What is the Cost of AI for BFSIs in 2026? 4 Examples To Budget Accordingly

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

If you’re a mid-sized to enterprise-level FSI firm searching for custom AI business solutions, it’s likely that:

We’ve seen these challenges play out across the industry, and we know what works (and what doesn’t) when it comes to getting AI into production.

At Neurons Lab, we co-create custom AI projects with financial services executives, helping align leadership goals with the right technologies while ensuring regulatory compliance and measurable business outcomes. Our experience spans more than 100 clients, including Fortune 500 companies and governmental organizations, which gives us the perspective to help firms cut through complexity and create AI solutions with confidence.

In this article, we’ll cover

Looking for an AI-exclusive consulting firm that builds custom solutions for financial services firms? Book a call with us today.

Tailoring an AI solution for financial services requires a different approach than simply adopting off-the-shelf tools. The process starts small but sets the foundation for long-term scalability.

To get started, consider the following steps:

Taken together, these steps create a strong foundation for experimenting with AI inside your organization and proving early value without heavy investment.

These steps can take you from idea to proof of concept. But moving beyond POCs to scalable, production-ready systems is where many FSIs hit capacity walls.

For example, you’ve integrated Claude Finance with your infrastructure, but the answers to your prompts take longer than 30 seconds. And when your AI solution finally does respond, it’s not accurate enough and even hallucinates. Even after months of effort, your team may find itself stuck refining the prototype, spending more time troubleshooting than delivering reliable, production-ready outcomes.

Recognizing when in-house efforts have reached their limits and when external expertise is needed becomes critical for long-term success.

Off-the-shelf tools require your business to adjust to their limitations, whereas custom artificial intelligence solutions are built to your unique business specifications. So it’s much more feasible to create bespoke AI solutions for complex workflows and applications rather than simple use cases, where an AI tool will do.

For example, take a small research team producing a few market reports each week. They deal with repetitive tasks, data is publicly available, and compliance risks are low. This makes an off-the-shelf AI tool like ChatGPT or Perplexity or Claude for Finance a more practical, cost-effective choice than bespoke development as it enables you to get started quickly and easily.

A Perplexity Finance market report Image source: Perplexity Finance

More complex use cases, like customer support, present greater challenges. With many off-the-shelf solutions, you can launch a basic chatbot quickly through subscription-based pricing and minimal configuration. This speed is appealing, but the limitations become clear almost immediately:

Very simple chatbot responses to banking requests. Image source: Inbenta

Third-party access can create hidden entry points for attackers, exposing sensitive customer data and increasing regulatory risk. Image Source: Process Unity

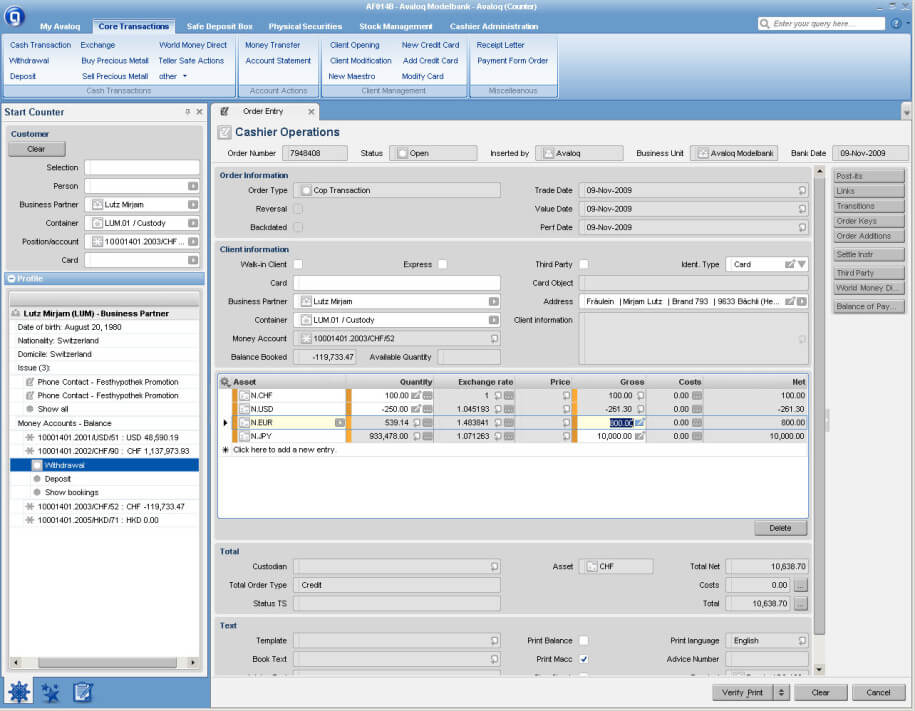

Generic chatbots can’t connect with core systems or software, like Avaloq – Image source: Computerworld.ch

This is where tailored AI-powered solutions become essential, especially in financial services, where needs vary widely.

For example, a wealth management firm may require an AI assistant that delivers data analysis, data-driven insights, on-demand calculations and predictive analytics for relationship managers. A crypto exchange, on the other hand, may want a more conversational chatbot designed for closing deals for its customers. Off-the-shelf tools can’t accommodate these differences and would require integrations and customizations before they are fit for purpose.

These examples highlight why bespoke AI becomes essential in financial services. While off-the-shelf tools are useful for low-risk tasks, only custom solutions allow you to integrate AI with core systems, meet compliance standards, and scale with your operations. The table below summarizes the differences to take into consideration when weighing AI tools vs tailored projects.

| Factor | Off-the-shelf AI tools | Custom AI solutions |

|---|---|---|

| Setup speed | Quick start with basic configuration | Slightly longer upfront, but tailored from day one |

| Compliance | Limited controls; often non-compliant in FSIs | Designed to meet regulatory requirements (GDPR, OCC, MAS, etc.) |

| Integration | Minimal — usually can’t connect to core systems | Built to integrate with internal systems and workflows |

| Scalability | Plateaus once use cases become complex | Scales with your operations and grows over time |

| Control | Vendor-defined features only | Full control over features, data, and security |

Building in-house makes sense if you have an experienced AI team with proven machine learning (ML) projects. (Learn more about what it takes to build your own AI engineer to support such efforts.)

For many FSIs, however, common challenges create natural points where consultancy support delivers more value:

Caption: Siloed vs unified customer view. Image Source: Stibo Systems

Even if your firm has strong internal expertise, external partners offering specialized AI services can be valuable when speed or experimentation is the priority. They can take on exploratory or lower-priority projects while your in-house teams remain focused on mission-critical initiatives.

If you decide that external support is the right path, the next step is choosing the right partner. This is where Neurons Lab works with you to design and deliver AI business solutions tailored to your regulatory, data, and customer realities.

Financial institutions face requirements that off-the-shelf tools can’t meet: strict compliance standards, complex integrations, and the need for solutions tailored to their business. As an AI-first enablement firm, Neurons Lab helps you address those gaps directly by building custom AI systems that are secure, compliant, and fit for your specific business purposes.

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. As an AI enablement partner, we design, build, and implement agentic AI solutions tailored for mid-to-large BFSIs operating in highly regulated environments, including banks, insurers, and wealth management firms. Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization.

Here’s how you can build tailored AI solutions for your FSI with Neurons Lab:

Neurons Lab supports FSIs across the full AI lifecycle, from strategy workshops to production deployment.

Our experience with financial services clients shows that moving beyond generic tools to custom-built solutions delivers real outcomes.

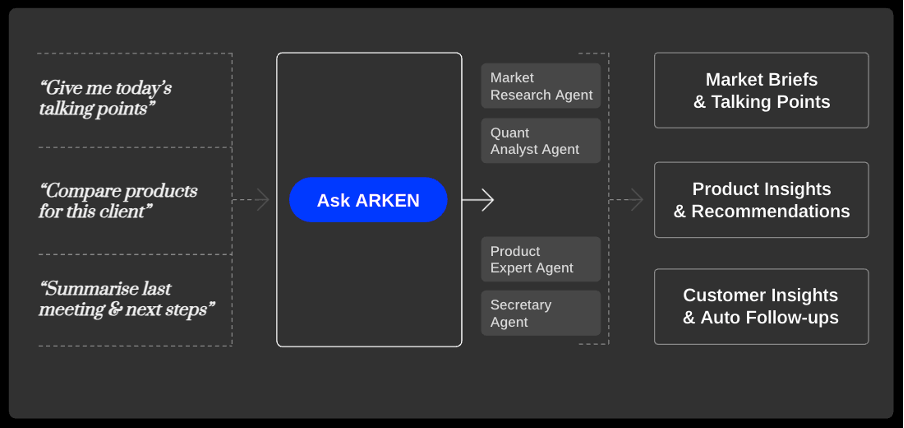

For example, we partnered with a wealth management firm to create a AI solution for its relationship managers (RMs). Previously, RMs spent hours searching through research reports or relying on analysts for insights. Their new tailored AI solution combines insights from markets, client portfolios, and product catalogues to surface tailored recommendations instantly and support faster data-driven decisions.

With this solution:

For the firm, the solution is already generating tangible results, such as:

By focusing on custom AI projects, Neurons Lab helps FSIs achieve faster decision-making, reduced risk, and tangible efficiency gains.

In the next section, we outline how you’ll benefit from choosing us as your AI enablement partner.

Financial services firms partner with Neurons Lab because we focus exclusively on AI, bring deep financial services expertise, and deliver tailored solutions with speed.

Unlike off-the-shelf tools, which plateau quickly and fail regulatory checks, we build AI systems that are compliant, secure, and adaptable to your environment. Here’s what you’ll get with Neurons Lab as your custom-built AI partner:

Many FSIs stall when moving from proof of concept to production. At Neurons Lab, we bridge that gap with financial services-specific solutions and an exclusive focus on AI. Unlike using tools that stop at basic features (or generalist consultancies that spread teams thin across various industries), you’ll have the expertise of 500+ engineers to help you create custom AI projects, extend your AI capabilities, and get faster results.

You can customize our AI accelerators to cover your business needs and specific use cases, such as:

Each accelerator includes tested code, reusable components, and proven frameworks. This allows you to start from a strong foundation, avoid months of rework, and move from idea to production in as little as two to four weeks.

You’ll also receive PoC guidance that comes with code implementation, documentation, test cases, and results that prove the value of your use case before you commit major resources. Once your solution is deployed, we’ll monitor its performance, gather feedback, and make ongoing improvements.

Our AI-only focus also means you always have access to the latest developments in machine learning and generative AI, translated into practical outcomes, such as faster innovation cycles and lower infrastructure costs.

Off-the-shelf solutions often fail when they run up against compliance requirements. With Neurons Lab, you’ll get AI solutions designed to meet the standards set by regulators, such as GDPR, OCC, MAS, and ISO/IEC 27001, while ensuring your data never leaves secure environments.

Our teams know financial services inside out, with experience that ranges from fraud detection and AML/KYC automation to credit risk modeling and regulatory reporting. With our expertise, you can address data fragmentation early by cleaning, structuring, and unifying your data through streamlined extract, transform, and load (ETL/ELT) workflows.

Beyond technical delivery, you’ll receive governance frameworks that cover AI policies, ethical standards, and compliance guardrails. This ensures your systems pass regulatory review and continue to perform reliably in real-world conditions.

This means you’ll have production-ready AI systems with the flexibility to scale into advanced use cases without costly rebuilds. With enterprise-grade security controls in place, your data remains private, outputs remain accurate, and intellectual property is fully protected.

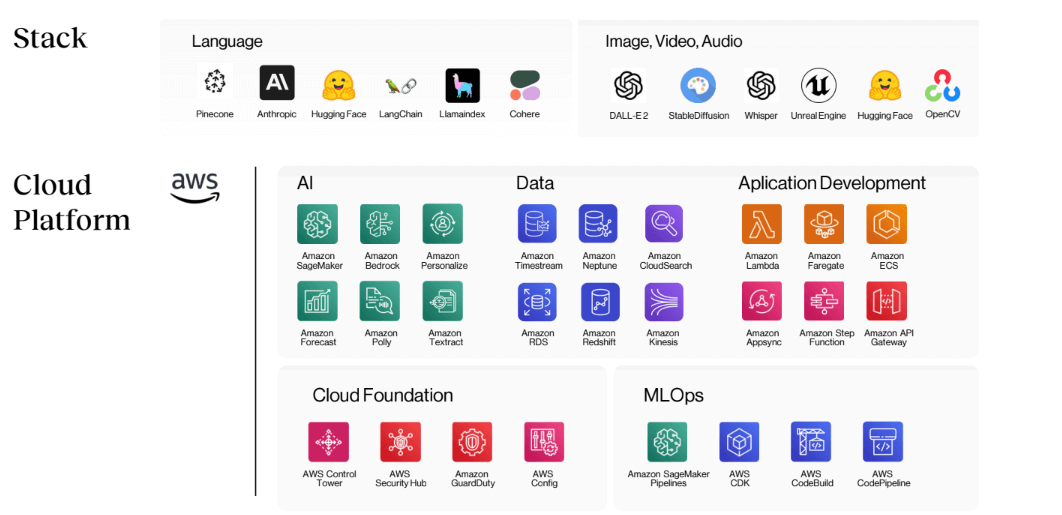

Neurons Lab’s tech stack aligns with industry regulations and offers enterprise-grade trust and safety features

Off-the-shelf tools plateau quickly when scaling. They can’t adapt to your unique workflows or gain adoption across diverse teams. Even after a tailored solution goes live, you may often struggle with scaling due to skills gaps, resistance to AI adoption, or poor testing practices. With Neurons Lab, you can address these head-on with:

This combination of technical rigor and organizational enablement ensures your AI solutions scale responsibly, something off-the-shelf products weren’t designed to do.

A global asset management and investment advisory firm came to us with four key goals:

The firm already knew an off-the-shelf solution wouldn’t be able to help them achieve these complex goals and tasked us with designing and deploying a tailored AI product. This included an advanced backtesting framework to improve confidence in out-of-sample performance. We also implemented market structure algorithms to deliver more accurate estimates of market data and fundamentals.

To support these capabilities, we built a scalable cloud architecture on AWS that runs large language models securely with high availability across multiple zones.

Neurons Lab’s scalable cloud architecture running LLMs securely with high availability across multiple zones.

As a result, the firm achieved measurable improvements across all four goals:

And with AWS-based architecture providing a secure, scalable foundation, the firm is now able to meet current demands while maintaining high levels of security and compliance. Discover more.

When you’re dealing with complex use cases, regulatory requirements, and integration challenges, only a tailored approach delivers measurable results. Working with an AI-exclusive partner that understands the financial services industry is crucial, as they can help you design purpose-built AI products and projects that are compliant, secure, and aligned with existing workflows, giving your firm a clear competitive advantage.

Just as important is how they work with you. The right partner provides support at every stage—from identifying use cases to deployment and post-launch support—so you can innovate faster, reduce costs, streamline operations, and scale AI technologies confidently organization-wide.

If you want to move beyond off-the-shelf tools and build custom AI solutions that meet your unique needs and drive measurable results, contact us today.

Off-the-shelf AI is faster and cheaper to deploy for common tasks, while custom AI is more flexible, scalable, and tailored to your specific needs. The right choice depends on whether speed or strategic fit matters more to your organization. In the financial services sector, where compliance and data security are critical, bespoke AI often delivers the control and scalability firms need.

It makes sense to use off-the-shelf AI for simple use cases where speed and cost are your main concerns, and where ease of deployment matters more than meeting complex regulatory requirements. Purpose-built AI solutions are ideal for more complex use cases like AI agents, and when your business has strict compliance requirements and advanced integration needs.

Custom AI agents are specialized AI systems designed to perform specific autonomous tasks based on an organization’s unique needs. Unlike generic off-the-shelf AI tools, agents are trained on a targeted knowledge base and given the ability to interact with specific tools and systems. This allows them to independently complete complex, multi-step actions, such as automating a business process or providing tailored customer service.

Estimates place the cost of building an AI solution at $50,000 to $100,000, though this can vary widely depending on project complexity, scope, data needs, infrastructure, and whether it’s built in-house or outsourced.

For financial services, you should also take into account the cost of regulatory class and governance (e.g., EU AI Act high-risk use cases like credit scoring/AML need risk management, data/record-keeping, etc.) as well as documentation, testing, monitoring, and board-level accountability under ESMA/MiFID guidance.

It can take anywhere from a couple of weeks to several months to build an AI solution from scratch for a financial services firm. There are various factors to consider, including the complexity of your project, your data readiness, integration needs, compliance requirements, and governance needs. Whether you build in-house or work with an AI consulting partner is also a factor.

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

See how wealth management firms can use AI to streamline workflows, boost client engagement, and scale AUM with compliant, tailored solutions

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.

LLMs for finance explained: compare top models, benchmarks, costs, and governance to deploy compliant, scalable AI across financial workflows.