AI Agent Evaluation Framework: Why It Matters for Financial Services

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

If you’re a financial institution researching global system integrator companies for your AI projects, you might be:

Working with the right AI integration company can help you address these issues. However, with so many options available, it can be challenging to determine the right fit. Drawing on our financial services expertise and insights from integrating 100+ AI projects, we’ll highlight five top global system integrators specialized in AI to help you make an informed decision.

In this article:

Want to get started with an AI-exclusive consultancy and system integrator specialized in delivering compliant, scalable AI solutions for BFSIs? Book a call with us today.

| Company | Overview | Headquarters and Reach | Key Professional Services | Example Clients | Best For |

|---|---|---|---|---|---|

| Neurons Lab | AWS Advanced Tier partner, specializing in modernization for financial services firms. | London and Singapore, supporting clients in the UK, US, Canada, Europe, and ASEAN. | AI Transformation Services Executive AI Alignment AI Strategy and Governance Enterprise Data Foundation Rapid Proof of Concept Agentic AI Systems AI Training and Education Cloud Cost Optimization |

Visa, AXA, HSBC | Mid to large financial institutions seeking to move AI from pilots into production while integrating with legacy systems and meeting regulatory requirements |

| GFT Technologies | AI technology partner delivering digital transformation for regulated industries, with strong financial services focus1 | Stuttgart, Germany, with presence in 21 countries | AI Services AI Consulting Data Services Cloud Services Software Engineering Platform Modernization |

Deutsche Bank, Salt | Mid to large regulated firms seeking AI-led transformation with built-in governance from strategy to scale |

| Sollers Consulting | Operational advisory and software integrator helping financial institutions modernize digital capabilities2. | Warsaw, Poland, with presence in over 30 countries | Process Automation Core Systems Implementation Digitalization Data Management System Integration3 Cloud Consulting |

Zurich, Allianz | Mid to large banks, insurers, and leasing firms needing end–to-end business and technology transformation |

| Capco | Technology and management consultancy focused on digitalization in financial services and energy4. | London, United Kingdom, with presence in 20 countries | Consulting Strategy Transformation And Change Financial Crime Risk Regulation And Finance5 |

NatWest, Deutsche Bank | Mid to large financial firms seeking tailored support from strategy through execution |

| Synechron | Digital consulting firm delivering customized technology solutions for financial institutions6. | New York, United States, with presence in 20 countries | AI, Cloud And Devops Consulting Cybersecurity Data Software Engineering7 |

Leading APAC bank, major financial services provider | Mid to large financial institutions pursuing end-to-end digital modernization aligned to business strategy |

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. As an AI enablement partner, we design, build, and implement agentic AI solutions tailored for mid-to-large banks, financial services and insurance firms (BFSIs) operating in highly regulated environments, including asset, investment and wealth management.

Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization. You can access key AI services, including:

By partnering with us and using our systems integrator services, you can expect to:

An ecosystem with complex infrastructure and fragmented data foundations make it difficult to build reliable RAG, analytics, or decisioning models. As a global systems integrator (GSI) exclusively focused on artificial intelligence, we help you overcome these challenges while eliminating the need to manage multiple providers by:

That way, you can deploy compliant custom AI business solutions that fit your existing systems and processes without high-risk failures, such as data leaks, hallucinated answers, and unauthorized agent actions.

With our specialization in developing GenAI and agentic systems for financial services, you’ll be able to build AI copilots or assistants to automate workflows across diverse use cases. These range from wealth, asset and investment management to core banking and insurance.

For example, by integrating your proprietary data and knowledge into your AI systems, you can differentiate from the competition while retaining specialized knowledge in house. You can also ensure accurate, relevant outputs that off-the-shelf LLM tools like Claude and Perplexity for Finance struggle to produce.

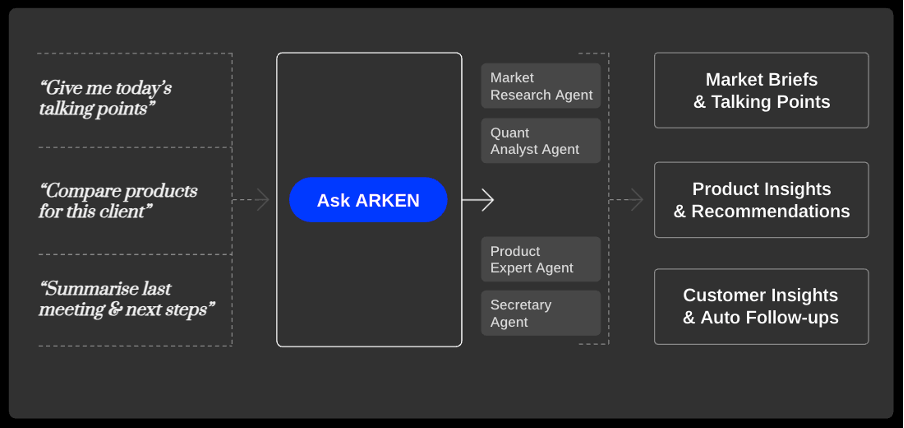

We did exactly this for a major Asian bank using ARKEN, a fully customizable internal AI-driven financial assistant. This AI accelerator solution is the integration and reasoning layer that connects and adapts LLM tools and software (e.g., Avaloq, Temenos) to your IT systems.

The bank’s wealth managers were able to ask questions via a single conversational interface via ARKEN and receive actionable insights instantly by integrating agentic AI with:

As a result, the bank achieved:

Meeting strict compliance, risk, and security requirements can be challenging without an AI partner who understands your industry. With our deep financial services expertise, we help you embed these requirements into your AI systems from day one so they won’t stall at regulatory review.

You can establish governance over data, including how it’s accessed, used, and stored. This is critical under data-specific regulations like GDPR, CCPA, and EBA Guidelines. It also ensures that models draw only from verified data and that each action can be traced and audited.

As your GSI partner, we help you set up AIOps and MLOps for continuous monitoring, versioning, lineage tracking, and explainability. This gives you strong audit trails and ongoing oversight, so you can demonstrate compliance at every stage.

You also get structured AI agent evaluation frameworks that use systematic testing and performance tracking to ensure your systems meet specific quality thresholds. This means you can be confident that your AI systems behave reliably before rollout.

And after you go live, you’ll have our ongoing support in monitoring performance, gathering feedback, and making improvements to maintain model performance and resilience.

Integrating, productionizing and scaling AI can be difficult without the right expertise. As a full-service AI consultancy, Neurons Lab understands how to support you where your financial services firm struggles most: automating compliance-heavy workflows and scaling without introducing regulatory risk.

You get expert guidance at every stage, from identifying high-value use cases and building proofs of concept to deploying production-grade systems and providing ongoing enablement.

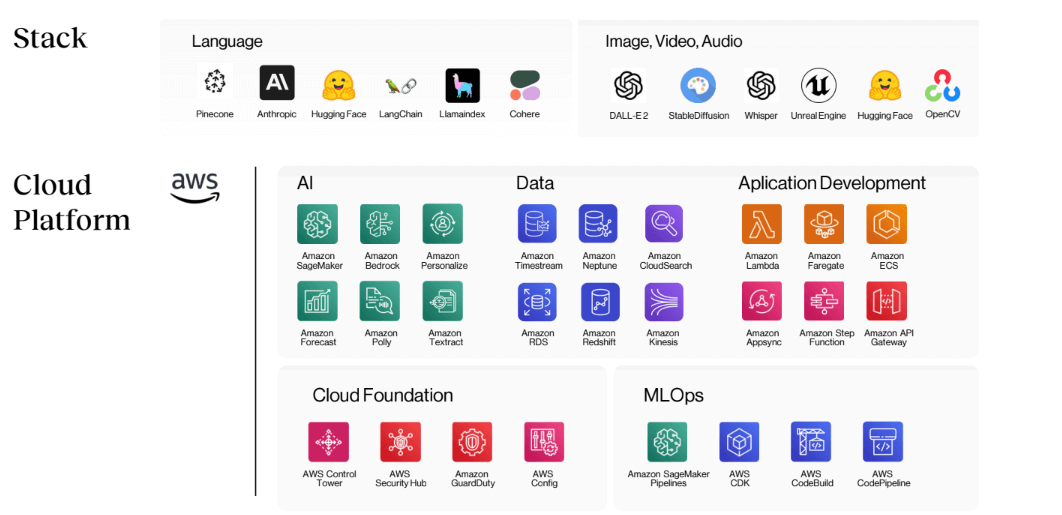

Meanwhile, our 500+ engineers bring proven expertise in RAG, orchestration, agentic and multi-agentic systems and MLOps. This means you’ll have the technical backing you need to move from prototype to production securely.

Our co-innovation approach also ensures that your AI development teams build the knowledge and internal capability to manage your AI systems. This way, you gradually take ownership of your AI systems and avoid vendor lock-in.

With our customizable AI accelerators, you can integrate and deploy production-ready AI fast enough to compete with fintech challengers. Built on tested code, reusable components, and proven frameworks, our accelerators are layered on top of your existing systems, addressing legacy infrastructure constraints.

This means you can scale AI quickly across use cases like bank customer service assistants, AI research co-pilots, voice assistants and document processing in as little as two to four months.

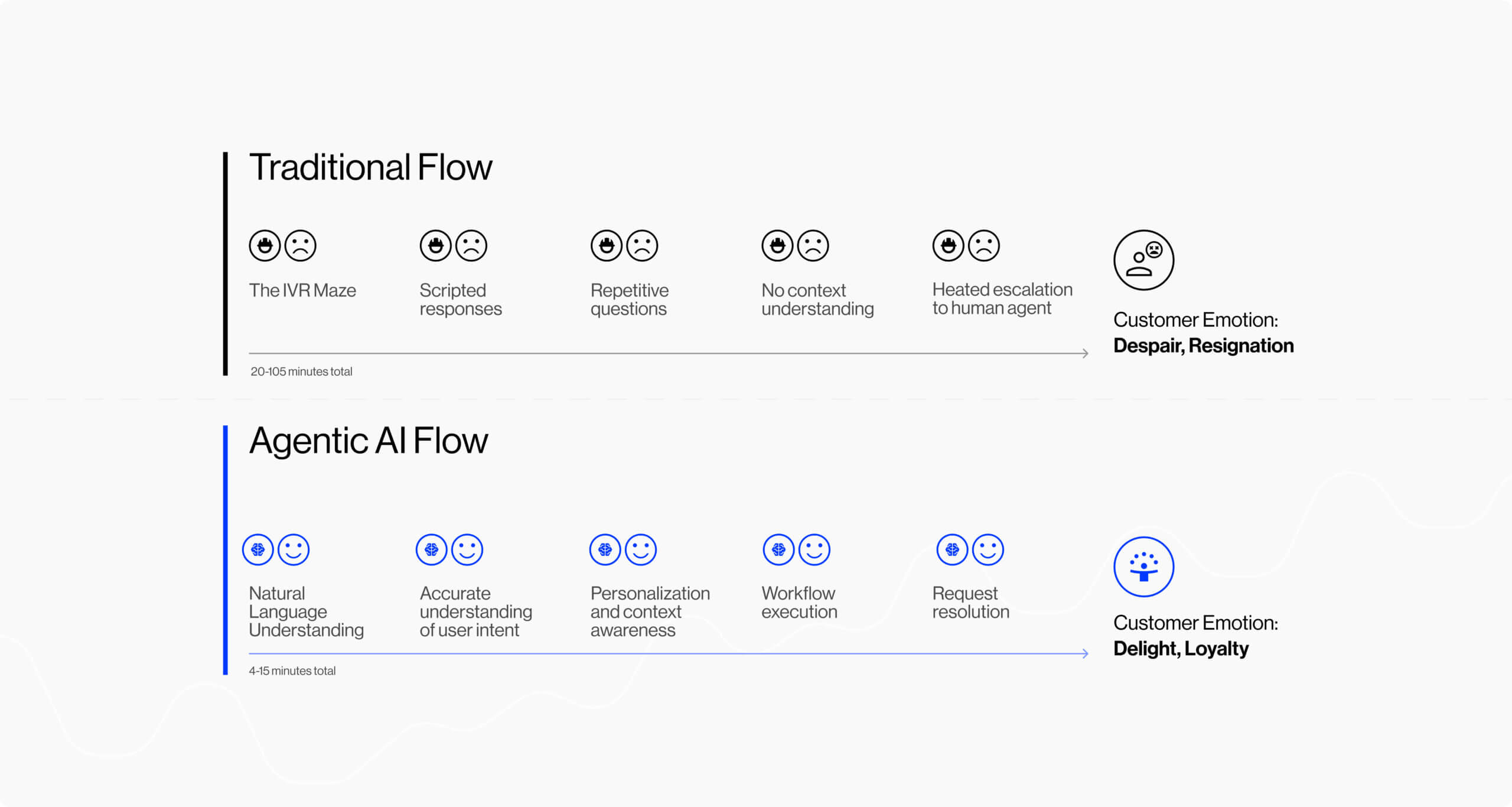

For example, our NeuraChat accelerator can help you tackle issues where standard chatbots fall short like impersonal responses, inconsistent answers, and poor escalation handling. By integrating it into your existing systems to automate chat-based workflows, you can also achieve the following results:

As an AWS partner, we also help you de-risk deployment by extending cloud credits and grants to ease upfront costs.

You’ll also have help estimating your return on AI investment at the PoC or projection level. That way, you can confidently base your investment decisions on measurable metrics, such as margin increase, productivity gains, and operational efficiency improvements.

Finally, our integration services include a phased rollout approach that enables you to validate ROI early and spread costs over time to avoid the financial barriers that often stall AI initiatives for BFSIs.

Mid to large financial institutions that want to modernize their legacy systems or consolidate their software and providers into one will find our integration solutions a good fit. If you’re stuck running pilots that never make it into production or struggling to connect AI to legacy systems in a way that fits with existing workflows and regulatory requirements, Neurons Lab can help.

Our partnership includes managed services for mid-to-large-scale projects. This means we take care of strategy, governance, deployment and ongoing monitoring, so you can scale AI safely across your organization. You’ll also have access to tailored training and education to embed AI knowledge within your organization.

We understand that we might not be the right fit for every company, so here are four other system integrators specializing in finance:

GFT is an AI technology partner providing digital transformation for financial services and other regulated industries worldwide. Headquartered in Stuttgart, Germany, GFT operates across 21 countries and has delivered AI solutions for institutions such as Deutsche Bank and Salt.

Key services:

Best for: Mid to large firms in regulated industries seeking AI-centric transformation with built-in governance and efficient delivery from strategy to scale.

Sollers Consulting is an international operational advisory and software integrator supporting financial institutions with enhancing their digital capabilities. Headquartered in Warsaw, Poland, Sollers operates in over 30 countries and has implemented AI systems for clients such as Zurich and Allianz.

Key Services:

Best for: Mid-to-large banks, insurers and leasing firms that want end-to-end support with business transformation and adapting to modern technologies.

Capco is a technology and management consultancy specializing in digitalization and emerging technology for firms in financial services and energy. Headquartered in London, Capco operates across 20 countries and has deployed AI solutions for clients such as NatWest and Deutsche Bank.

Key services:

Best For: Mid-to-large financial firms in banking and payments, capital markets, wealth and asset management and insurance seeking tailor-made solutions and support from strategy to execution.

Synechron is a digital consulting firm providing technology services for financial services firms globally. Headquartered in New York, Synechron operates across 20 countries and has built AI solutions for clients such as a leading Asia-Pacific bank and a major financial services provider8.

Key services:

Best for: Mid-to-large financial institutions that want end-to-end digital modernization and tailored solutions built around their business strategy.

Unlike generalists, global system integrators for financial services have extensive industry experience. This means they can help you deploy and scale AI faster while avoiding risk and costly rebuilds. That’s because:

Financial services workflows involve many steps and span multiple systems, which makes integrating AI challenging. Let’s take, for example, a financial advisor making investment recommendations to a client. To do this, the advisor must draw on information from:

For AI to reliably support this workflow, it must be connected to all of these systems. It must also be able to access and use the right data and tools. AI integration companies with deep financial services expertise can prepare your data, design AI architectures, and establish governance frameworks and the right decision logic. This ensures your outputs are accurate, reliable and auditable.

As a BFSI, you face strict regulations around how data is used, shared and stored. For example, suppose an AI banking chatbot helps your clients with support requests. The chatbot must access a client’s account details, transaction history, and CRM records in a secure, compliant way.

System integrators in financial services understand regulations across areas like data privacy, security and consumer protection. This means they can set up governance and security frameworks that protect sensitive customer and company data. They can also control access and ensure AI models aren’t trained on your private information.

Like many financial services firms, you may be dealing with fragmented data across your systems. This can make deploying AI across your systems difficult. Without unified access to both internal and external data, AI is limited and can’t produce outputs that are relevant.

System integrators with expertise in AI, IT services and data analytics help modernize data infrastructure. They break down data silos and connect your systems, so you’re not limited to what one off-the-shelf AI model or LLMs for finance can do.

For example, AI can power a co-pilot for wealth managers that draws on both internal systems and relevant external data sources. By taking over administrative tasks, it frees up wealth managers for high-value tasks like relationship building.

Moving from pilots to real business value requires the right strategic and technical expertise.

Many BFSIs lack these capabilities in-house, which is why AI initiatives often stall when pilots meet real systems. Some system integrators like Neurons Lab guide firms from strategy through deployment. They also test, monitor, and evaluate AI performance.

That way, you know exactly how your AI systems are working and can scale them confidently when you’re sure of ROI.

When evaluating system integrators, here’s a checklist of the qualities that matter most:

As a BFSI, you face numerous hurdles when it comes to AI. Between legacy systems, complex workflows, and strict regulations, off-the-shelf tools fall short. And building in-house can often stall when technical complexities arise.

A global system integrator company helps you overcome these barriers by integrating data, infrastructure, and the right governance frameworks. By working with a partner with deep financial services expertise, you ensure that security and compliance are built into your AI systems from the start.

This prevents AI projects from stalling during regulatory reviews. It also eliminates the need for costly reworks as you scale. Beyond the technical aspects, the right partner also provides hands-on support at every stage, including post-deployment, so your AI transformation stays effective and compliant.

Want to deploy AI and scale it across systems and use cases in a way that’s compliant and drives measurable results? Neurons Lab can help. Book a call with us today.

Traditional system integrators connect disparate software, hardware, and legacy systems, such as ERP or CRM, to ensure reliable data flow and operational consistency. Meanwhile, AI integrators embed AI into workflows, systems, and data to automate decision-making. For example, an AI integrator like Neurons Lab that specializes in financial services integrates AI with BFSI legacy systems, fragmented data, and complex multi-step workflows.

Whether large global system integrators are the best option for banks depends on each bank’s required speed and flexibility. Large global system integrators often have long delivery cycles due to their scale and bureaucracy. Smaller AI integrators like Neurons Lab operate with an agile boutique structure and fewer delivery layers. This ensures faster execution, collaboration, and deployment.

AI system integrators commonly deploy use cases across customer service, fraud management, employee-facing and customer-facing AI assistants, transaction monitoring, customer onboarding, and compliance in BFSI. AI integrators like Neurons Lab also help banks determine and prioritize high-value use cases that scale across teams and deliver measurable impact.

System integrators can help prove ROI on AI investments in financial services if they establish baselines at the start of a project, define clear measurement criteria, and track outcomes continuously. An integrator like Neurons Lab sets up the right cases, governance, monitoring, and reporting frameworks that link AI performance to measurable business results.

Sources:

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

See how wealth management firms can use AI to streamline workflows, boost client engagement, and scale AUM with compliant, tailored solutions

Discover how FSIs can move beyond stalled POCs with custom AI business solutions that meet compliance, scale fast, and deliver measurable outcomes.

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.

LLMs for finance explained: compare top models, benchmarks, costs, and governance to deploy compliant, scalable AI across financial workflows.