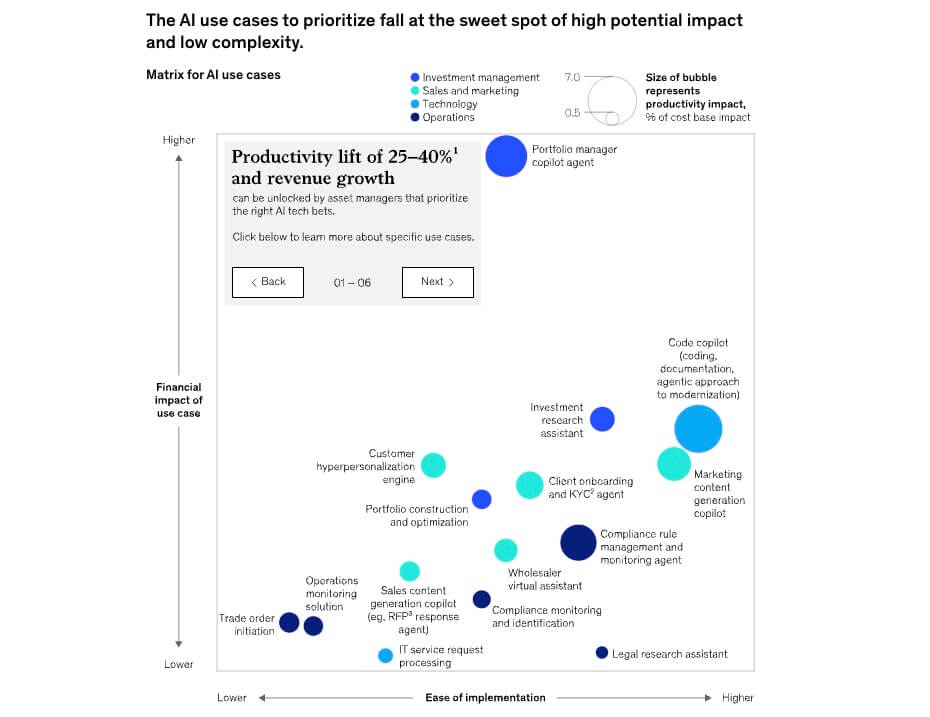

Wealth managers spend 70% of their time on manual prep, admin, and compliance work, reducing the time available to anticipate and address client needs. AI, machine learning, generative AI (GenAI) and agentic AI can change this by taking over complex, multistep workflows associated with back-office and middle-office tasks. According to McKinsey, this kind of end-to-end workflow redesign can lead to 25–40% efficiency gains across the total cost base.

For example, AI advisor agents can assemble meeting packs, check for compliance, and continuously monitor portfolios for drift, auto-flagging rebalancing opportunities and generating orders for review.

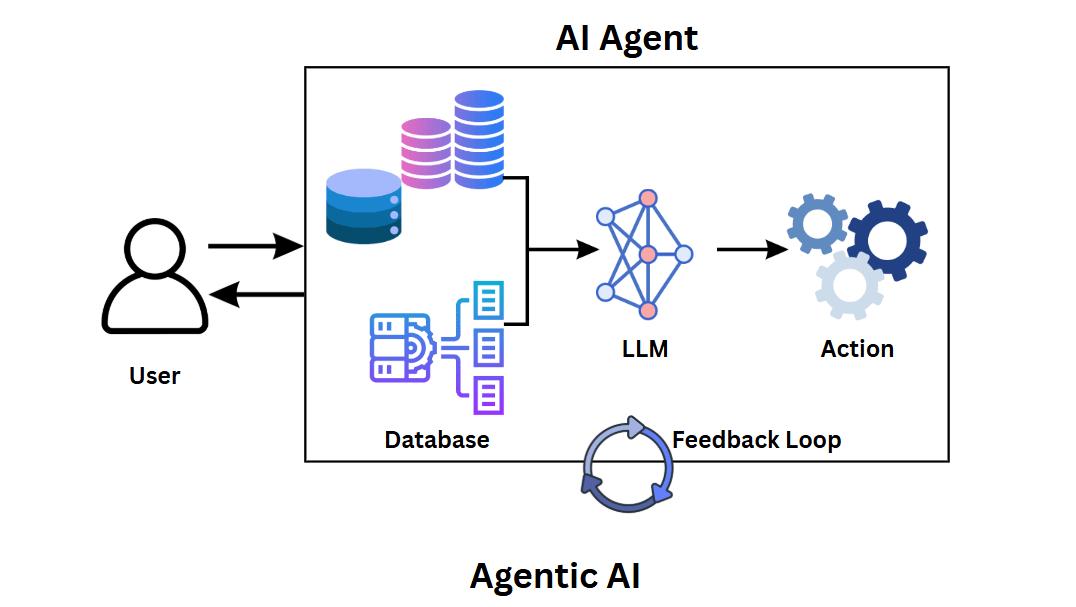

Agentic AI combines data, large language models (LLM) and LLM tools, and feedback loops to automate complex workflows while learning and improving over time. Image source: Codecademy

Because agentic AI systems learn and improve over time, they continuously enhance decision-making quality, accelerate time to value, and free up managers to focus on higher-value work like client strategy.

The added operational efficiency enables each manager to handle 50–60 more meaningful client relationships without lowering service quality. This kind of AI solution means higher client satisfaction and more revenue per relationship manager, all without increasing headcount.

Manual and time-intensive processes often mean that only the top 10-20% of clients receive regular engagement, while the remaining 80–90% like retail investors see little more than transactional contact.

AI changes this by enabling hyper-personalization at scale for front office or client interaction tasks. It generates tailored financial plans, monitors portfolios, identifies opportunities, and adapts recommendations in real time as client data and market conditions evolve. This can result in up to a 9% efficiency improvement while delivering financial advice that matches each client’s goals.

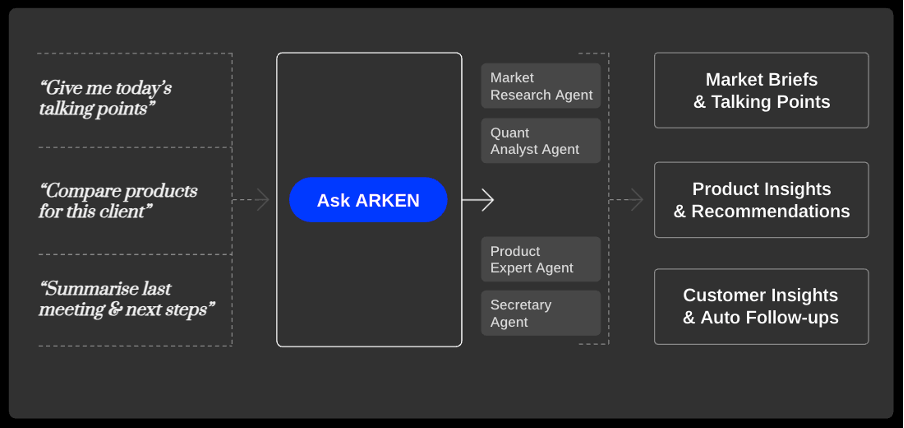

Neurons Lab’s ARKEN AI co-pilot for wealth managers turns simple prompts into market briefs, product insights, and client follow-ups, enabling more personalized recommendations

For example, AI systems can detect key service moments, such as large deposits or market events and volatility, and proactively notify wealth managers. This ensures all clients receive timely attention, creating new opportunities for engagement and growth.

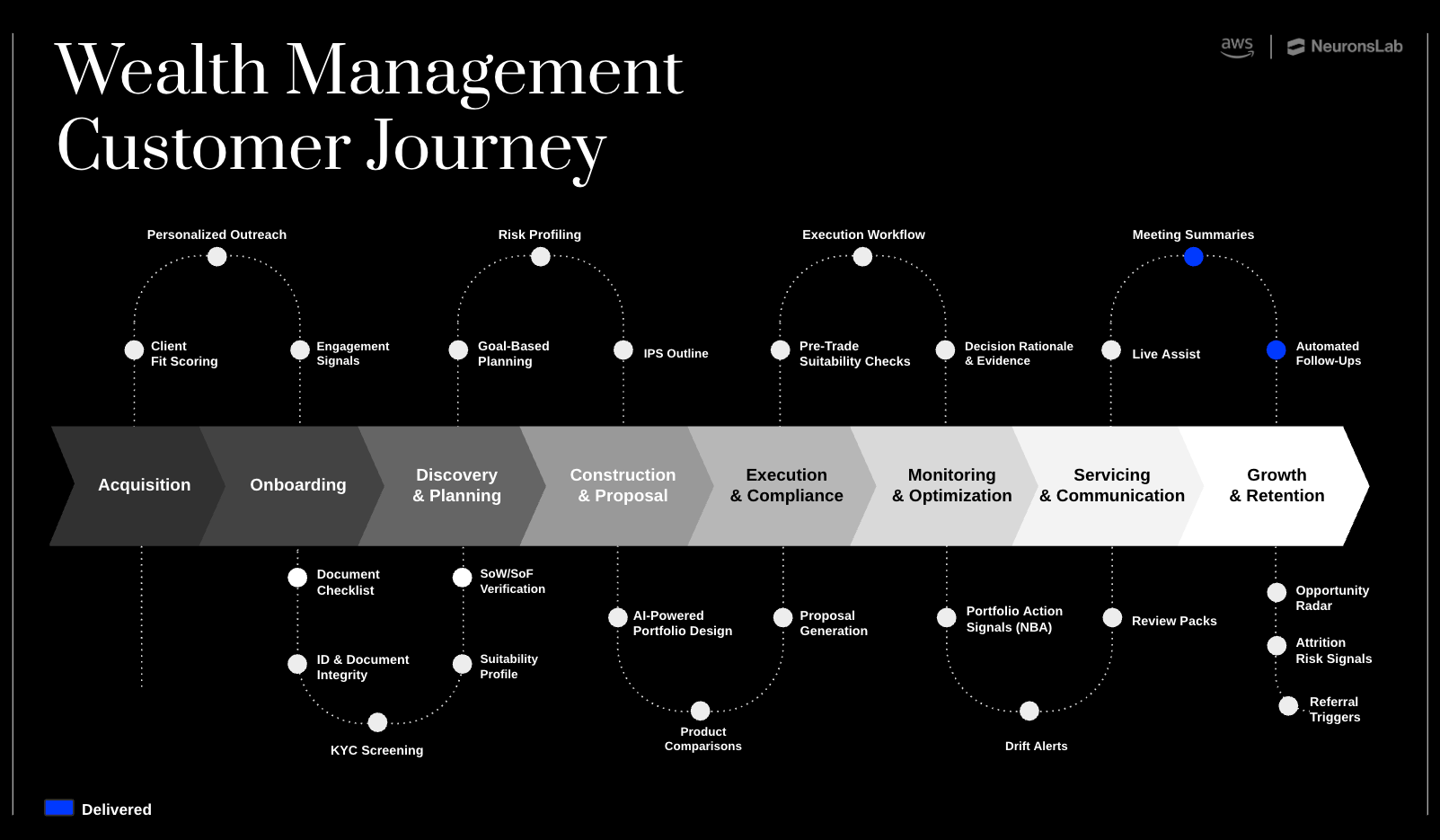

By automating repetitive, manual tasks and complex processes, AI can address real operational pain points, such as time lost to admin and compliance, while delivering tangible, measurable results across every stage of the wealth-management lifecycle.

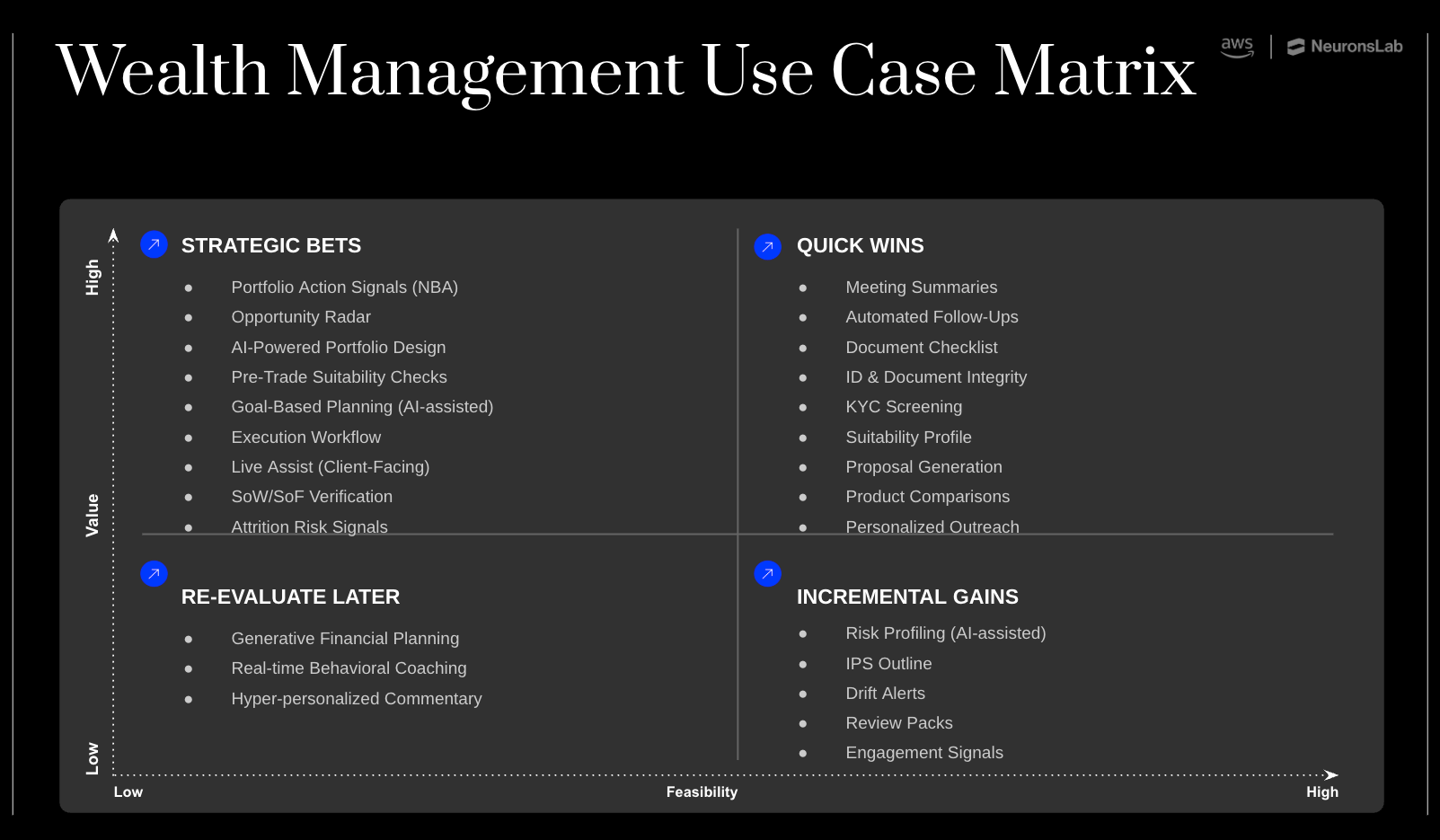

Here are the top AI use cases in wealth management and their impact, from the acquisition stage to the growth and retention phase:

Finding new clients can be slow and scattershot, with generic outreach and poor response rates.

AI can change this by identifying the prospects with the highest potential, drafting compliant personalized messages, and suggesting the next best action (NBA) based on engagement signals. Based on our own research with respondents, this can result in a 40–80% increase in meetings for every 100 prospects.

Know your customer (KYC), anti-money laundering (AML), source of wealth and funds (SoW/SoF) and other due diligence checks during client onboarding are tedious. They are often slowed by lengthy screening processes and back-and-forth interactions (e.g., resolving missing documents, verifying beneficial owners).

AI can accelerate this through optical character recognition (OCR) pre-fill, registry, commercial data searches, and automated checks for adverse media, politically exposed persons (PEPs), or sanctions. As a result, you can reduce onboarding time by 30–50%.

Opening accounts for clients and transferring assets is another common time consumer. It can often be slowed down by incorrect paperwork and opaque status updates.

AI can solve this by selecting the right jurisdictional forms, pre-filling details, orchestrating e-signatures, and tracking custodian SLAs. According to our research, the payoff is first-time-right rates of 85–90% and 30–50% faster cycle times.

Clients, including high-net-worth individuals, often express their goals in a vague or unstructured way, making it hard for your wealth managers to capture risk and constraints clearly.

AI can turn narrative conversations into structured objectives, generate cash-flow and liability snapshots, and detect financial planning gaps.

We’ve seen over 95% fact-find completeness—the percentage of required client data and documents captured and validated—and 75% faster planning time with AI.

The AI use cases with the most value combine high impact and low complexity, resulting in 25–40% productivity gains and revenue growth. Image source: McKinsey

With so many complex products to choose from, managers struggle to make confident recommendations. AI solves this by comparing products side by side, identifying fees and risks, and generating suitability notes (i.e., why the product fits) with proposal-ready content. We’ve seen 40% faster product recommendations and policy adherence rates above 98%.

Wealth managers spend lots of time on manual portfolio modeling, which is prone to policy breaches, and offer little transparency into the rationale behind asset allocation.

With AI, managers can automate:

In our experience, time-to-model can drop by 50 to 75% while policy breaches can fall below 1%.

Client proposals also take time to prepare, with important regulatory disclosures often slipping through. Proposals may also fail to persuade if clients struggle to understand the trade-offs between options.

AI can speed up the process by generating comprehensive proposals that include the right disclosures and clear, client-ready slides. This means your managers can deliver client proposals 40–60% faster and increase win rates by 15–30%, based on our findings.

Trades often fail because of slow manual checks, weak documentation of why the trade was placed, compliance breaches, and costly price slippage. AI can integrate with Order Management Systems (OMS) and Execution Management Systems (EMS) to reduce these risks.

It can also perform pre-trade compliance checks, recommend execution tactics, draft order notes (the reason for the trade), and flag anomalies against expected fills. As per our findings, this can lower implementation shortfall by 5–15 basis points (bps) and cut order rejection rates by 40–70%.

Portfolio drift can often go unnoticed, leaving your clients with risk levels that no longer match their goals. Wealth managers end up reaching out reactively, letting valuable tax-loss harvesting (TLH) opportunities slip by.

AI can detect drift, generate tax-aware rebalance proposals, spot TLH opportunities, and deliver these reviews with client-friendly explainers.

According to our findings, time-to-rebalance is reduced by 50–70%, after-tax returns increase by 30–120 bps a year, and proactive client touches are doubled.

Meetings, especially those with new clients, can fall flat if your managers arrive under prepared. AI-enabled systems address this by automatically:

This improves conversion rate and can result in up to 40% more opportunities from each first meeting, as per our research.

Cross-selling often happens on an ad-hoc basis or without a clear strategy, clients rarely make referrals, and managers miss opportunities to handle more of each client’s assets and financial needs.

AI can rank clients daily, spot opportunities, suggest next-best actions, and trigger referral prompts tied to NPS data. According to our insights, this can double client interactions, improve cross-sell conversions, and increase retention by 2–5%.

Turning wealth management AI use cases into production-ready solutions requires secure integration with proprietary data and adoption frameworks designed for regulated processes.

As an AI enablement partner with proven experience in wealth management, Neurons Lab helps you translate high-ROI ideas into compliant, production-grade systems.

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. We design, build, and implement agentic AI solutions tailored for mid-to-large BFSIs operating in highly regulated environments, including banks, insurers, and wealth management firms. Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization.

With Neurons Lab, you can start your AI implementation by shortlisting promising use cases and validating one with a PoC to confirm if an AI approach is viable for your specific technical and compliance challenges (e.g., checking latency, accuracy, data access, and build speed). This de-risks feasibility before you scale.

We then help you identify the most impactful use case, ensuring your investment is directed toward a solution that will deliver the highest value for your business.

To ensure faster delivery, lower risk, and a shorter time to value, you can use our pre-built AI accelerators, with tested code, proven frameworks, and reusable solution components. You can customize every accelerator to align with your policies, data sources, and client workflows.

Below, we’ll show you how these accelerators adapt to common wealth management scenarios.

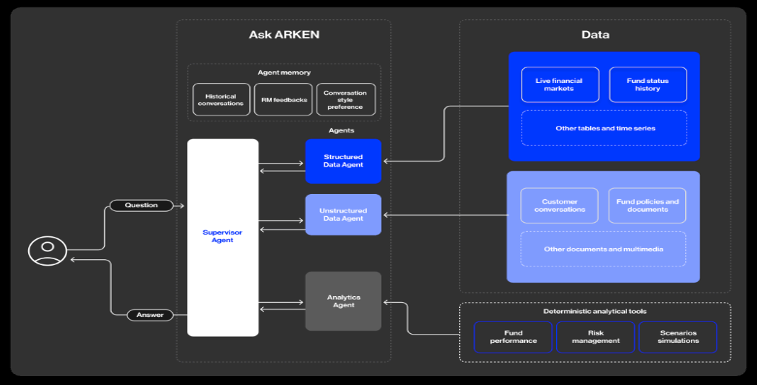

To lift the capabilities of wealth managers and free them for more client-facing activities, we developed ARKEN. Unlike off-the-shelf AI tools, like Perplexity or Claude for finance, that fall short on performance and compliance, ARKEN can be customized around your unique workflows and ecosystem, regulatory frameworks, legacy platforms, client data, and CIO-approved policies. This ensures relevant, measurable, and compliant results that generic tools can’t deliver.

ARKEN works by combining a multi-agent system with internal data, market feeds, compliance rules, and knowledge graphs that mirror your top managers’ decision patterns.

Neurons Lab’s ARKEN uses a multi-agent system to generate relevant real-time insights wealth managers can confidently use to scale their workflows

As shown below, ARKEN can act as a portfolio manager assistant, automatically flagging opportunities and turning alerts into actions. It analyzes client portfolios, cross-references products, and surfaces tailored recommendations instantly. That way, your managers focus on the right clients without needing to spend hours digging through reports or waiting for analyst answers.

ARKEN also automates your processes and core functions, from client preparation and proposal generation to compliance checks and post-meeting documentation. It instantly pulls portfolio data, risk profiles, and recommendations into branded presentations that normally take hours, leaving more time for client-focused work.

Beyond automation, ARKEN also tracks client interactions, revenue impact, and daily productivity. In seconds, your relationship managers have access to clear analytics to help optimize daily workflows.

With ARKEN automating preparation and generating instant insights through portfolio analysis and product matching, your managers walk into meetings fully prepared to deliver data-backed answers, tailored recommendations, and faster responses. This helps them better understand client goals, deliver faster recommendations, drive higher conversions, and create more upsell and cross-sell opportunities.

Our AI accelerator, NeuraDoc, combines advanced OCR with generative AI to automate document extraction and validation, cutting costs by 40% and speeding up processing by 80%. You can customize it to help you move beyond manual, error-prone document handling.

NeuraDoc extracts data from client IDs, proof of address, tax forms, and bank statements with 99% accuracy, then validates that information. This cuts repeated requests and reduces delays for up to 50% faster client onboarding.

NeuraDoc also speeds up account opening and asset transfers by classifying forms, pre-filling details, and automating workflows for signatures, custodian approvals, and portfolio migration.

NeuraChat is an AI accelerator solution that uses agentic AI to handle up to 80% of client requests, from routine FAQs to complex inquiries, without human handoffs. You can customize it to help your managers speed up client response times.

With emotional intelligence and compliance-aware reasoning, NeuraChat can act as a 24/7 assistant providing clients with compliant, real-time answers and proactive follow-ups. This helps managers deliver higher levels of client engagement for more satisfied, loyal clients.

Discover how agentic AI turns every bank customer service rep into a top performer

With NeuraVoice, you’ll have an artificial intelligence accelerator that uses agentic AI and NLP to enhance client conversations with natural voice understanding, real-time assistance, and autonomous handling. You can tailor it to support your managers in managing routine inquiries and even complex multi-step discussions quicker.

By providing real-time guidance, suggested responses, and compliance checks during client conversations, NeuraVoice helps your managers stay accurate, build client trust faster, and increase conversions.

As an AI-exclusive consultancy with Advanced Tier AWS competencies in Generative AI and Financial Services, we have a proven track record of delivering tailored financial services AI solutions for wealth management firms. With Neurons Lab, you gain a partner focused on AI to guide you through every stage of your AI implementation. This means you get access to the latest AI developments, translated into practical use cases that create measurable impact for your business.

With deep financial services expertise, we understand the specific workflows and regulatory landscape of the wealth management industry. This means your AI development teams can co-create your use cases with us to ensure every solution matches your goals, processes, and regulatory requirements. Our boutique agility and 500+ global engineer network also allows you to build, test, and scale your AI solutions quickly and go live in as little as 8 to 12 weeks.

You can lay the groundwork for current and future use cases with a strong data foundation we help you establish. This includes unifying and cleaning your data, streamlining ETL/ELT workflows, and putting governance frameworks in place to ensure data security and compliance with GDPR, ISO/IEC 27001, and ethical AI standards.

That way, solutions don’t fail regulatory reviews or break down against legacy architecture or custom workflows. Rather, you’ll have production-ready systems with the flexibility to scale into more advanced use cases without costly rebuilds. And, with built-in guardrails, you can trust your proprietary data is never used to train AI models, all outputs remain accurate with explainability built in, and your intellectual property stays protected.

Our support doesn’t stop at delivery. We also empower your teams with role-specific training, post-launch workshops, and ongoing enablement programs, so AI adoption is sustainable and becomes part of your organizational DNA.

Here’s how one bank relied on our AI expertise for wealth management:

At a leading Asian bank, wealth managers were struggling to keep up with their portfolio demands. Each wealth manager was tasked with managing 200 to 250 clients, but most of their time was taken up by manual work.

For example, managers spent nine hours collecting market insights, two hours a day preparing client messaging, three hours building a single client deck, and another three hours a week on opportunity triage. As over 70% of their time was lost to preparation and compliance, service delivery began to suffer.

Managers constantly missed revenue opportunities and fell short of their KPIs, like increasing customer satisfaction. The bank came to us with three key goals:

By analyzing the bank’s daily workflows, we identified where AI could free up wealth managers for more client-facing work. We then customized and deployed ARKEN, our purpose-built solution for wealth and asset management firms.

With ARKEN sitting on top of the bank’s existing data systems and acting as a tailored co-pilot, it has enabled instant market insights and automated routine tasks. In a short time, the bank has seen tangible outcomes like:

By completely redesigning and automating wealth managers’ workflows, the bank has achieved measurable capacity, productivity, and customer satisfaction gains.

Recent AI advancements have the power to redefine wealth management by streamlining processes, simplifying data access, and improving how firms serve clients. With Neurons Lab, you can turn these opportunities into reality. We help you realize value across use cases that matter most.

This includes everything from admin-heavy tasks like onboarding and compliance to high-value activities such as personalized advisory and portfolio optimization. Backed by deep AI expertise and a proven track record in wealth management, we guide your AI implementation end to end, ensuring a successful AI enablement.

If you’d like to explore how AI can apply to your wealth management workflows, our team can share insights from working with financial institutions and industry leaders. Book a call with us today.

Key AI in wealth management examples include AI assistants that act as copilots to your human advisors, AI agents that aggregate insights from internal portfolios and external market data, and AI systems that automate onboarding, compliance, and other manual workflows. They also include robo-advisors for portfolio management, digital financial advisor tools, predictive analytics for risk modeling, and fraud detection tools that flag irregular activity.

AI in wealth management is currently being used in ways that reduce manual work, increase personalization, and help wealth firms scale client service. This includes portfolio optimization, regulatory compliance monitoring, meeting preparation, automated onboarding and KYC checks, conversational assistants for client queries, predictive analytics for churn and upsell opportunities, and workflow automation for compliance, reporting, and trade execution.

AI improves client experiences in wealth management by making service faster, more proactive, and personalized. Instead of generic responses, clients can receive tailored recommendations based on their financial goals, risk profile, and market conditions. By automating routine tasks like reporting, onboarding, and compliance, managers can spend more time on quality client interactions. And with dynamic alerts and real-time insights, clients get up-to-date information on portfolio shifts or market events.

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

Discover how FSIs can move beyond stalled POCs with custom AI business solutions that meet compliance, scale fast, and deliver measurable outcomes.

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.

LLMs for finance explained: compare top models, benchmarks, costs, and governance to deploy compliant, scalable AI across financial workflows.