What is the Cost of AI for BFSIs in 2026? 4 Examples To Budget Accordingly

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

On paper, your wealth management division may look strong: rising client numbers, growing teams, ambitious AUM targets. But beneath the surface, there’s a leak: inefficient relationship manager (RM) workflows that quietly lead to billions ending up with your competitors.

Every hour your managers spend gathering data instead of advising clients is an opportunity lost. AI is no longer a future consideration, it’s key for wealth managers with ambitious AUM targets.

By automating manual tasks and workflows that support faster decision making, you can free managers up to focus on relationships. New agentic approaches also cut operating costs by 25–40%¹, making AI a driver of both growth and profitability.

As an AI-exclusive consultancy that’s delivered 100+ projects for Fortune 500 companies, we’ve seen these results firsthand. We’ll share the common obstacles of wealth relationship management, and how financial institutions can overcome them with AI and custom solutions that match your efficiency and growth KPIs.

In this article, we cover:

Want to get started with tailored AI solutions for financial services? Book a call with us today.

Your relationship managers (RMs) are under pressure. They need to grow their assets under management (AUM) and hit their cross-sell targets while providing tailored advice to hundreds of clients. But structural barriers in your operating model make this nearly impossible. From our experience, three challenges stand out as the root cause.

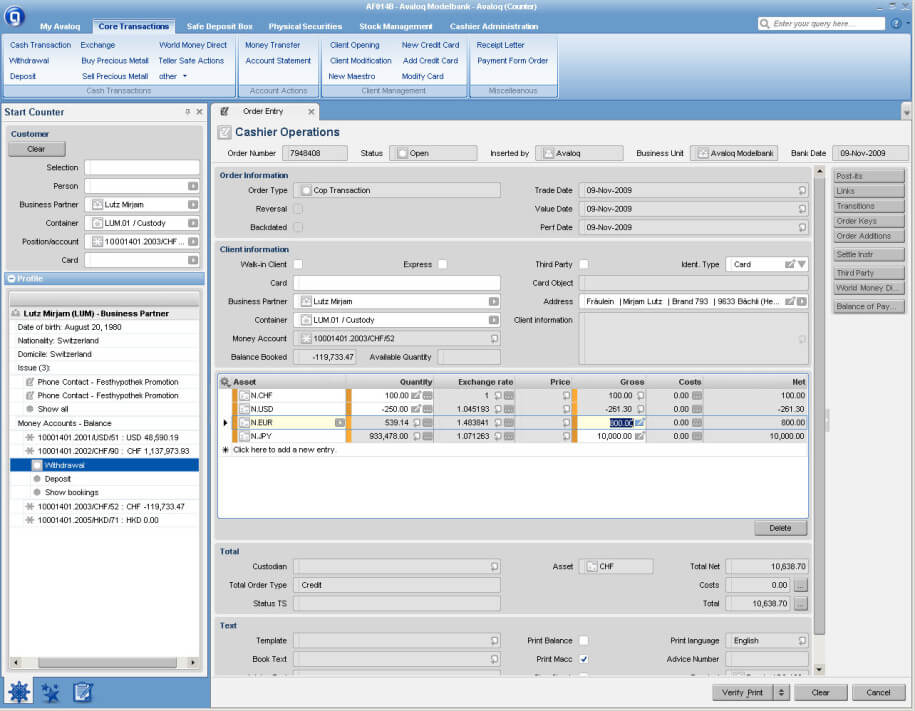

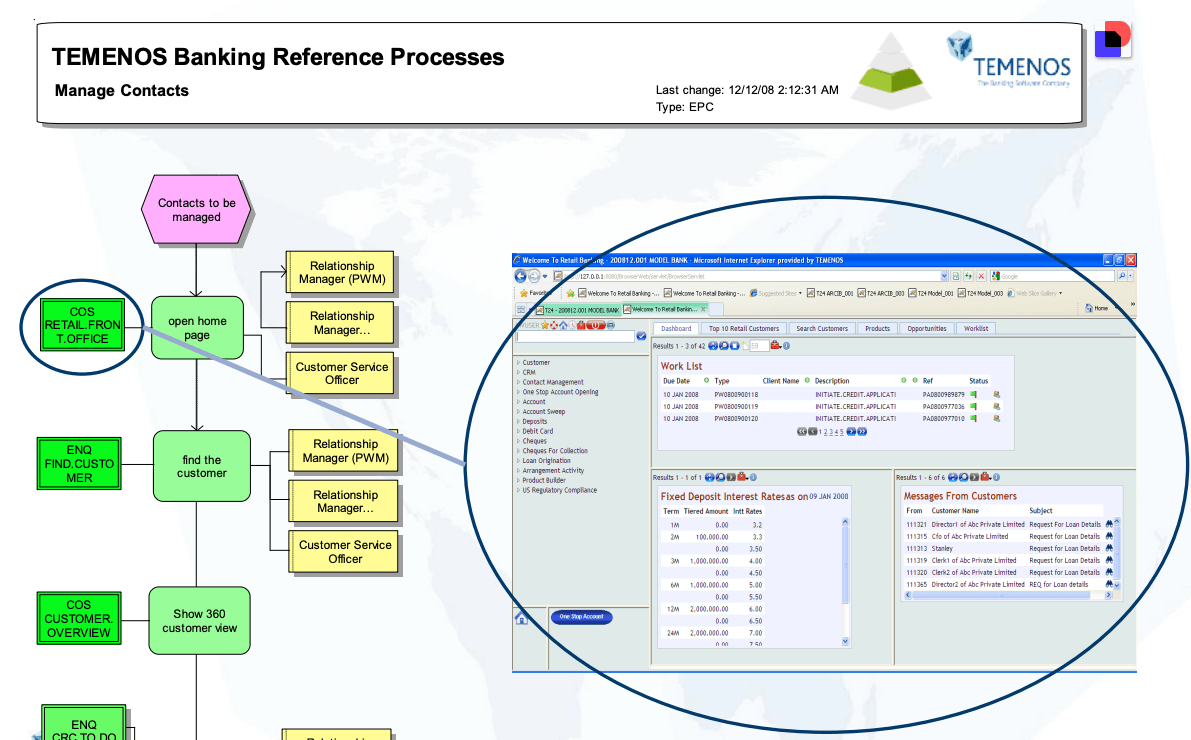

To recommend tailored investment products, provide advice, or answer client questions, your RMs need to combine external, internal, and client data. The problem is that this data lives across multiple systems. RMs have to gather market insights from CIO office reports, analyze client portfolios in systems of record like Avaloq or Temenos, and then manually connect this with relevant products.

The complexity of Avaloq’s interface – Image source: Computerworld.ch

Temenos’ interface Image source: Temenos

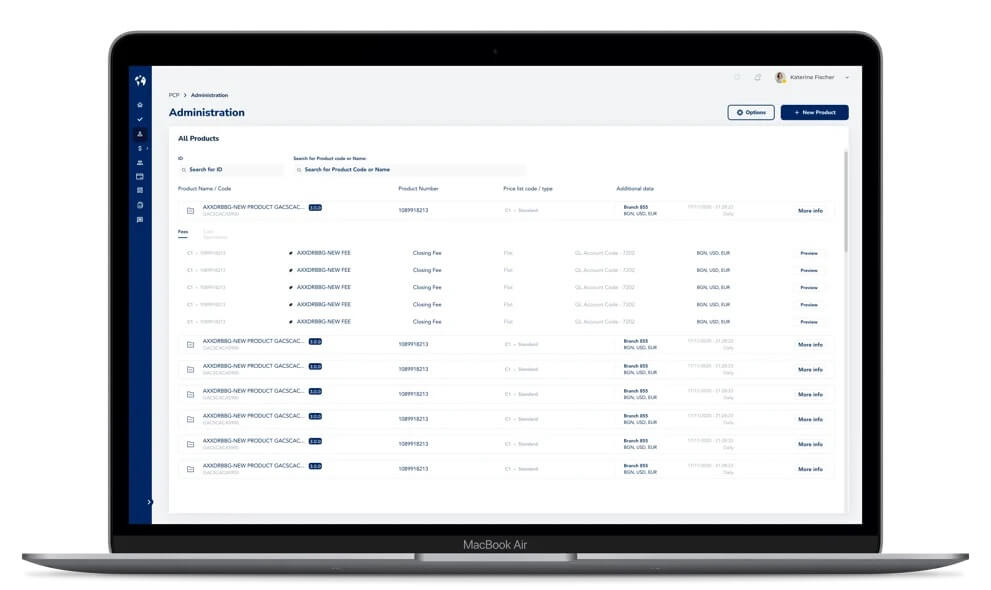

In large banks with thousands of offerings, this fragmented setup makes it difficult to extract the right insights quickly, even for experienced RMs. Instead of focusing on what matters to each individual client, your RMs are stuck piecing together information, which leads to generic or delayed recommendations.

The richness of a bank’s product catalogue – Image source: Axxiome

For newer hires, the lack of a single source of truth means it takes months before they can confidently advise clients without constant support.

So, both experienced and new RMs end up relying heavily on analysts to answer client questions or match products to clients. This extra step and the time involved result in slower service delivery and generic responses and proposals, risking client churn.

After gathering the data, your RMs still need to prepare for client interactions. Even then, they may need analysts’ support to explain complex products or market movements clearly while keeping their messaging compliant.

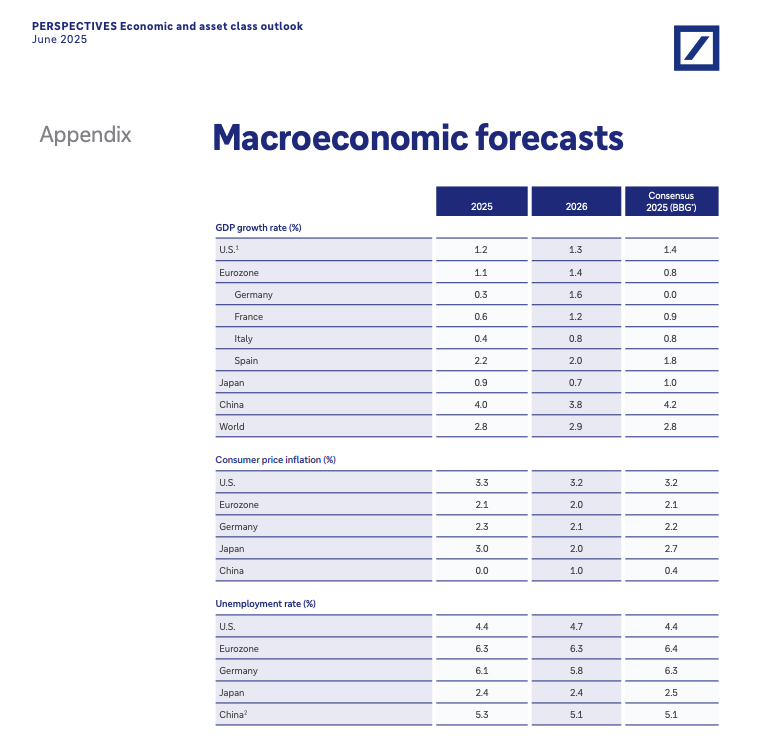

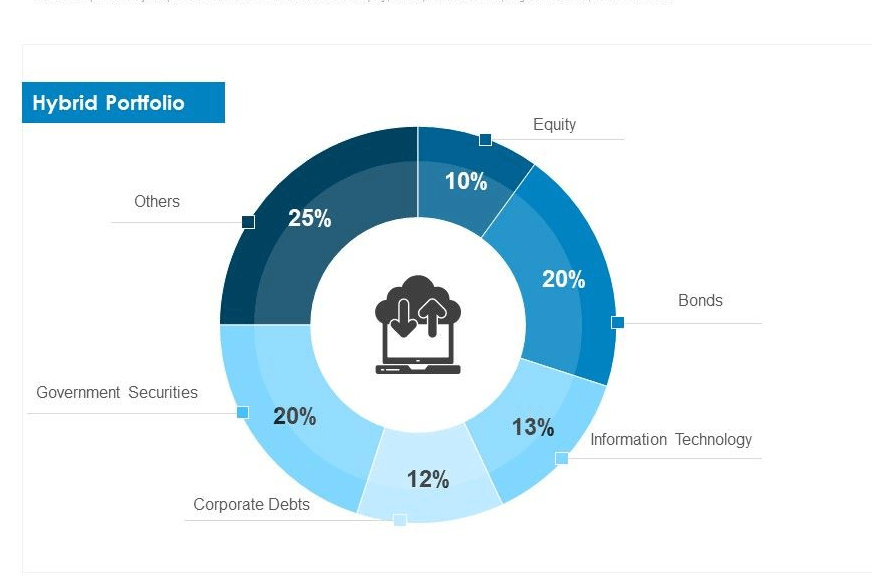

This work also includes preparing client decks and talking points. The RM spends additional hours reviewing pie charts, portfolio allocations, and graphs from market reports, before deciding what works best for each client. If an RM has a scheduled call in 30 minutes, they can’t compile all of this data quickly or accurately enough. Rushed prep then leads to proposals that miss the mark or responses to client queries that lack depth.

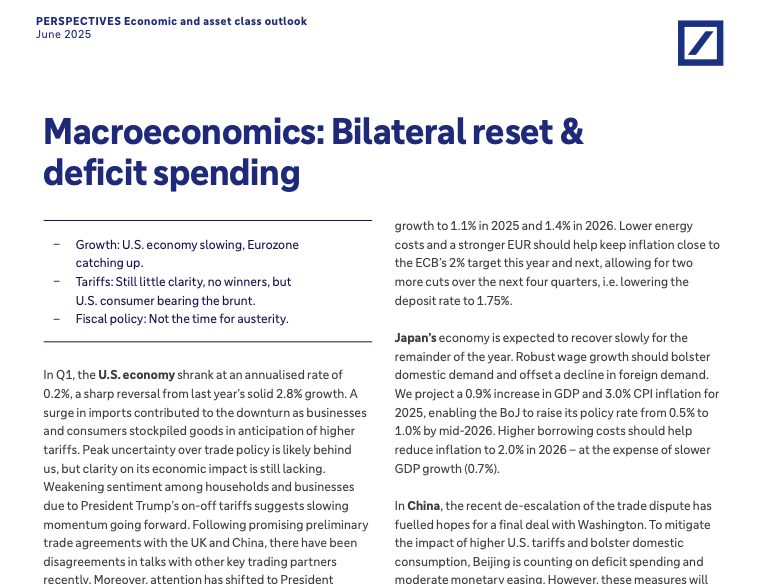

Fragmented systems and static CIO reports make it hard for RMs to connect the dots quickly. Image source: Deutsche Bank PERSPECTIVES Economic and asset class outlook – June 2025

At the same time, every recommendation has to be auditable and traceable back to CIO-approved sources. Even follow-up materials must align with what the CIO office provides. From our experience, this manual prep, admin, and compliance work consumes as much as 70% of your RMs’ capacity. That leaves little time for proactive client engagement, and opens the door for competitors to win your customers.

The sheer number of clients combined with the lack of appropriate tools prevents RMs from reaching clients and personalizing interactions. A typical RM maintains around 100 client relationships. That volume combined with the amount of manual tasks means RMs are forced into daily tradeoffs about who to prioritize. In practice, this usually means the largest or most urgent accounts get most of their attention.

The result is only the top 10–20% of clients receive regular engagement, while the remaining 80–90% see little more than transactional contact, creating missed opportunities for asset growth.

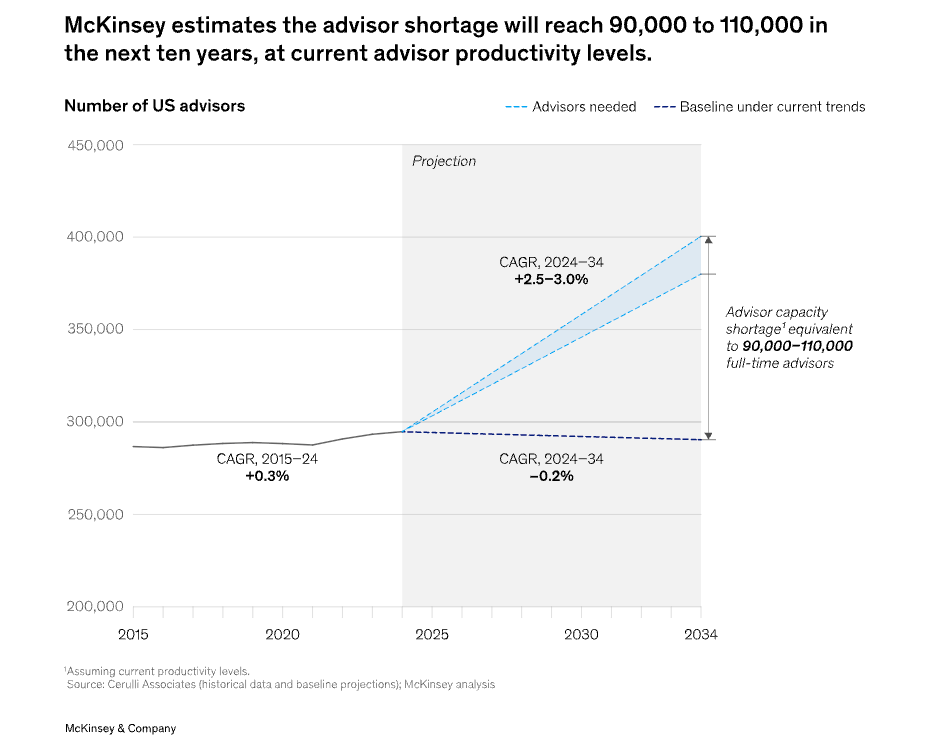

And this challenge will only get worse. With a projected shortage of 100,000 RMs by 2034, each RM will be forced to take on even more clients while still doing manual processes, stretching their coverage thinner and putting your asset growth at risk.

To break this cycle, your RMs need better tools to decide which clients to focus on, when to reach out, and what to offer. Without this support, revenue growth can remain a struggle.

AI gives banks new ways to rethink RM workflows, from how data is gathered to how clients are prioritized. Tasks that once took hours, such as preparing client decks, checking compliance, or matching products to portfolios, can now be handled in minutes. This frees RMs to spend more time with clients, strengthens relationships, and creates the conditions for faster AUM growth and greater customer capacity.

You may already be experimenting with AI in wealth management, but you often don’t get the results you were hoping for. LLM tools like ChatGPT, Perplexity Finance, or Claude for Finance looked promising, but fell short in production. The outputs weren’t integrated, weren’t tailored enough, and weren’t compliant.

That doesn’t mean AI can’t deliver. It means those first attempts relied on tools that were never designed for the complexity of wealth management.

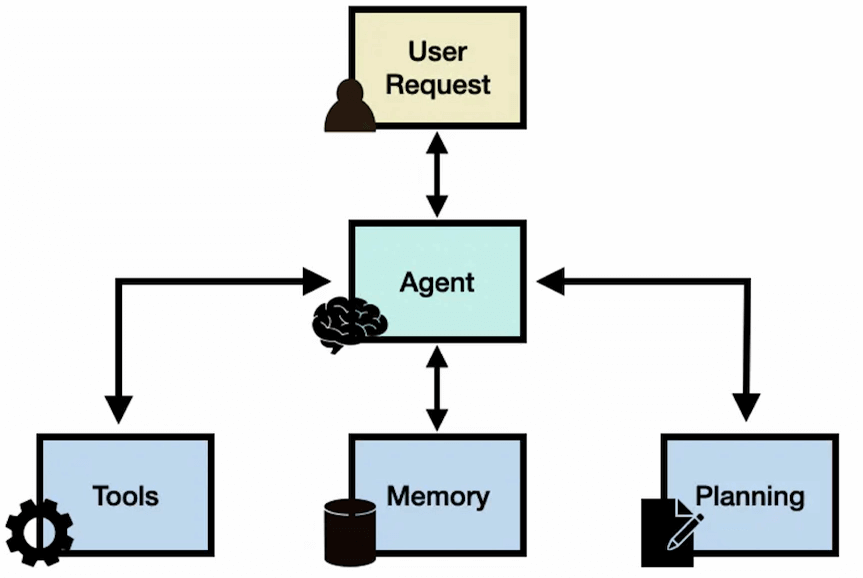

What’s needed is a different approach: custom agentic AI solutions that, when built accordingly, close this gap by combining the adaptability of LLMs with structured, rule-based programming. This means you have custom systems that can reason, reference approved sources, and execute automated workflows reliably.

Here’s how agentic AI can change how your RMs work:

If you’ve already tried tools like Perplexity Finance or Claude for Finance, you probably saw how insights break down in practice. These LLM tools can summarize market data, but they don’t integrate with Avaloq, Temenos, or CIO reports. The result is outputs that sound smart but lack the context your RMs actually need.

By customizing your AI solutions, you can create a single point of access for RMs by pulling from internal systems, market data, and compliance-approved sources. Specialized agents can analyze these inputs and combine them into clear insights that would otherwise take hours of manual work.

With custom AI copilots, RMs don’t have to dig through CIO reports or Temenos dashboards. They can ask one system and get an instant, source-backed answer.

An AI copilot unifies data from CIO reports, CRMs, and product catalogs into one interface

A custom AI business solution allows an RM to respond instantly when a client asks why a fund was terminated, instead of waiting hours or days for analyst support. The outcome is faster insights, stronger client trust, and better use of RM time.

Because agentic AI pulls information directly from CIO reports, product sheets, and compliance documents, you can configure it so every recommendation comes with a reference back to its source. It can also explain how those inputs led to the answer, showing the link between client data, market conditions, and product fit.

New hires can follow both the sources and the reasoning, which accelerates learning while ensuring compliance is built into their workflow from the start as citations act as audit logs.

If you experimented with ChatGPT or Claude Finance, getting client-specific insights is probably where you felt the gap most clearly. You most likely received generic responses with no audit trail back to CIO-approved sources. This could be fine for brainstorming, but unusable in front of a client.

AI now makes it possible for your RMs to tailor advice to each client’s goals, risk tolerance, and financial situation in real time across their entire portfolio. Instead of handing clients generic fund sheets, RMs can walk into meetings with AI-prepared talking points that are tailored to each portfolio.

AI generates client-ready insights in minutes, tailored to portfolios and risk profiles. Image source: SlideGeeks

Agentic AI does this by drawing on unified data and running analysis through multiple specialized agents. One agent may track a client’s transaction history, another may monitor market conditions, while another evaluates product fit. A synthesizing agent then brings these findings together into recommendations tailored to each client.

These outputs are structured through a knowledge graph that encodes how analysts assess portfolios and products. This makes recommendations explainable. The RM can see the sources, the logic that connects client data with market changes and product fit, and outputs that mirror the reasoning of a seasoned RM but at greater scale.

Instead of relying on analysts or static product lists, RMs can walk into meetings with specific talking points, portfolio recommendations, and forward-looking insights. Over time, feedback loops refine accuracy and adapt to changing client needs.

The result is advice that feels more relevant, timely, and proactive. Clients see that your institution understands their goals and acts on them, which strengthens trust and creates more opportunities to grow AUM.

As we mentioned earlier, about 80% of clients receive little contact with relationship managers. Repetitive and manual administrative work, such as preparing reports and reviewing client histories, consumes much of their time. This limits how many clients they can serve well.

We’ve seen some banks try to solve this with off-the-shelf AI assistants or rigid automation. The problem was either unreliability (e.g., answers with no audit trail) or inflexibility (e.g., rules that only worked for one workflow). Neither scaled across thousands of clients without breaking trust.

Agentic AI can handle these tasks so RMs don’t have to manage them manually. An RM can request a portfolio overview, recent market changes, or tailored product recommendations in plain language, and the system delivers polished outputs in seconds. That includes slides with portfolio allocations, visualizations of performance, and recommended products tied to CIO-approved sources.

AI prepares decks and reports automatically, giving RMs back capacity to serve more clients. Image source: Tableau

This additional capacity enables RMs to add around 50 to 60 more meaningful relationships to their portfolio without lowering the quality of service.

These same agentic AI systems can also be configured to track how RMs use their time, the quality of their recommendations, and client outcomes. That visibility makes it easier for executives to identify best practices, give targeted feedback, and raise overall team performance.

For your bank, this translates to improved satisfaction scores, more revenue potential per RM, and higher client retention, without needing to increase headcount.

To illustrate the difference between general off-the-shelf solutions and custom builds, here’s how common RM workflows look before AI, when attempted with generic LLM tools, and when powered by custom agentic AI solutions:

| Workflow | Before AI | Tried with generic LLMs | With custom agentic AI solutions |

|---|---|---|---|

| Market insights | Manually search CIO reports or ask analysts for answers | Quick summaries of public data, but no integration with Avaloq, Temenos, or CIO reports | Instant answers drawn from CIO reports, CRMs, and market data |

| Market messaging | Draft manually, rewriting insights for each segment | Generic wording not tied to client portfolios or compliance | Client-ready messaging in minutes, tailored to segments and portfolios |

| Client preparation | Review portfolios across systems and compare assets against market events | Fragmented suggestions with no audit trail | Personalized talking points and proposals in seconds, based on CRM + market data |

| Opportunity triage | Prioritize clients by gut feel, spreadsheets, or subjective factors | No prioritization beyond surface-level metrics | Clients automatically ranked by market events, exposure, and product fit |

| Meeting preparation | Build decks manually with product comparisons and charts | Incomplete or error-prone slides, often missing compliance sources | Ready-to-use decks with client-specific insights and product matches |

| Client meetings | Answer questions with limited market knowledge; follow up with analysts | Risky answers that can’t be traced back to CIO-approved sources | Real-time insights and product matches, with confident responses on the spot |

| Compliance assurance | Double-check recommendations against CIO guidelines manually | No way to verify outputs against CIO-approved policies | Recommendations mapped to approved CIO products, with instant, source-backed follow-ups |

As you can see, there is immense opportunity for AI in wealth management. It could allow RMs to double the number of relationships they manage, vastly increasing a wealth management company’s AUM / RM ratio. It could greatly improve the quality of the service, and cut the amount of time RMs spend on research from hours to minutes. This is why it’s a key area that we’re working on and helping our clients with.

Neurons Lab is a UK and Singapore-based Agentic AI consultancy serving financial institutions across North America, Europe, and Asia. As an AI enablement partner and AWS Advanced Tier Partner with Generative AI and Financial Services Competencies, we design, build, and implement agentic AI solutions tailored for mid-to-large BFSIs operating in highly regulated environments, including banks, insurers, and wealth management firms. Trusted by 100+ clients, such as HSBC, Visa, and AXA, we co-create agentic systems that run in production and scale across your organization.

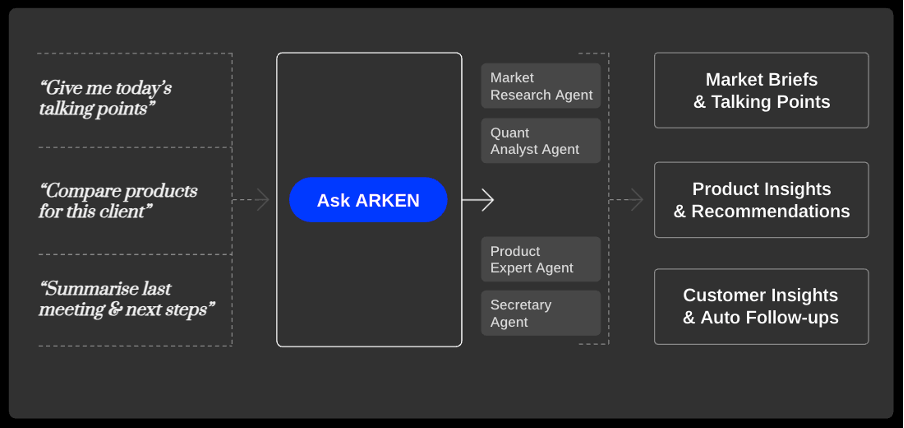

To help banks address the specific challenges in wealth management, we built ARKEN: an AI accelerator solution designed to give RMs more capacity, stronger insights, and the tools to serve clients at scale.

The ARKEN co-pilot purpose-built for wealth relationship managers you can customize

ARKEN is an accelerator AI co-pilot for relationship managers that you can customize based on your specific needs. It gives RMs a single conversational interface where they can ask questions or request support for client work.

When an RM makes a request, an orchestrator agent breaks it into tasks and routes them to a network of specialized agents. For example:

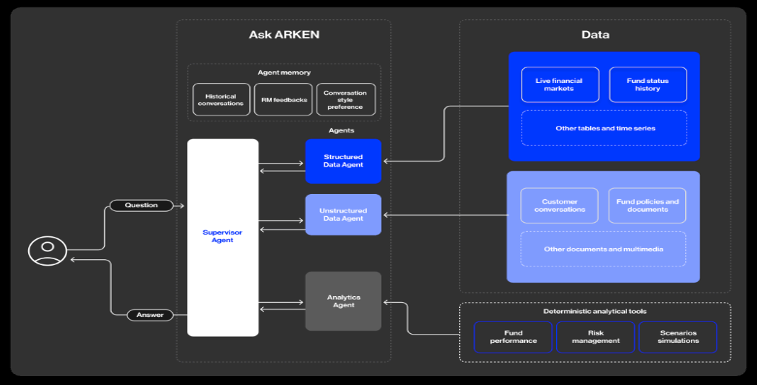

These agents draw on three integrated data streams:

This ensures outputs reflect not only market conditions, but also the client’s portfolio and the bank’s offerings, making recommendations both actionable and relevant.

A synthesizing agent then brings these outputs together into a clear, client-specific briefing.

Neurons Lab’s ARKEN makes use of a multi-agent system to surface real-time insights RMs can trust and use to scale their workflows confidently

For your RM, this means that instead of spending hours reviewing dashboards, products and reports, they can ask ARKEN for support and receive tailored talking points, portfolio overviews, and presentation materials in seconds. Every recommendation is linked to CIO-approved sources, so it is both auditable and compliant.

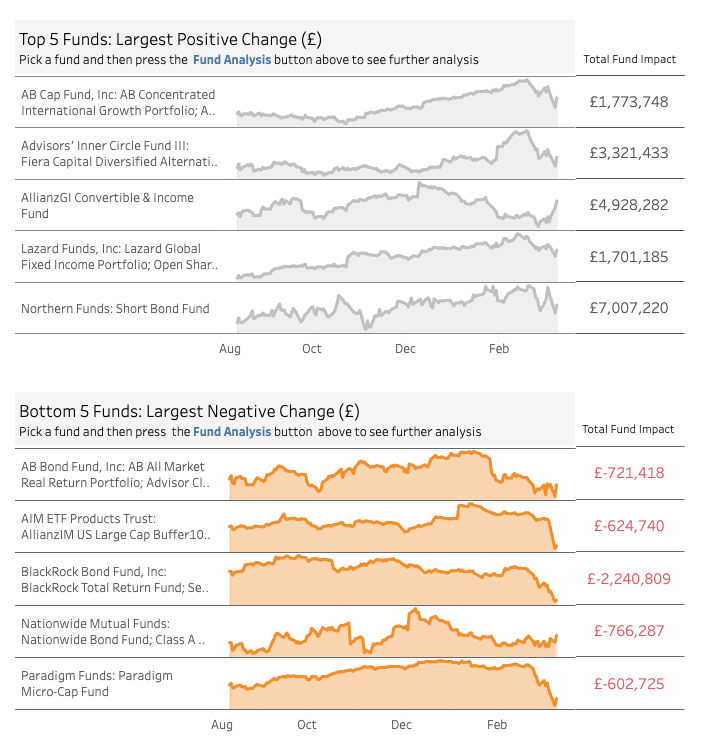

For example, your RM receives a market alert and can turn that into actionable insights within seconds with ARKEN.

All you need to do is ask ARKEN which products can you recommend to one of the clients flagged by the alert, Miguel S. The AI agent instantly analyzes Miguel’s portfolio exposure, cross reference that to your product catalogue, and surface relevant recommendations.

You don’t need to dig through any research reports or wait for any analyst calls.

ARKEN also helps with automating instant professional proposals and meeting management. Let’s say you now have Miguel’s recommendations ready and you want to create a proposal.

With a few clicks, ARKEN automatically pulls together Miguel’s risk profile, your current market analysis, and your recommendations into a branded, professional presentation. What takes a relationship manager hours of manual work can now be done within seconds.

Imagine your relationship manager wants an end-of-day report on productivity and performance. ARKEN provides clear visibility into time allocation and productivity metrics. It will track client interactions, measure revenue impact, and optimize daily workflows.

With ARKEN, your RM walks into the meeting fully prepared, confident, and ready to deliver advice that strengthens client trust. And when clients raise questions, such as why a fund was terminated or how a product fits their portfolio, ARKEN equips the RM with data-backed answers in the moment.

This approach is already in use. The following example shows how ARKEN helps RMs expand their capacity and grow assets, without compromising service quality, in a real-world setting.

A leading Asian bank needed to grow its wealth management division but was limited by the strain on its relationship managers. Leadership had already identified three priorities for change:

For context, each of the bank’s RM manages roughly $50 million in client assets. Increasing their portfolio by 50 clients raises that figure by $10 million on average, making even modest gains in capacity highly material for revenue growth.

The bank had begun exploring AI as a way to achieve these goals and partnered with Neurons Lab to design a solution.

At the time, each RM managed 200 to 250 clients but spent much of their week on manual work: nine hours gathering market insights, two hours a day preparing messaging, three hours building a single client deck, and another three hours a week on opportunity triage.

With so much time lost to preparation and compliance, RMs missed opportunities, struggled to engage clients consistently, and fell short on their KPIs.

We analyzed the day-to-day workflows and identified where AI could create meaningful time savings. ARKEN was deployed on top of the bank’s existing systems as a tailored co-pilot for RMs. With access to instant market insights and automation for routine tasks, the deployment is underway with the goal of delivering:

While ARKEN is designed as a production-ready platform, you can tailor it to fit your institutions’ infrastructure and workflows. This ensures that the system reflects the way your RMs actually work, while giving them the benefits of automation, unified insights, and compliance from day one.

Banks exploring AI in wealth management often ask us how ARKEN compares to other tools already on the market. The difference comes down to reliability, context, and fit for RM workflows.

General-purpose chatbots like ChatGPT are built for broad conversations. They can generate text quickly but are not reliable for high-stakes financial decisions. They lack access to internal systems and often produce answers that cannot be verified or are out of date.

Finance-specific LLMs such as Claude for Finance or Perplexity Finance are stronger on real-time market data.² They can pull from sources like Bloomberg, S&P, or FactSet. But they stop there.³ As ready-made solutions, they cannot connect to your CRM, past client interactions, or internal compliance frameworks. Most importantly, they do not reason like your RMs or analysts. They cannot explain why a product fits a client’s portfolio or generate tailored talking points for a meeting.

We built ARKEN to close this gap. It combines a multi-agent system with access to internal data, market feeds, compliance rules, and knowledge graphs that map the relationships between clients, products, and market factors. The system follows the same decision patterns as an RM, producing recommendations that are transparent, auditable, and linked to approved sources.

Neurons Lab acts as a system integrator. We do not build new LLMs, but orchestrate the best available models with deterministic tools, internal bank systems, and domain-specific reasoning patterns. This ensures outputs are auditable, aligned to CIO policies, and embedded in existing RM workflows.

ARKEN is also backed by our end-to-end AI consultancy and expertise. We take you from strategic roadmap development and proof of concept through to production deployment and ongoing support. This ensures the platform integrates with your existing infrastructure, aligns with regulatory requirements, and adapts as your workflows evolve.

Beyond wealth management, we also help you create custom AI solutions for compliance, customer service, marketing, and operations, so the benefits of artificial intelligence extend across your entire organization.

While wealth management faces a clear challenge on how to implement AI, the question for executives now is timing.

Firms that move early on AI will give their RMs the capacity to serve more clients, deliver better advice, and grow AUM with confidence. Those that delay risk falling behind competitors who are already adopting these tools.

At Neurons Lab, we partner with financial institutions to bring AI into production in a way that is compliant, tailored, and aligned with existing workflows.

If you would like to see how this could apply in your organization, our team would be glad to share what we have learned from working with leading banks. Book a call with us today.

Sources:

Here is how banks, insurers, and fintechs can budget for AI with scenarios and cost drivers—subscriptions, overages, infrastructure, and ownership

AI agent evaluation framework for financial services: SME-led rubrics, governance, and continuous evals to prevent production failures.

See how wealth management firms can use AI to streamline workflows, boost client engagement, and scale AUM with compliant, tailored solutions

Discover how FSIs can move beyond stalled POCs with custom AI business solutions that meet compliance, scale fast, and deliver measurable outcomes.

See what AI training for executives that goes beyond theory looks like—banking-ready tools, competitive insights, and a 30–90 day roadmap for safe AI scale.