Written by Igor Sydorenko, the CEO and co-founder of Neurons Lab. Igor is an expert in AI, algorithmic trading, and quantitative finance. He was previously the CEO of two successful FinTech startups and has conducted doctoral research in financial markets.

Written by Igor Sydorenko, the CEO and co-founder of Neurons Lab. Igor is an expert in AI, algorithmic trading, and quantitative finance. He was previously the CEO of two successful FinTech startups and has conducted doctoral research in financial markets.

The banking sector is no stranger to artificial intelligence. AI and machine learning are already playing crucial roles across various back- and front-office functions, such as fraud detection and customer management. Now, generative AI in finance is set to have an important role, too.

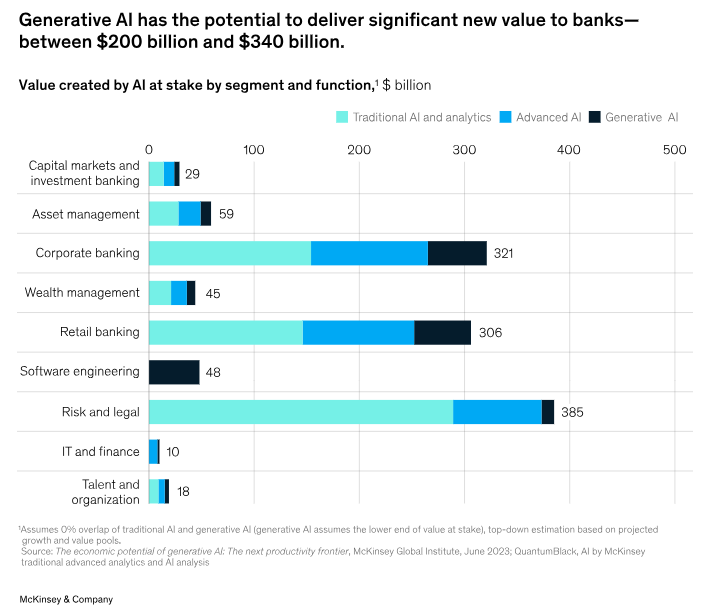

The growing adoption of GenAI could provide significant additional value to the banking industry. McKinsey estimates that GenAI could add $200-340 billion in global value annually, up to 4.7% of total banking revenue, through higher productivity and other benefits.

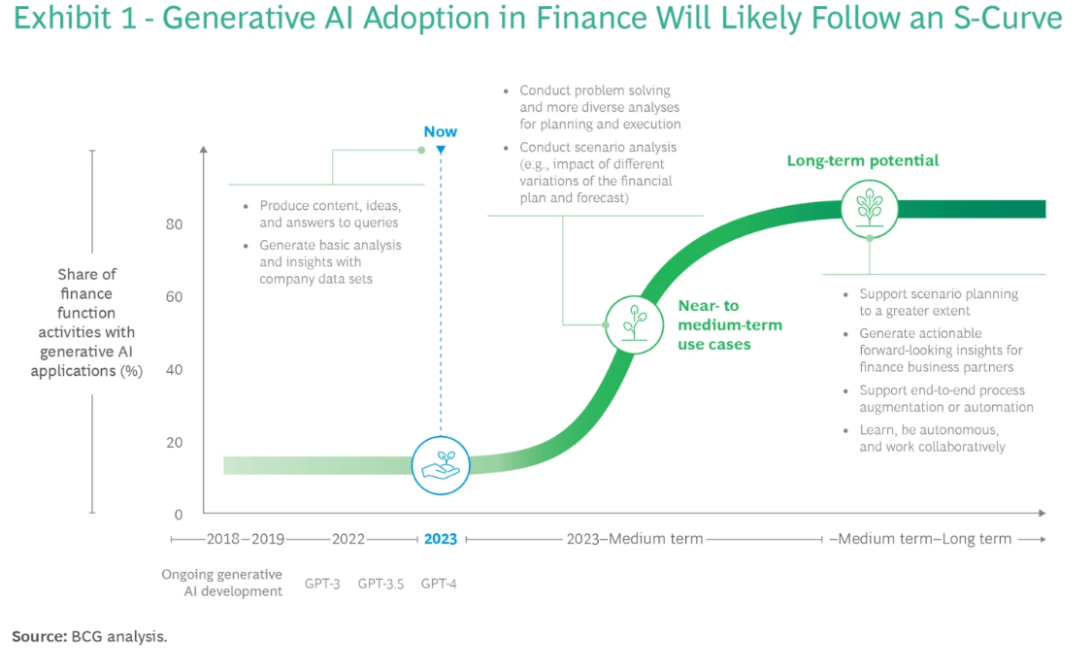

Some financial institutions have already experimented with GenAI for relatively short-term tasks, such as producing written content or conducting simple analyses on company data sets.

We are now seeing more medium-term use cases, with the banking industry using this technology for advanced scenario analysis and problem-solving. In the long term, there is widespread potential for GenAI to automate end-to-end processes and provide actionable insights.

As suggested by BCG in 2023, financial services will likely follow an S-curve pattern for GenAI adoption. The use cases will become increasingly sophisticated as many financial institutions apply GenAI across functions.

In this article, we’ll outline some of the most anticipated and impactful use cases for GenAI in banking, explaining the potential advantages and key challenges to watch out for.

AI use cases in banking

As mentioned, AI has a long history in finance. According to a KPMG survey, 83% of respondents in corporate finance use it to support planning, including predictive models.

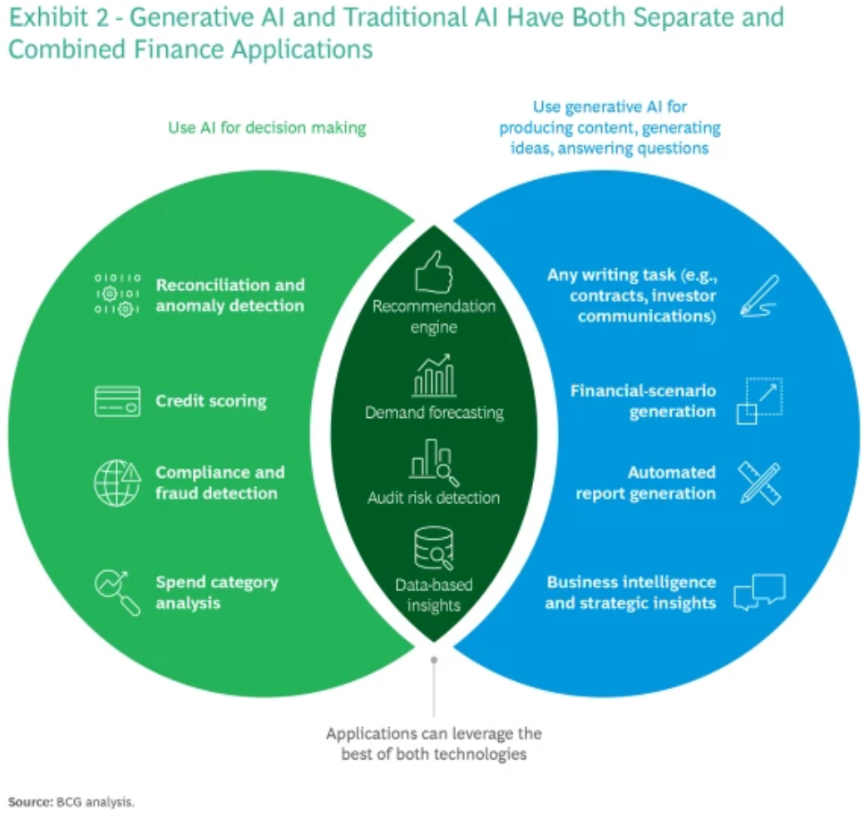

Now there are wide-ranging use cases for GenAI in finance. And there are several areas where financial institutions can leverage both AI and GenAI simultaneously to achieve specific goals. For example, AI-led fraud detection and GenAI-led automated reports can augment audit risk detection capabilities.

After analyzing the full range of use cases in banking, we have identified five highly valuable ones:

- Fraud detection and prevention

- Anti-money laundering compliance

- Chatbots and virtual assistants for customer service

- Intelligent document processing

- Predictive analytics for customer retention

#1 Fraud detection and prevention

Finance teams are already using AI to identify anomalies that could signal non-compliance or fraud. GenAI can take this a step further.

GenAI models can analyze vast amounts of transaction data in real-time and identify unusual activity that may indicate fraudulent behavior.

Machine learning algorithms can continuously improve fraud detection capabilities, studying past data to minimize false positives and improve overall transaction security.

GenAI can leverage various data sources – including transaction records, user behavior patterns, biometric data such as voice or facial recognition, and social media activity – to detect and prevent fraudulent activities.

It can detect hidden patterns by incorporating external insights and generating synthetic data (more on this shortly).

Additionally, it could play a crucial role in detecting sophisticated fraud techniques such as fake IDs – analyzing metadata to identify forged documents.

#2 Anti-money laundering (AML) compliance

GenAI is a valuable potential asset in AML operations by analyzing vast datasets and identifying patterns.

Financial institutions can use machine learning algorithms to automate the detection of suspicious transactions or activities with greater accuracy and speed.

It streamlines the compliance process and reduces the likelihood of human error, ensuring that fewer suspicious transactions go unnoticed.

In addition, GenAI can distinguish between false positives and genuine threats with a higher degree of precision, supporting more nuanced AML compliance.

This efficiency in identifying and addressing potential risks conserves resources, allowing AML professionals to focus on the most critical cases.

#3 Chatbots and virtual assistants for customer service

Large language model (LLM) capabilities for customer service and conversational AI experiences in the banking industry include:

- Hyper-personalized chatbots that can understand nuanced queries and provide tailored responses beyond basic parameters

- Analyzing voice, text, and visuals through multimodal AI to offer personalized advice, answer queries, and assist with account management

- Self-service support tools that quickly find answers in knowledge bases and can translate responses into other languages

- More advanced, conversational virtual assistants that reduce strain on customer service agents by handling complex queries not covered in existing databases

- Increasing agent productivity with real-time call transcription, suggestions, and summaries

- Expediting onboarding and training for customer service agents, providing responses that align with a bank’s policies and guidelines

Overall, there is scope for more natural, conversational, and personalized interactions via GenAI while supporting customer service agents through automation and instant information retrieval.

It can empower customer service representatives to answer complex customer queries faster by providing detailed knowledge, recommendations, and best practices during interactions.

Find out how we streamlined localized multi-channel marketing with an LLM constructor for Visa.

“The Neurons Lab team demonstrated deep expertise in GenAI and worked diligently to build a tailored solution that has significantly improved our marketing personalization.”

“The Neurons Lab team demonstrated deep expertise in GenAI and worked diligently to build a tailored solution that has significantly improved our marketing personalization.”

Anna Melnychuk, Senior Marketing Manager VISA

#4 Intelligent document processing (IDP)

GenAI can transform financial institutions’ handling of information and documents, improving productivity and efficiency.

IDP uses AI and machine learning to analyze PDFs, emails, scans, images, and handwritten notes.

It can systematically extract, classify, and route information from various document formats across the organization. It can be used to analyze credit risk reports and score them.

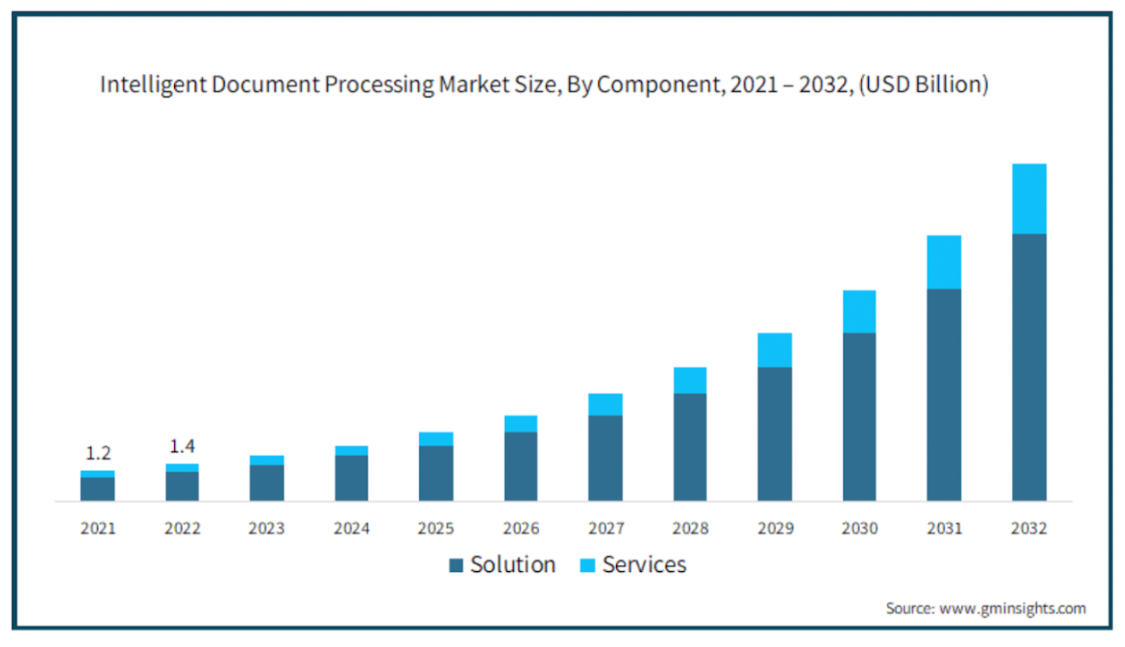

The graph below from Global Market Insights shows the fast-growing market size of IDP solutions and services, anticipated to register a CAGR of 24.7% between 2023 and 2032.

Key capabilities include helping employees find and understand information in contracts, regulatory filings, and other unstructured documents.

GenAI can also automate manual data entry and document processing tasks, which have long been costly and inefficient, especially for large organizations.

It frees up employees’ time from hours of searching for information and handling documents, allowing them to focus more on client interactions and high-value tasks.

It introduces new efficiencies by automating and accelerating previously manual processes – reducing effort, minimizing errors, and facilitating faster, more accurate decision-making.

For more information about how IDP works, take a look at our two guides:

#5 Predictive analytics for customer retention

Financial institutions can identify when specific customers are a good fit for new products and get recommended next steps for engaging with clients via GenAI.

Predictive models trained on previous transactions can analyze the potential need for new products.

A model can then propose upselling opportunities and draft an email to the customer for the salesperson to review.

Enterprises also have the opportunity to use GenAI to improve the customer experience by more readily addressing feedback.

This technology can quickly interpret and summarize large volumes of customer feedback and provide suggested product improvements with detailed requirements and user stories.

It can also extract themes from feedback from lost customers to highlight trends and suggest new sales strategies, arming sales teams with business intelligence and pre-scripted follow-ups.

Client-facing teams can more proactively take steps to retain customers close to discontinuing their service or unlikely to renew their contracts, prioritizing high-value customers.

It empowers sales teams to increase speed and value, while there’s also great potential to accelerate the speed of responsiveness and innovation in product or service design.

Overall benefits

Most of these use cases have several qualities in common, such as:

- Presenting opportunities for experts and supporting staff to work more productively, freeing up time for complex or high-priority tasks by reducing manual workload

- Building upon already established initiatives, augmenting existing technology stacks without requiring a complete overhaul or starting again from scratch

- Increasing the speed of back-end operational or customer-facing innovation, helping to future-proof financial institutions as technology continues to advance

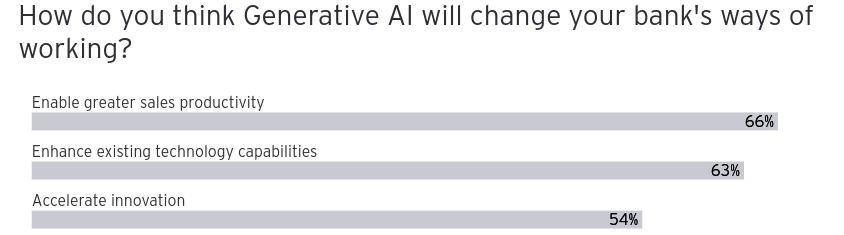

According to research from EY, these are the priority benefits that decision-makers at commercial banks want to see from GenAI:

Two-thirds want GenAI to enable greater sales productivity. By streamlining and improving customer interactions, financial institutions can improve the experience and create competitive differentiators.

Improving the customer experience tends to increase sales revenue by 2-7% and profitability by 1-2%, according to McKinsey research.

Key applications for GenAI here include:

- Streamlining and enhancing customer interactions through AI-powered summary and analysis of data like call transcripts and chat logs – providing insights into drivers of good and bad experiences previously difficult to obtain

- Using those insights to personalize customer experiences at scale across an organization’s large customer base

Organizations can use these insights to create a more positive, consistent experience.

Challenges

However, finding the right way to adopt GenAI and capitalize on its potential is easier said than done.

The above EY research highlights two main barriers for banks looking to take advantage:

- 55% of banking decision-makers see insufficient internal expertise as a barrier

- 37% lack confidence in their technology infrastructure and talent to capitalize on GenAI use cases in banking

Therefore, many financial institutions will need support to see the benefits quickly and efficiently.

Security concerns are also paramount in a highly regulated industry such as banking. Accurate calculations require the utmost diligence when designing GenAI tools for banking.

When training GenAI models in the public cloud, companies transmit proprietary data that a security breach could leak.

In contrast, Neurons Lab ensures privacy for our banking clients. They retain full ownership of proprietary cloud environments or can choose on-premises deployment, providing complete control within your secure infrastructure. Sensitive data is never used to train open-source models like Mistral, safeguarding confidentiality at all times.

Our locally deployed LLMs operate entirely within clients’ ecosystems, eliminating the risk of data breaches or unauthorized access. All data stays within the client’s controlled environment, guaranteeing compliance with data protection regulations and internal security policies.

With models running locally, there is no need for external data transfers, ensuring that proprietary information is never exposed to third-party systems. Bespoke security protocols tailored to specific requirements increase the protection of sensitive information.

Final thoughts

Aside from the benefits above, support for marketing activities is one of the primary use cases for enterprise GenAI adoption.

GenAI can make the creation of relevant, targeted, personalized marketing collateral a much more efficient process.

LLMs can identify user intents and contexts, taking sentiment analysis to a higher level, with the data driving hyper-personalized recommendations.

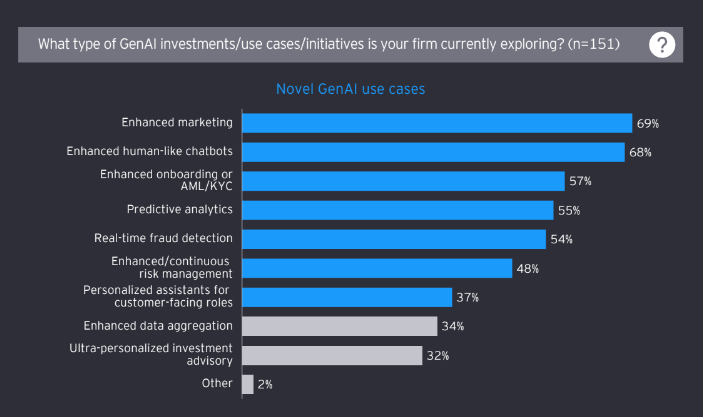

Surveying commercial banks in the US and Asia, further research from EY found these main types of investments and initiatives underway, covering all of the above use cases:

GenAI has a wide range of use cases in banking, but the initiative with the highest likely return on investment will look different for each institution. It could involve automating and accelerating back-end operations or innovating customer experiences at the front end.

If you’re not sure where to start, Neurons Lab can help:

- Discover the GenAI Enablement service – gain the confidence you need to leverage AI’s capabilities and see first-hand how it can enhance your operations

- With our GenAI Workshop and Proof of Concept service, 75-100% funded by AWS, we can turn your ideas into strategies and tactics – we build a working PoC to validate assumptions, reducing the risk in GenAI tech investments

To discuss how we can help you gain a competitive edge with GenAI, please get in touch.

About Neurons Lab

Neurons Lab is an AI consultancy that provides end-to-end services – from identifying high-impact AI applications to integrating and scaling the technology. We empower companies to capitalize on AI’s capabilities.

As an AWS Advanced Partner, our global team comprises data scientists, subject matter experts, and cloud specialists supported by an extensive talent pool of 500 experts. We solve the most complex AI challenges, mobilizing and delivering with outstanding speed to support urgent priorities and strategic long-term needs.

Ready to leverage AI for your business? Get in touch with the team here.

Sources

Capturing the full value of generative AI in banking, McKinsey, December 2023

Generative AI in the Finance Function of the Future, BCG, August 2023

Intelligent Document Processing Market Size, Global Market Insights, September 2023

Five priorities for harnessing the power of GenAI in banking, EY, November 2023

Prediction: The future of Customer Experience, McKinsey, April 2022

Supercharge your Finance workforce with GenAI, KPMG

Generative AI in retail and commercial banking, EY-Parthenon, July 2023